Shares of Larsen & Toubro (L&T) Ltd. erased losses on Monday, July 21, after it informed the exchange that its energy arm will set up India's largest Green-Hydrogen plant. L&T Energy GreenTech Ltd. will establish the plant at Indian Oil Corp's Panipat Refinery in Haryana.

L&T Energy GreenTech Ltd will develop the plant on build-own-operate basis and will supply 10,000 tons of green hydrogen annually to Indian Oil Corp for 25 years. The energy unit intends to support the Government's National Green Hydrogen Mission with this move, according to exchange filing.

L&T To Set Up India's Largest Green Hydrogen Plant

The upcoming plant will produce the green hydrogen using high-pressure alkaline electrolysers, which is manufactured at L&T Electrolysers Ltd's facility in Hazira, Gujarat, the exchange filing said.

The green hydrogen plant will work around the clock using renewable energy which aligns with Indian Oil Corp's broader strategy to decarbonise its refining operations and contribute to India's net zero ambitions, the company said in the exchange filing.

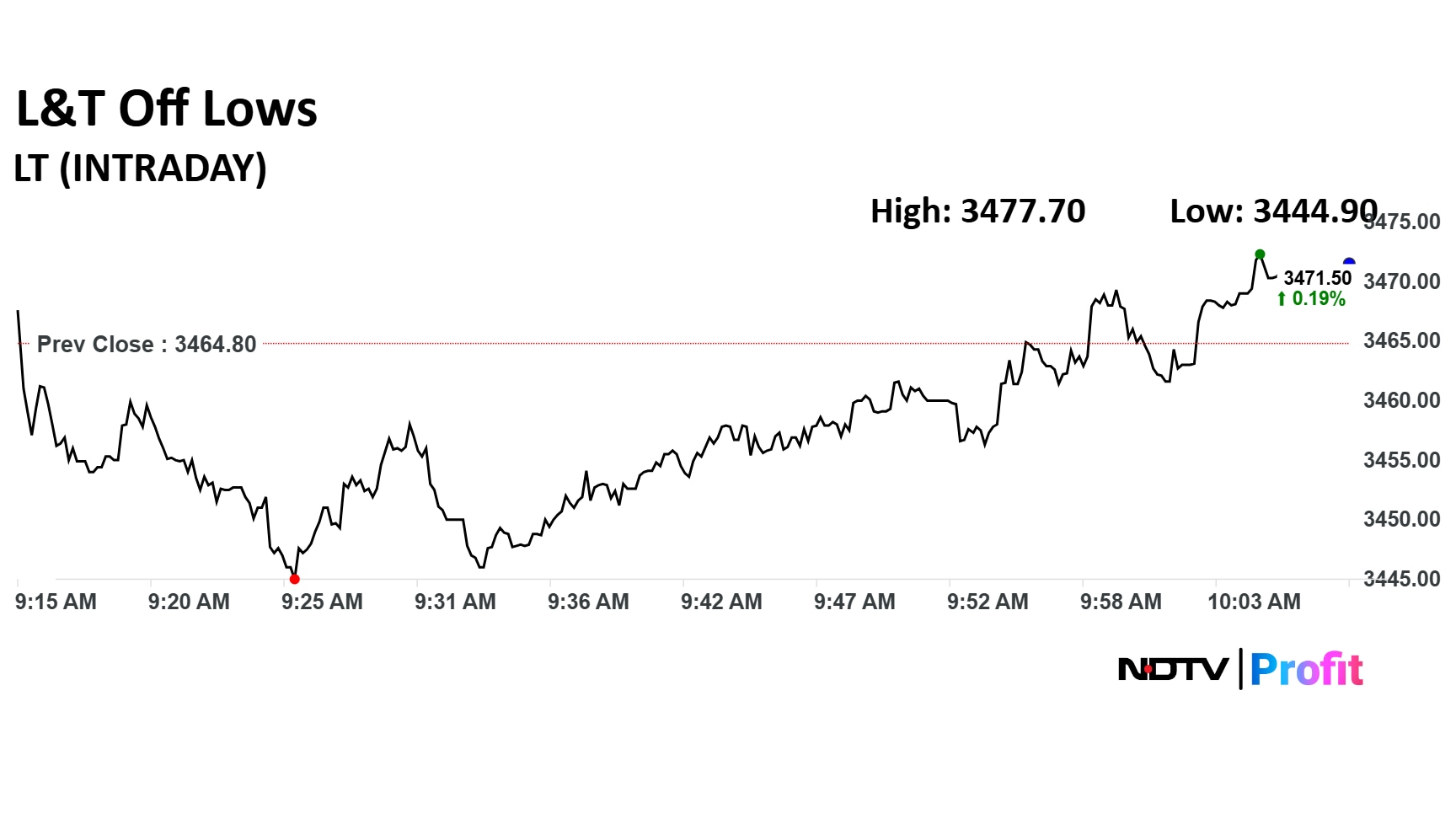

L&T Share Price Movement

Larsen & Toubro share price declined 0.57% to Rs 3,444.90 apiece shortly after open. However, the share price erased losses and rose 0.83% to Rs 3,497. The share price was trading 0.81% higher at Rs 3,493.3 apiece as of 10:49 a.m., as compared to 0.35% advance in the NSE Nifty 50 index.

The stock declined 4.32% in 12 months, and 3.17% on year-to-date basis. Total traded volume so far in the day stood at x times its 30-day average. The relative strength index was at 38.91.

Out of 34 analysts tracking the company, 28 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.