Laurus Labs on Monday said that the pause in foreign aid for President's Emergency Plan for AIDS Relief by the United States will not have a significant impact on its business.

The pharmaceutical company's response came after the exchanges sought its clarification to a news report which pointed out that its stock has plunged by over 15% in the aftermath of US President Donald Trump reportedly halting aid for the AIDS relief programme.

The company pointed out that the overall antiretroviral medicine market size is $1.5 billion or Rs 150 crore, which represent 10% of the total HIV financing budget annually. "Overall AIDS funding is from the respective country Governments, PEPFAR, and the Global fund," it said in an exchange filing.

"Global agencies have worked well so far and controlled pandemic disease of AIDS. If at all there may be funding challenge, the company reasonably believes it will not affect the procurement of medications," Laurus Labs added.

If at all there may be funding challenge, the company reasonably believes it will not affect the procurement of medications, the filing stated.

"We also understand from the media that USA again decided back to join WHO yesterday," Laurus Labs further said. Notably, the US has not finalised the decision to rejoin the World Health Organisation, but Trump said in a rally in Las Vegas on Saturday that he may consider the option.

"Maybe we would consider doing it again, I don't know. Maybe we would. They would have to clean it up," news agency Reuters quoted him as saying.

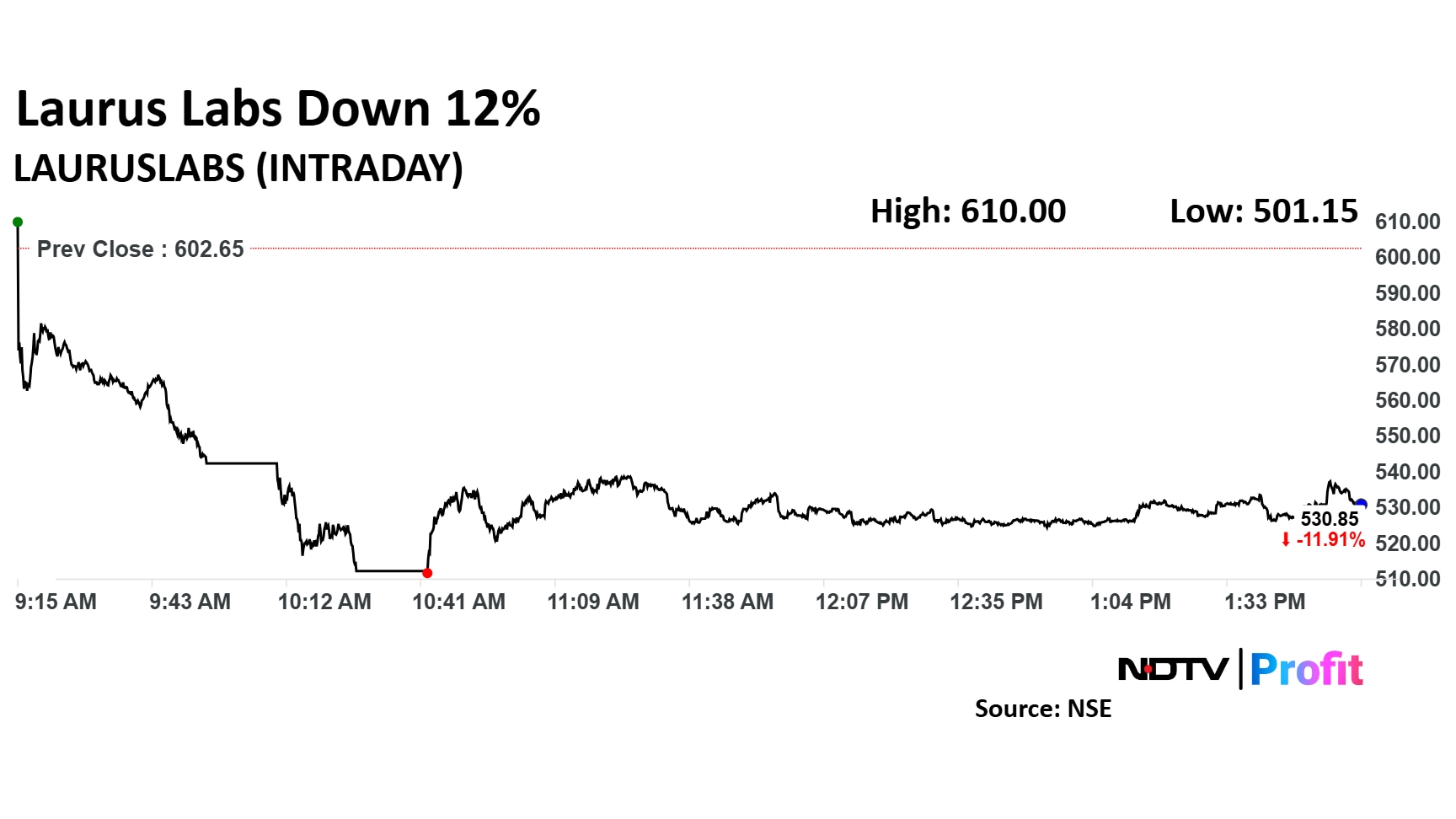

Laurus Labs' scrip fell as much as 16.8% to Rs 501.15 apiece on the NSE, the lowest level since Nov. 22. It pared some of the losses to trade 10.9% lower at Rs 536.55 apiece, as of 2:25 p.m. This compares to a 1% decline in the benchmark Nifty 50 index.

The stock traded with high volumes, with its total traded volume so far in the day standing at 10.1 times its 30-day average. The relative strength index was at 39.2.

Over the last 12 months, Laurus Labs shares have risen by around 41%.

Out of 16 analysts tracking the company, six maintain a 'buy' rating on the stock, four recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a potential upside of 8.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.