Indian equity benchmarks ended mixed as investors weighed a possible weaker outcome of September quarter earnings.

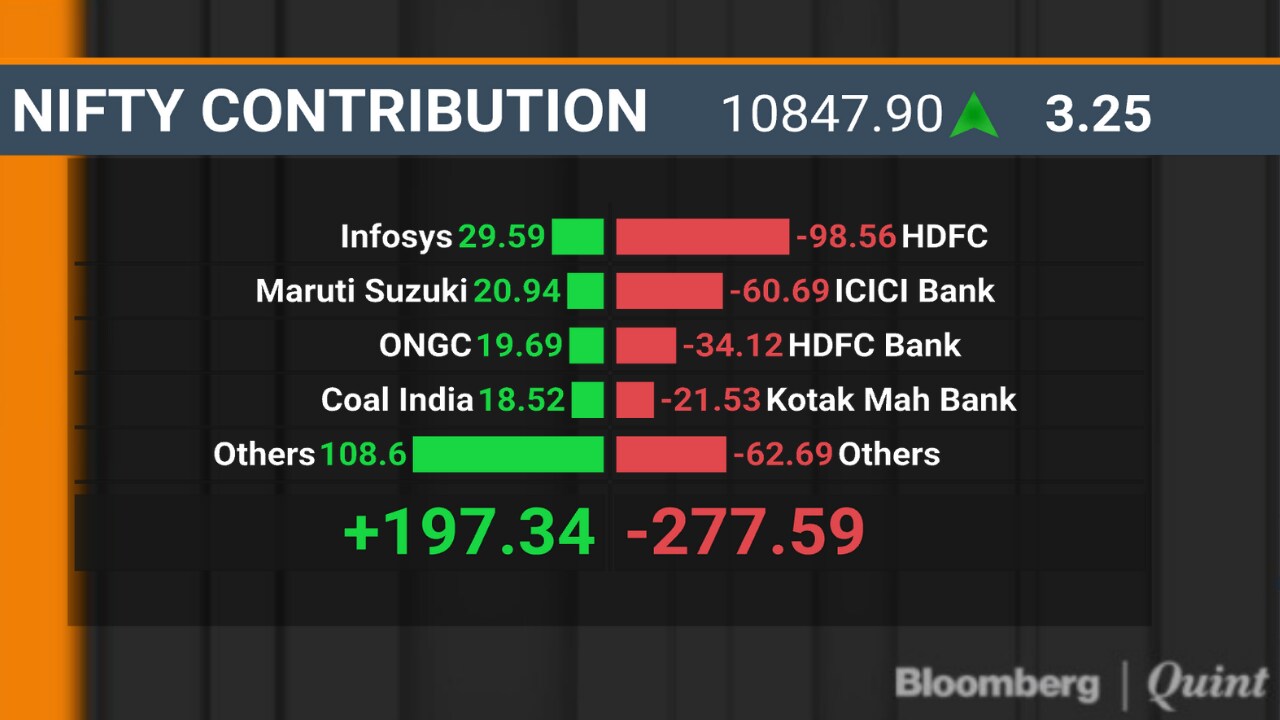

The S&P SBE Sensex closed 0.22 percent lower at 36,644.42 while the NSE Nifty 50 ended little changed at 10,847.90. The broader markets represented by the NSE Nifty 500 Index closed 0.15 percent higher.

The markets are expected to be volatile and in a very tight range in the near term, Joindre Capital Services’ Head of Research Avinash Gorakshakar said.

“The investors are waiting for the September quarter earnings and fear that it may not keep up the expectations, particularly in the auto sector considering weak sales. The earnings will also guide the direction for the markets along with the global developments such as the developments in U.S.-China trade war,” Gorakshakar told BloombergQuint in an interaction.

Commenting on the 50-stock gauge, Gorakshakar said that the index may not touch 11,200 levels in the near term.

The market breadth, however, was tilted in favour of buyers. About 1,129 stocks advanced and 631 shares declined on National Stock Exchange.

Six out of 11 sectoral gauges compiled by NSE ended lower, led by the NSE Nifty Realty Index’s 1.8 percent fall. On the flipside, the NSE Nifty Metal Index was the top sectoral gainer, up 2.6 percent.

Indian equity benchmarks ended mixed as investors weighed a possible weaker outcome of September quarter earnings.

