KPIT Technologies Ltd.'s share price dropped by over 5% on Tuesday. This decrease followed the company's mid-quarter update, which highlighted ongoing uncertainties in the business environment.

In its mid-quarter update, KPIT Technologies pointed out several factors contributing to the uncertain business environment, including rising geopolitical concerns and ambiguity around the overall tariff scenario. Despite these challenges, the company emphasised that its pipeline remains strong.

Key Points From Update

Pipeline Strength: KPIT Technologies reported that while the pipeline is substantial, conversions are slower than expected. However, the overall direction remains positive.

Geographical Insights: Europe is showing positive signs, whereas the USA and Asia are experiencing some uncertainties.

Sector Wins: The company has seen early, small but important wins in the trucks and off-highway sectors.

Ramp-Up Challenges: Ramp-ups for new wins are progressing at a slower pace than anticipated at the end of the last quarter.

Revenue Cannibalisation: In some cases, new wins have led to part cannibalisation of existing revenues due to limited budgets and immediate priority spending.

Forex Impact: The company does not expect any one-time gains in Q1 FY26 as seen in Q4 FY25, and anticipates additional deficits in other income due to sudden movements in forex rates.

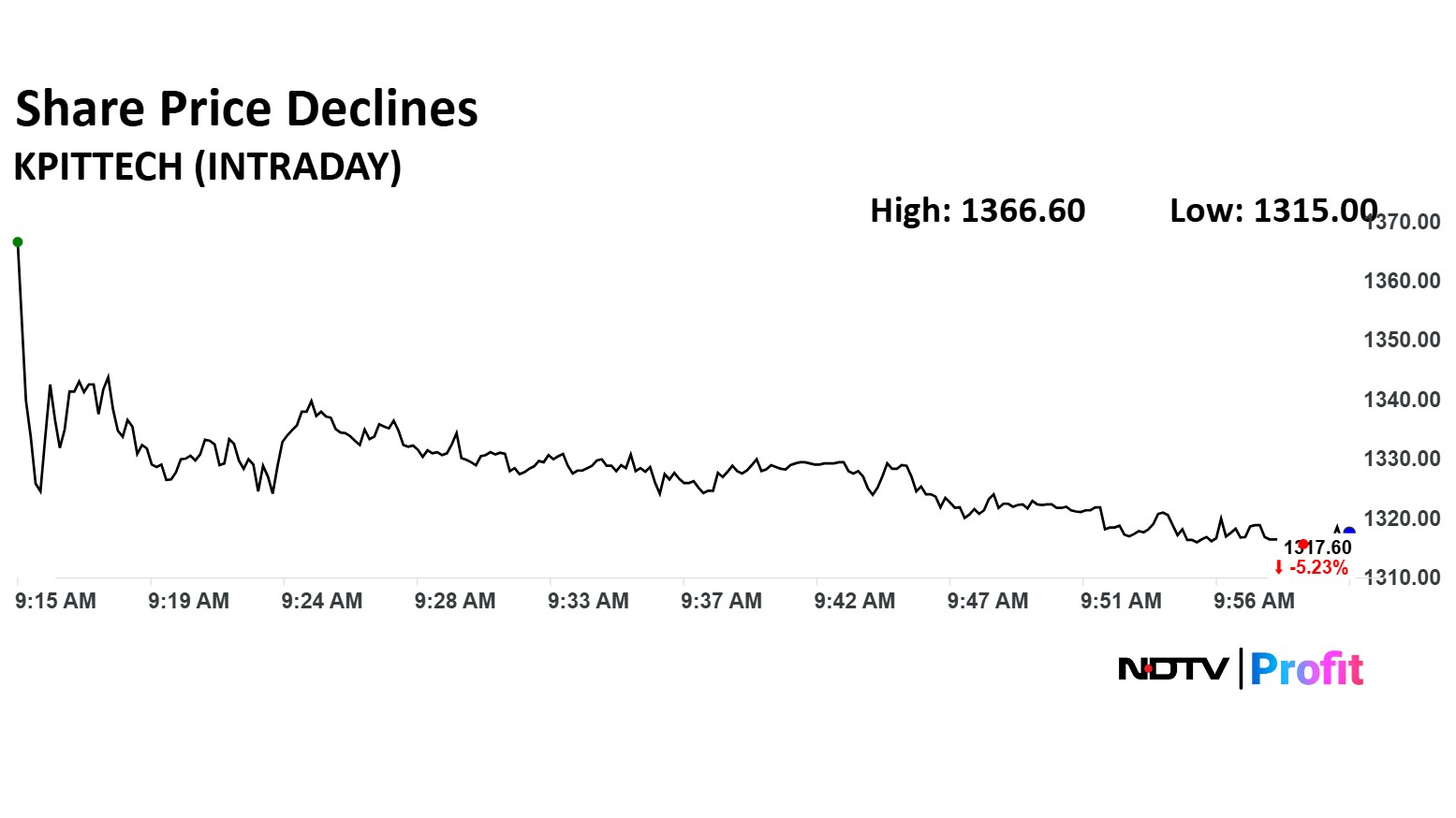

KPIT Technologies Share Price Today

The scrip fell as much as 5.39% to Rs 1,315.40 apiece. It pared losses to trade 5.31% lower at Rs 1,316.50 apiece, as of 09:59 a.m. This compares to a 0.88% advance in the NSE Nifty 50.

It has fallen 18% in the last 12 months. Total traded volume so far in the day stood at 7.5 times its 30-day average. The relative strength index was at 43.

Out of 21 analysts tracking the company, 15 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.