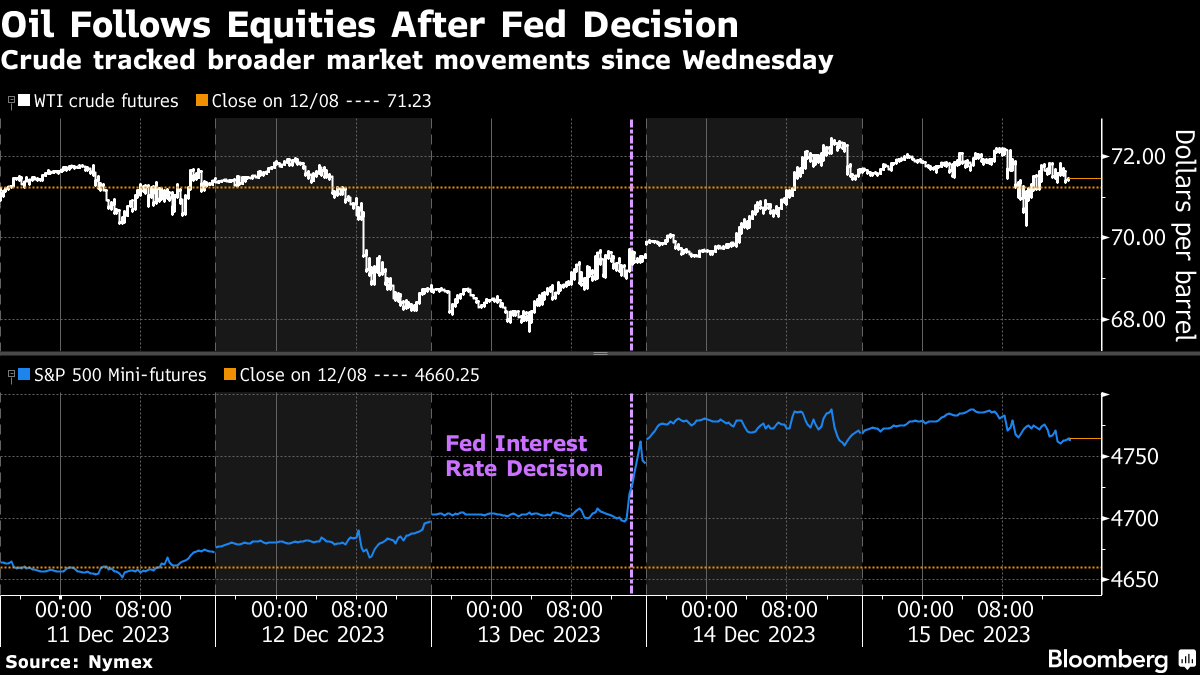

(Bloomberg) -- Oil eked out a small gain for the week, snapping a seven-week losing streak, as signs that the Federal Reserve's aggressive rate-hiking campaign is over bolstered risk assets.

West Texas Intermediate settled little changed above $71 a barrel in the afternoon. Gains early in the session gave way to a decline of as much as 1.8% on New York Fed President John Williams' comments that it's too early for officials to think about cutting rates in March. Oil later pared those losses to post its first positive week since late October.

Crude rallied the most in about a month on Thursday, propelled by broader risk-on sentiment after Chairman Jerome Powell indicated the central bank is turning its focus to when to cut borrowing costs as inflation continues to drop.

That nascent rebound came after a prolonged skid that brought futures to the lowest since June. A surge in exports from non-OPEC countries, including the US, and concerns over weakening demand are pressuring prices, while market participants remain skeptical whether all OPEC members will adhere to the deeper voluntary cuts.

The International Energy Agency on Thursday added to the bearish outlook, slashing its estimates for global oil demand growth this quarter by almost 400,000 barrels a day as economic activity weakens. The Paris-based consumer organization continues to expect growth to almost halve next year, to about 1.1 million barrels a day.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.