The S&P SBE Sensex closed 0.22 percent lower at 36,644.42 while the NSE Nifty 50 ended little changed at 10,847.90. The broader markets represented by the NSE Nifty 500 Index closed 0.15 percent higher.

The markets are expected to be volatile and in a very tight range in the near term, Joindre Capital Services’ Head of Research Avinash Gorakshakar said.

“The investors are waiting for the September quarter earnings and fear that it may not keep up the expectations, particularly in the auto sector considering weak sales. The earnings will also guide the direction for the markets along with the global developments such as the developments in U.S.-China trade war,” Gorakshakar told BloombergQuint in an interaction.

Commenting on the 50-stock gauge, Gorakshakar said that the index may not touch 11,200 levels in the near term.

The market breadth, however, was tilted in favour of buyers. About 1,129 stocks advanced and 631 shares declined on National Stock Exchange.

Six out of 11 sectoral gauges compiled by NSE ended lower, led by the NSE Nifty Realty Index’s 1.8 percent fall. On the flipside, the NSE Nifty Metal Index was the top sectoral gainer, up 2.6 percent.

MCX

IndiaMART InterMESH

BPCL

Maharashtra Scooters

Elecon Engineering

Ramkrishna Forgings

Arvind

Dish TV

Indian equity benchmarks were subdued and struggle to recover morning gains.

The S&P BSE Sensex fell 0.2 percent to 36,654 and the NSE Nifty 50 traded little changed at 10,850. The broader markets represented by the NSE Nifty 500 Index rose 0.16 percent.

European stocks followed Asia’s lead, pushing higher on renewed trade optimism as China and the U.S. are set resume talks next month.

Source: Bloomberg

European stocks followed Asia’s lead, pushing higher on renewed trade optimism as China and the U.S. are set resume talks next month.

Source: Bloomberg

Source: Bloomberg

Indian equity benchmarks struggled to recover and were trading marginally lower.

The S&P BSE Sensex fell 0.35 percent to 36,604 as of 2:05 p.m. and the NSE Nifty 50 fell 0.07 percent to 10,837. The broader markets represented by the NSE Nifty 500 Index rose 0.07 percent.

