Shares of construction giant Larsen & Toubro Ltd. declined over 3% on Friday after UBS downgraded the stock and cut target price on likely weakening of new order growth and weak near-term outlook.

UBS downgraded the stock to 'neutral' from 'buy' and lowered the target price to Rs 4,000 per share from Rs 4,330 apiece earlier, implying an upside of 16% from the previous close.

The construction major will have to focus on execution over order intake growth, which incrementally might not be easy given the global competition, UBS said.

Going ahead, risk to order intake growth could come from rising core order book to net worth, limited domestic orders in the pipeline and the high share of West Asia business, UBS said.

The near-term earnings should be supportive of healthy execution and margin normalisation, UBS said adding, "However, the order inflow outlook is key for investors."

Larsen & Toubro has an order book of Rs 4.9 lakh crore, of which 38% is from West Asia, UBS noted. While executing these projects on time is critical, any further increase in order book share from the regions might not be appreciated by the street, given current geopolitics, it said.

However, L&T's stock might not weaken as sharply, given earnings resilience and a wider market reach than in the past, UBS said.

The construction giant bagged an order worth Rs 1,000 to Rs 2,500 crore on Friday, to deploy advance welding technology for global nuclear fusion project.

L&T Share Price Today

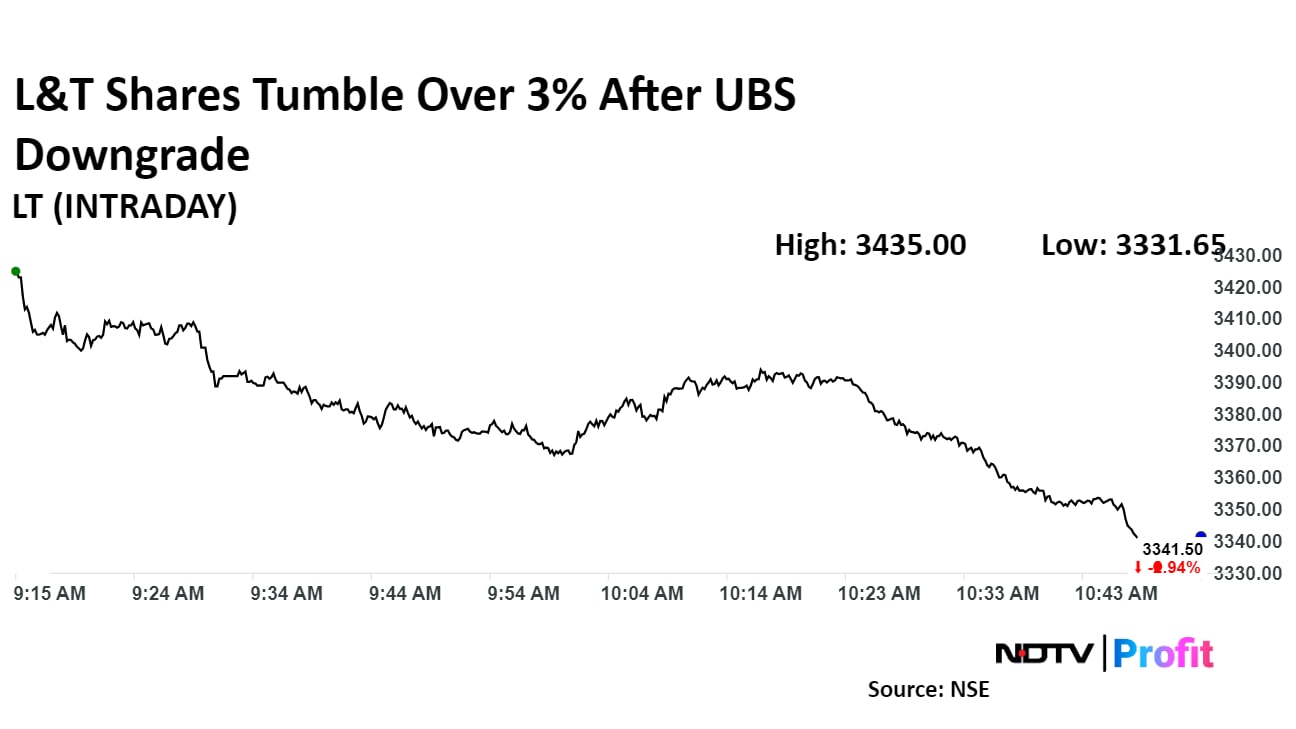

L&T's share price fell as much as 3.22% during the day to Rs 3,331.6 apiece on the NSE. It pared some gains to trade 3.1% lower at Rs 3,335.8 apiece, compared to a 1.15% decline in the benchmark Nifty 50 as of 10:56 a.m.

The stock has risen 14% during the last 12 months and has declined by 5.3% on a year-to-date basis. The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 30.

Twenty eight of the 35 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and two have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.