Indian infrastructure giant Larsen & Toubro Ltd.'s stock was downgraded to 'reduce' by Kotak Institutional Equities after the recent "strong uptick" in scrip amid a potential weakness in its margin improvement.

The brokerage assigned a target price of Rs 3,650 per share, implying a downside of 5.4% from the previous close on the NSE.

The recent management meeting brings out levers of diversification that is helping the company buck the trend of weakness in order for its mainstay business in the current fiscal, Kotak said in a note on Dec. 13. "We also note its endeavors to improve margin that may take time to play out."

The macro support to margin recovery appears lacking and thus the pace and quantum of improvement would be contained, Kotak Institutional Equities said.

Larsen & Toubro has benefitted from the growing relevance of the renewable portfolio and growing relevance of Central Asia, which has supported growth in order inflows over a large base. "This has led to the relevance (and potential weakness) of capex driven by state governments as a limited variable."

The company appears competitive and well-placed to offer both engineering, procurement, and construction and hydrogen as a service offering to customers in India and globally. Semiconductor design will see impediments to scale up, it said.

Key macro-factors of margin improvement are missing due to high competition, no shift seen in bidding norms, and lack of meaningful uptick seen in tendering, among other reasons, Kotak said. "The micro support from hydrocarbon mega orders won last year is also missing."

The brokerage cut estimates by 3-5% on account of lower growth in execution in second half and lower pace of improvement in margin.

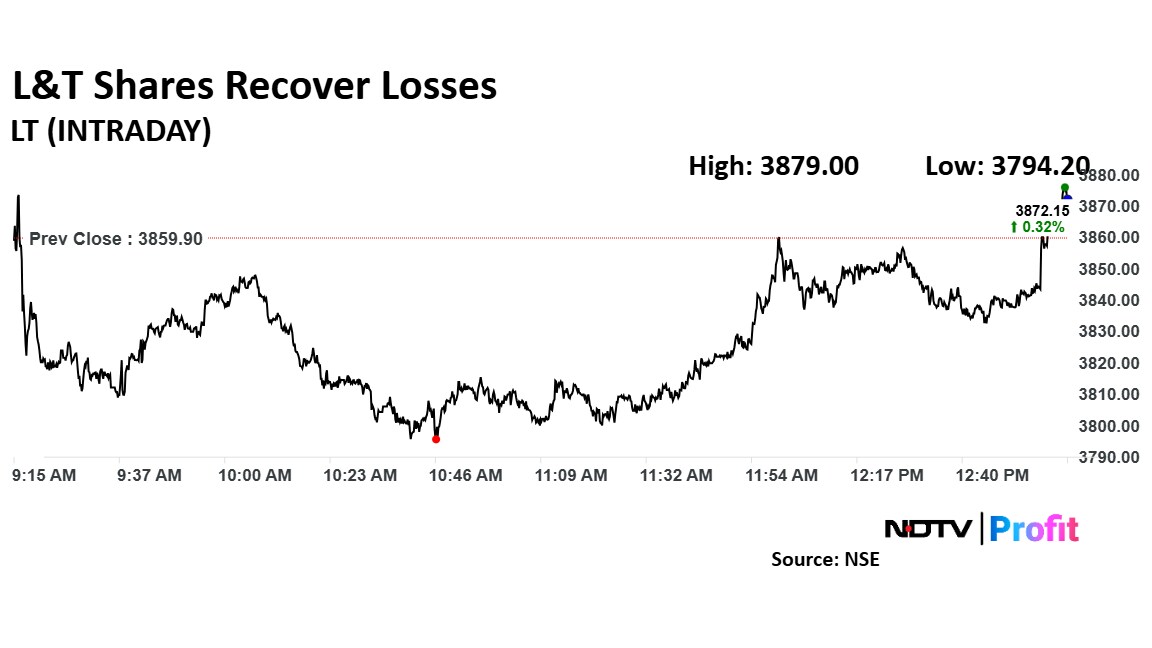

L&T Share Price Today

L&T's stock fell as much as 1.7% during the day to Rs 3,794 apiece on the NSE. It was trading 0.23% higher at Rs 3,868.7 apiece, compared to a 0.4% advance in the benchmark Nifty 50 as of 1:00 p.m.

It has risen 13.7% during the last 12 months and has advanced by 9.7% on a year-to-date basis. The relative strength index was at 62.

Of the 36 analysts tracking the company, 32 have a 'buy' rating on the stock, three suggest a 'hold' and two have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 5.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.