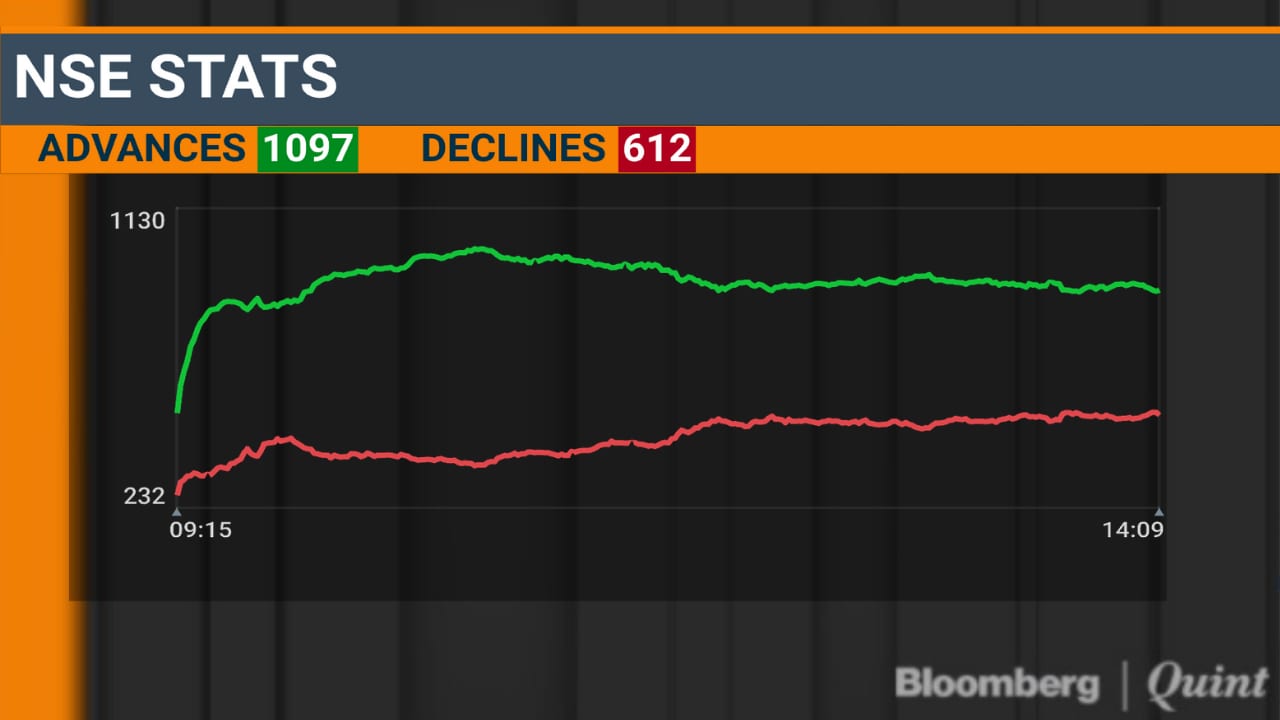

The market breadth was tilted in favour of buyers. About 1,097 stocks advanced and 612 shares declined on National Stock Exchange.

Indian equity benchmarks struggled to recover and were trading marginally lower.

The S&P BSE Sensex fell 0.35 percent to 36,604 as of 2:05 p.m. and the NSE Nifty 50 fell 0.07 percent to 10,837. The broader markets represented by the NSE Nifty 500 Index rose 0.07 percent.

The market breadth was tilted in favour of buyers. About 1,097 stocks advanced and 612 shares declined on National Stock Exchange.

About 17.3 lakh shares of SBI changed hands in a block deal, Bloomberg data showed. Buyers and sellers were not known immediately.

Shares of Tata Motors rose as much as 6.2 percent to Rs 116.25.

“Potential postponement of Brexit could be helping Tata Motors perform better than other carmakers,” Bloomberg reported quoting Ambit Capital’s Basudeb Banerjee. “We have been telling our clients that besides Brexit we don’t see any logical downside for Tata Motors below Rs 100,” Banerjee told Bloomberg.

Of the shares traded, 47 percent were at the ask price and 45 percent were at the bid, according to Bloomberg data.

