India, the first emerging market to shake off the April 2 Washington tariff-induced rout, has witnessed foreign institutional investors pump increasing sums of money into the market ever since.

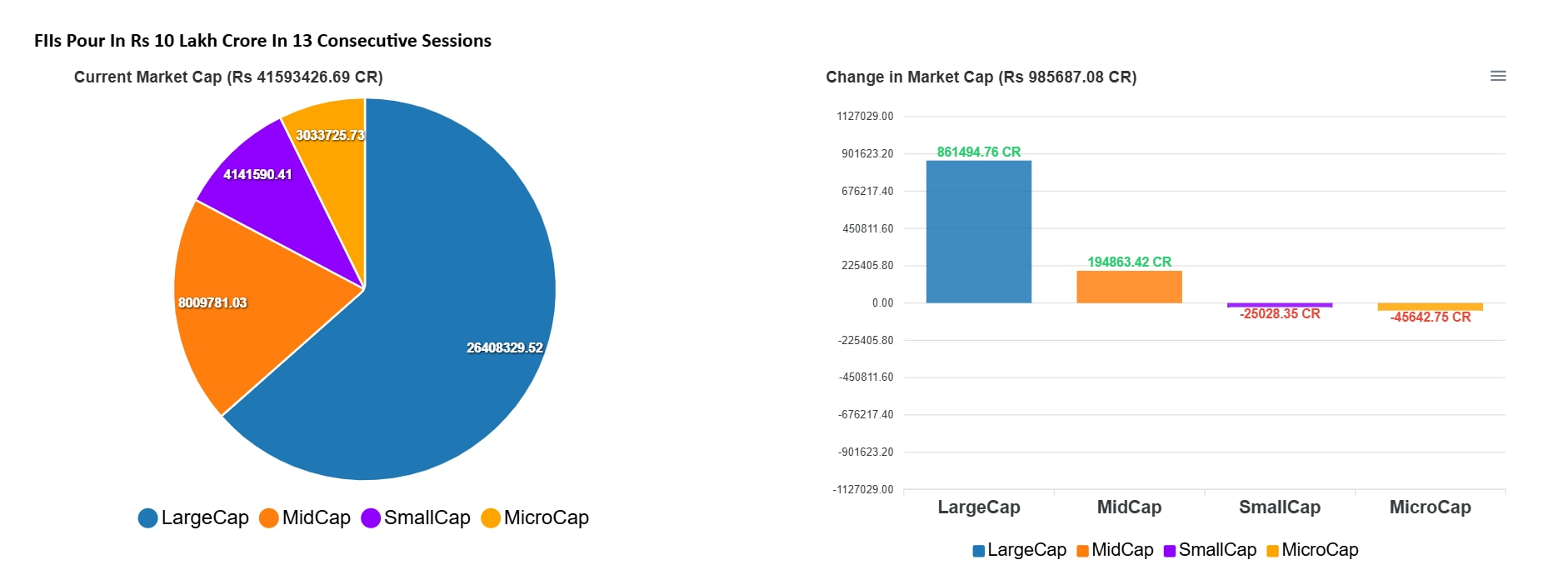

The market capitalisation overall increased by Rs 10 lakh crore in the last 13 trading sessions. Largecaps led the contribution, accumulating Rs 8.6 lakh crore over the 13-session span, with midcaps following suit at Rs 1.9 lakh crore.

Smallcaps and microcaps bucked the trend, with the former seeing an outflow of over Rs 25,000 crore and the latter seeing a slightly higher selloff of over Rs 45,000 crore.

In the aforementioned time span, FIIs have bought shares worth Rs 40,644 crore, while domestic investors displayed volatile sentiment, yet accumulating shares worth Rs 6,719 crore.

"This sustained inflow from both domestic and foreign investors reflects underlying market confidence, despite global uncertainties," said Mandar Bhojane, equity research analyst at Choice Broking.

In April, the overseas investors had net bought shares worth Rs 4,223 crore, according to the National Securities Depository Ltd.'s data. In 2025 so far, the FPIs have net sold equities worth Rs 1.09 lakh crore, the NSDL data further showed.

Reliance Industries Ltd. topped the market cap accumulation with Rs 2.44 lakh crore. Tata Consultancy Services Ltd. was second in place, gaining Rs 76,631 crore in market cap.

Bharti Airtel Ltd. posted a rise in the market cap of Rs 58,275.52 crore, and ICICI Bank Ltd. and Mahindra & Mahindra Ltd. each reported a rise of Rs 57,516.59 crore and Rs 52,526.66 crore, respectively.

The NSE Nifty 50 and BSE Sensex snapped two-day gaining streak on Tuesday. The Nifty 50 ended 0.33%, or 81.55 points, lower at 24,379.60 and the Sensex closed 0.19% down or 155.77 points lower at 80,641.07.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.