Shares of Indian stationery firm Linc Ltd. plunged nearly 10% on Monday after it allotted 2.97 crore bonus shares to its shareholders as part of its move to enhance liquidity of the company's shares.

The company's board allotted the shares of Rs 5 apiece each as fully paid-up bonus shares, in the proportion of 1:1, it said in an exchange filing on Monday. The number of shares after the bonus would be 5.9 crore shares with a share capital of 29.7 crore.

When bonus shares are issued, the price of the scrip gets adjusted downward in proportion to the bonus issue ratio.

The estimated date by which the bonus shares would be dispatched would be within two months from the date of approval by the board. Further, Dec. 20 is set as the record date for determining the eligibility of shareholders.

The company on Oct. 29 also approved the split of their existing equity share, having a face value of Rs 10 each, into two equity shares, having a face value of Rs 5 each.

The company said that it undertook this move to enhance the liquidity of the company's equity shares and to encourage the participation of retail investors by making equity shares of the company more affordable.

The expected time of completion is within two months from the date of approval of the shareholders of the company. It will have 2.9 crore fully paid-up shares after the split with a share capital of Rs 14 crore.

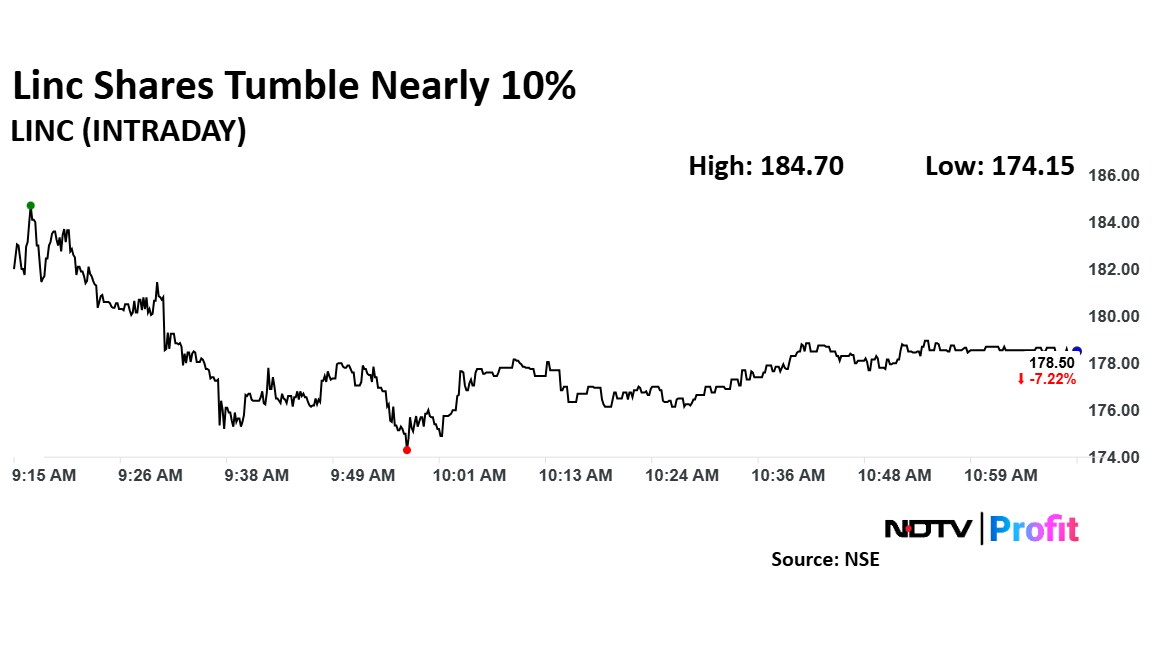

Linc's stock fell as much as 9.4% during the day to Rs 174.1 apiece on the NSE. It was trading 7.2% lower at Rs 178.5 apiece, compared to a 1.03% advance in the benchmark Nifty 50 as of 11:07 a.m.

It has risen 8% during the last 12 months and has advanced by 6.7% on a year-to-date basis. The total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 57.

One analyst tracking the company have a 'buy' rating on the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.