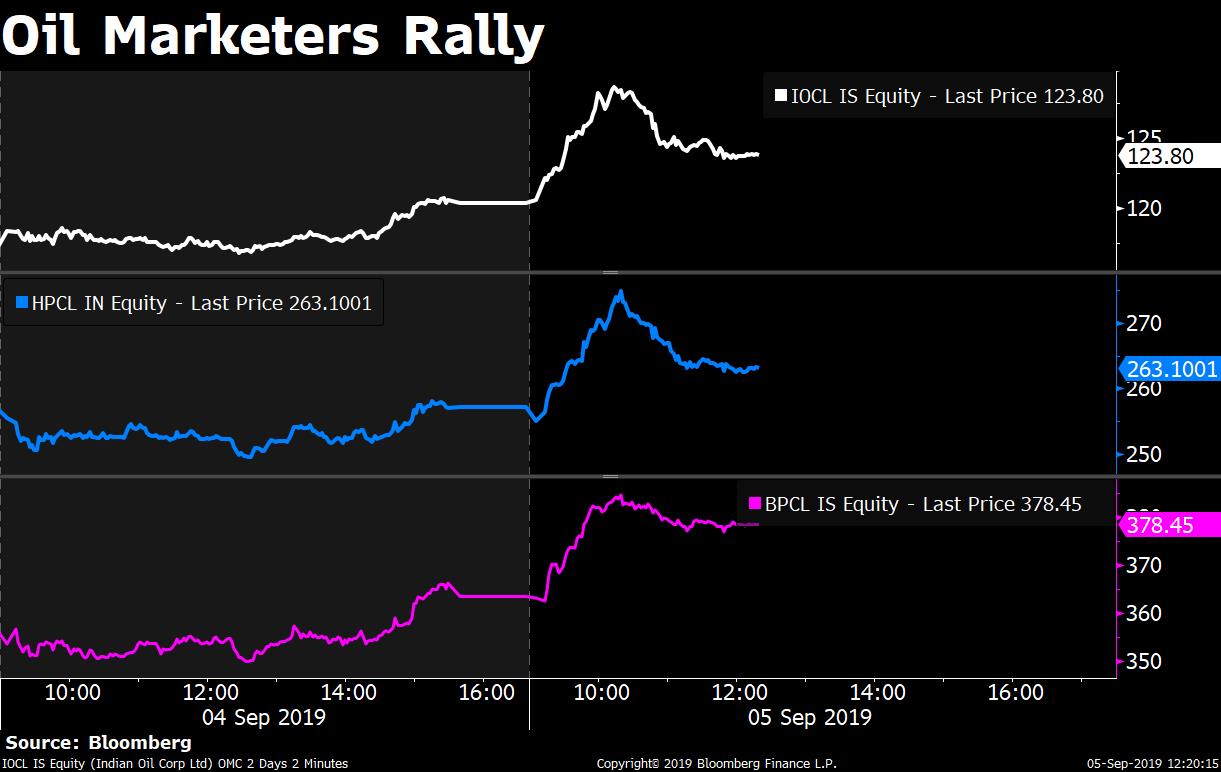

Shares of the oil marketing companies rallied in today’s trade.

Bharat Petroleum Corporation Ltd. rose over 4 percent, while Hindustan Petroleum Corporation Ltd. and Indian Oil Corporation Ltd. rose over 2 percent each.

Shares of the oil marketing companies rallied in today’s trade.

Bharat Petroleum Corporation Ltd. rose over 4 percent, while Hindustan Petroleum Corporation Ltd. and Indian Oil Corporation Ltd. rose over 2 percent each.

Indian equity benchmarks erased morning gains and were trading at day’s low.

The S&P BSE Sensex fell 0.36 percent to 36,588 as of noon and the NSE Nifty 50 fell 0.16 percent to 10,827. The broader markets represented by the NSE Nifty 500 Index fell 0.04 percent.

Source: People with knowledge of the matter told Bloomberg

Nine out of 11 sectoral gauges compiled by National Stock Exchange traded higher, led by the NSE Nifty Metal Index’s 2.9 percent gain. On the flipside, the NSE Nifty Realty Index was the top sectoral loser, down 0.73 percent.

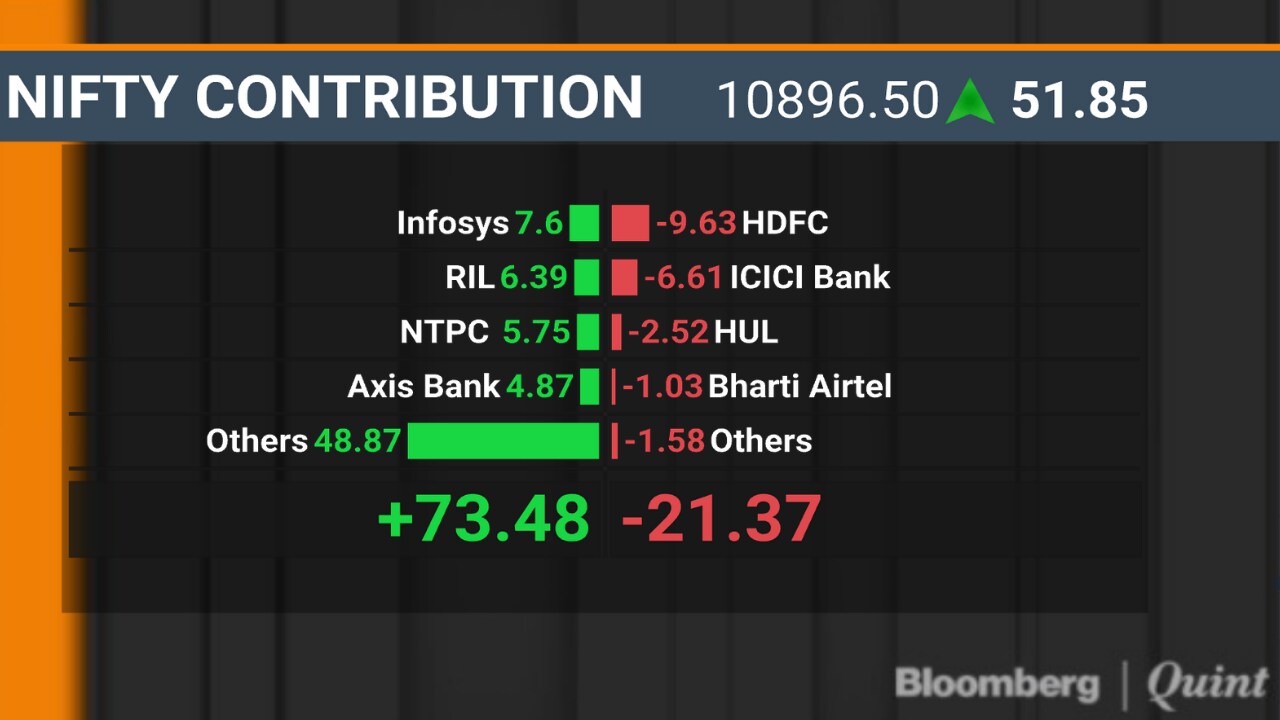

Indian equity benchmarks traded higher, led by the gains in Infosys Ltd. and HDFC Bank Ltd.

