Nirma Ltd. emerged as the winner of the highly sought-after Indian cement assets of LafargeHolcim Ltd. While the sale of LafargeHolcim's India business was aimed at meeting the competition regulator's rules, other recent deals, like those between Ultratech Cement Ltd.-JP Associates Ltd. and Birla Corporation Ltd.-Reliance Infrastructure Ltd., was to pare debt.

Deal Valuation

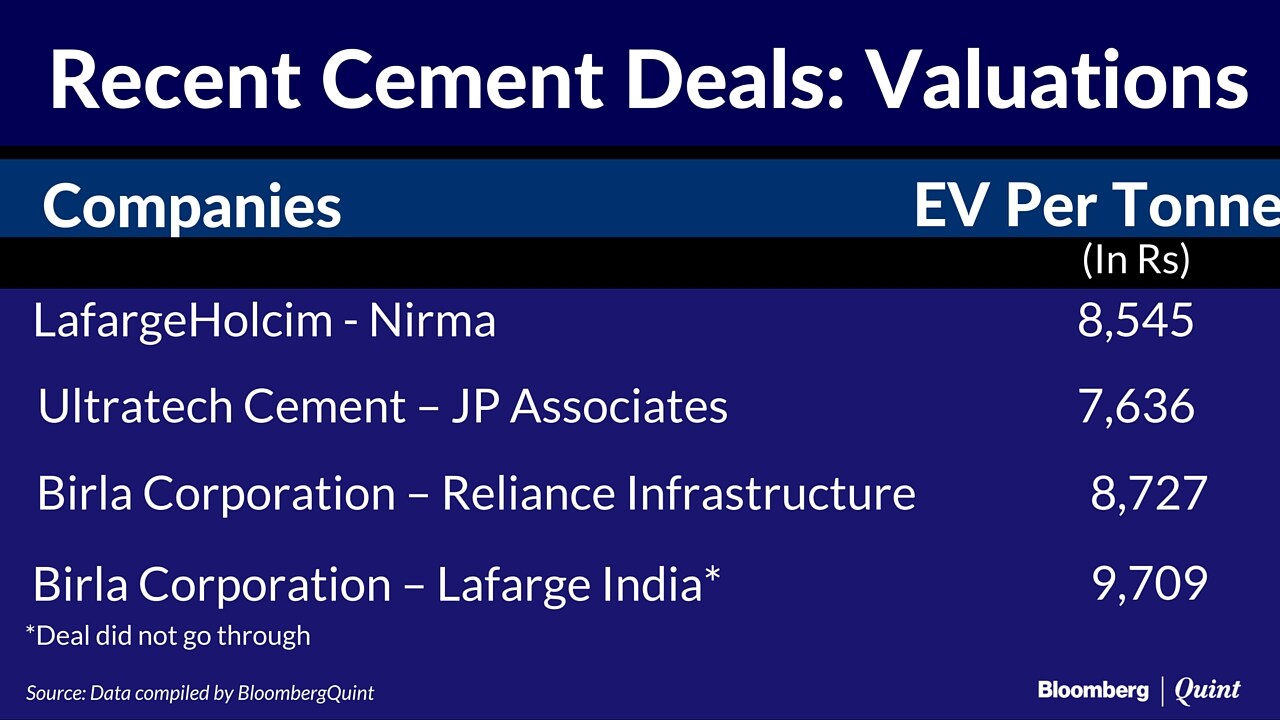

The LafargeHolcim-Nirma deal was done at an enterprise value of approximately $1.4 billion, which translates into an enterprise value per tonne of Rs 8,545.5 for the total sale capacity of LafargeHolcim's three Indian plants of 11 million tonnes per annum.

The enterprise value per tonne is broadly in line with the recent deals in the cement sector, Ashish Jain, an equity analyst at Morgan Stanley, wrote in his July 11 note to clients.

Recent Cement Deals in India

1)Ultratech Cement – JP Associates (July 2016)

- Enterprise value: Rs 16,189 crore

- Acquired capacity: 21.20 MTPA

- EV per tonne: Rs 7,636.3

2)Birla Corporation – Reliance Infrastructure (February 2016)

- Enterprise value: Rs 4,800 crore

- Acquired capacity: 5.5 MTPA

- EV per tonne: Rs 8,727.3

3) Birla Corporation – Lafarge India deal that did not go through (August 2015)

- Enterprise value: Rs 5,000 crore

- Capacity: 5.15 MTPA

- EV per tonne: Rs 9,708.7

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.