The S&P BSE Sensex rose 0.38 percent to 36,867 as of 11 a.m. and the NSE Nifty 50 rose 0.57 percent to 10,906. The broader markets represented by the NSE Nifty 500 Index rose 0.58 percent.

Nifty’s 10,900 call option contract was among the most active Nifty option contracts on National Stock Exchange.

Premium on the weekly contract, which is set to expire today rose 84.8 percent to Rs 43.15. Over 2.38 lakh shares were added to the open interest which stood at over 32 lakh shares.

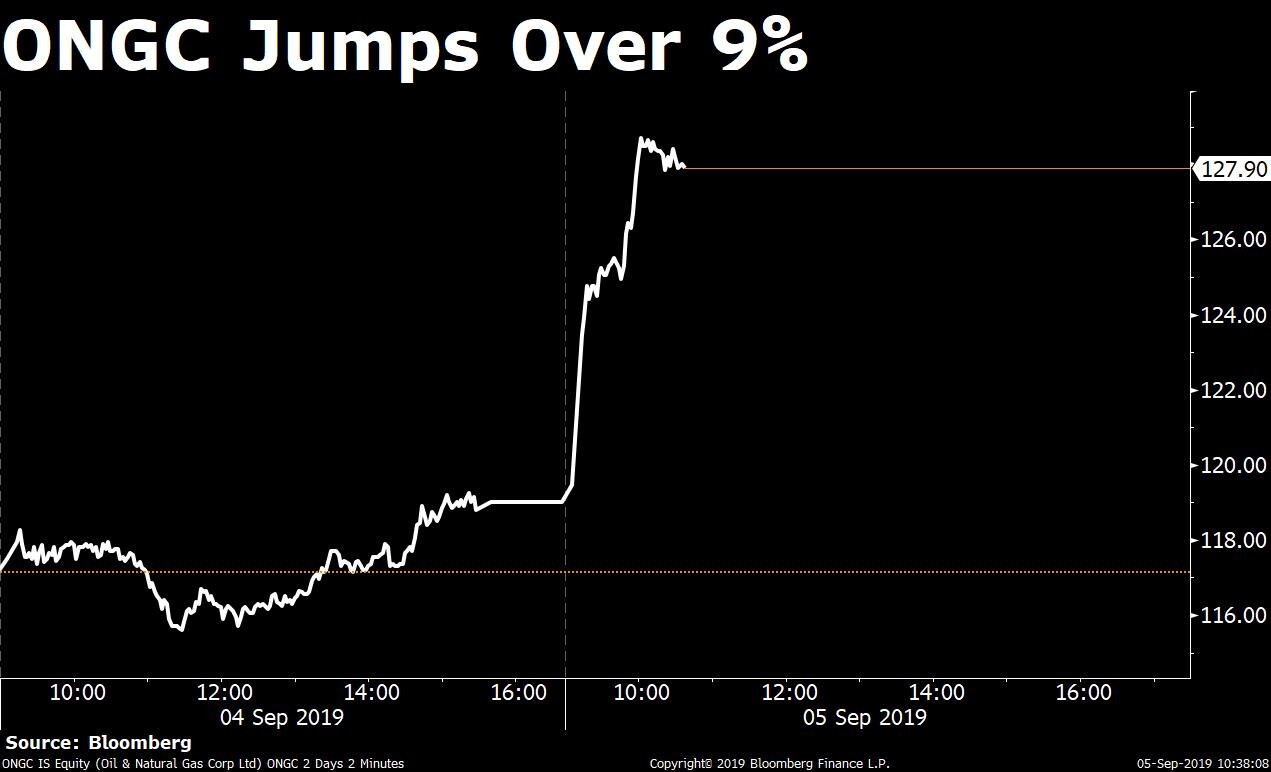

Shares of Oil & Natural Gas Corporation rose as much as 9.2 percent, the most since June 2014, to Rs 129.90.

The stock extended gains for the second consecutive trading session. Trading volume was seven times its 20-day average, Bloomberg data showed.

The stock declined 26 percent in the past 12 months compared to a 3.1 percent fall in the Sensex.

Shares of Oil & Natural Gas Corporation rose as much as 9.2 percent, the most since June 2014, to Rs 129.90.

The stock extended gains for the second consecutive trading session. Trading volume was seven times its 20-day average, Bloomberg data showed.

The stock declined 26 percent in the past 12 months compared to a 3.1 percent fall in the Sensex.

The markets will witness a turnaround only after foreign portfolio investors turn substantial buyers, according to Dimensions Corporate Finance Services’ Managing Director Ajay Srivastava.

“The markets will not witness a turnaround by any upcoming government policies. Besides, domestic investors are already overinvested,” Srivastava told BloombergQuint in an interaction. “The investors need to wait for ‘buying trigger’ by the overseas investors. That will give confidence to rebalance portfolio,” he added.

Srivastava suggested investors to have a large-cap stock in the sectors they are interested and was cautious of mid- and small-cap stocks.

“Mid and small caps are not looking good fundamentally and economically. Investors need to stick to large caps as they are the only ones which will grow,” he said.

Shares of Aavas Financiers rose as much as 8.2 percent, the most since its listing in October 2018, to Rs 1,633.10.

Trading volume was double its 20-day average, Bloomberg data showed. Of the shares traded, 54 percent were at the ask price and 24 percent were at the bid.

The stock has returned 94.6 percent since its listing. The scrip gained over 11 percent in two trading sessions.

Shares of Aditya Birla Capital rose as much as 2.2 percent to Rs 92.40.

The company’s board approved issuing 7.7 crore shares on a preferential basis to Grasim Industries Ltd for Rs 770 crore, according to its stock exchange filing.

The company also plans to issue:

Shares of Lakshmi Vilas Bank rose as much as 2.98 percent to Rs 40.50.

About 2.5 percent equity changed hands in a block deal during pre-market trade, Bloomberg data showed. Buyers and sellers were not known immediately.

Of the shares traded, 72 percent were at the ask price and 24 percent were at the bid.

Indian equity benchmarks edged higher in the opening trade, led by the gains in Reliance Industries Ltd. and Infosys Ltd.

The S&P BSE Sensex rose 0.3 percent to 36,843 and the NSE Nifty 50 rose 0.46 percent to 10,895. The broader markets represented by the NSE Nifty 500 rose 0.45 percent.

The market breadth was tilted in favour of buyers. About 844 stocks advanced and 485 shares declined on National Stock Exchange.

Nine out of 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty Metal Index’s 2.28 percent gain. On the flipside, the NSE Nifty FMCG Index was the top sectoral loser, down 0.1 percent.

Indian equity benchmarks edged higher in the opening trade, led by the gains in Reliance Industries Ltd. and Infosys Ltd.

The S&P BSE Sensex rose 0.3 percent to 36,843 and the NSE Nifty 50 rose 0.46 percent to 10,895. The broader markets represented by the NSE Nifty 500 rose 0.45 percent.

The market breadth was tilted in favour of buyers. About 844 stocks advanced and 485 shares declined on National Stock Exchange.

Nine out of 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty Metal Index’s 2.28 percent gain. On the flipside, the NSE Nifty FMCG Index was the top sectoral loser, down 0.1 percent.

The Indian rupee opens higher against the U.S. dollar. The home currency appreciated as much as 0.39 percent to strengthen past 72 against the greenback.

The Indian rupee opens higher against the U.S. dollar. The home currency appreciated as much as 0.39 percent to strengthen past 72 against the greenback.

Indian equity benchmarks are set to open higher.

The S&P BSE Sensex rose 0.3 percent to 36,865 during the pre-market and the NSE Nifty 50 rose 0.19 percent to 10,866.80.

Good Morning!

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index’s performance in India, rose 0.26 percent to 10,885.50 as of 8:15 a.m.

Asian stocks and U.S. equity futures climbed after China said it will be holding trade talks with American counterparts next month, building on a broad rally in global equities amid an improvement in investor sentiment.

S&P 500 futures extended gains to around 1 percent. Shares in Japan outperformed, and rose in Australia and South Korea. (Get your daily fix of global markets here.)

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.