Kaynes Technology India Ltd.'s share price fell to hit its five-month low after the company's results missed consensus estimates on all fronts in the December quarter.

The company reported a year-on-year revenue growth of 29.8% to Rs 661 crore, missing Bloomberg consensus estimate of Rs 796.6 crore, while net profit grew 47.2% year-on-year to Rs 66 crore, lower than Rs 88 crore estimated.

Orders worth Rs 100 crore from industrial segment got postponed this quarter, due to slower ramp up of new factory of smart meters, Jairam Sampath, whole time director and chief financial officer of Kaynes Technology, told NDTV Profit. "We are revising our revenue guidance to Rs 2,800-2,900 crore from Rs 3,000 crore earlier," he said. "We are confident of achieving a 70% growth in revenues in Q4 FY25."

The company continues to invest in high potential and high margin segments and expects them to help sustain growth momentum and make Kaynes, a differentiated player in this segment, the company said in an exchange filing.

"We are consistently adding new capabilities, new geographies and looking to expand our customer base, with specific focus on large customers and high growth segments," it said.

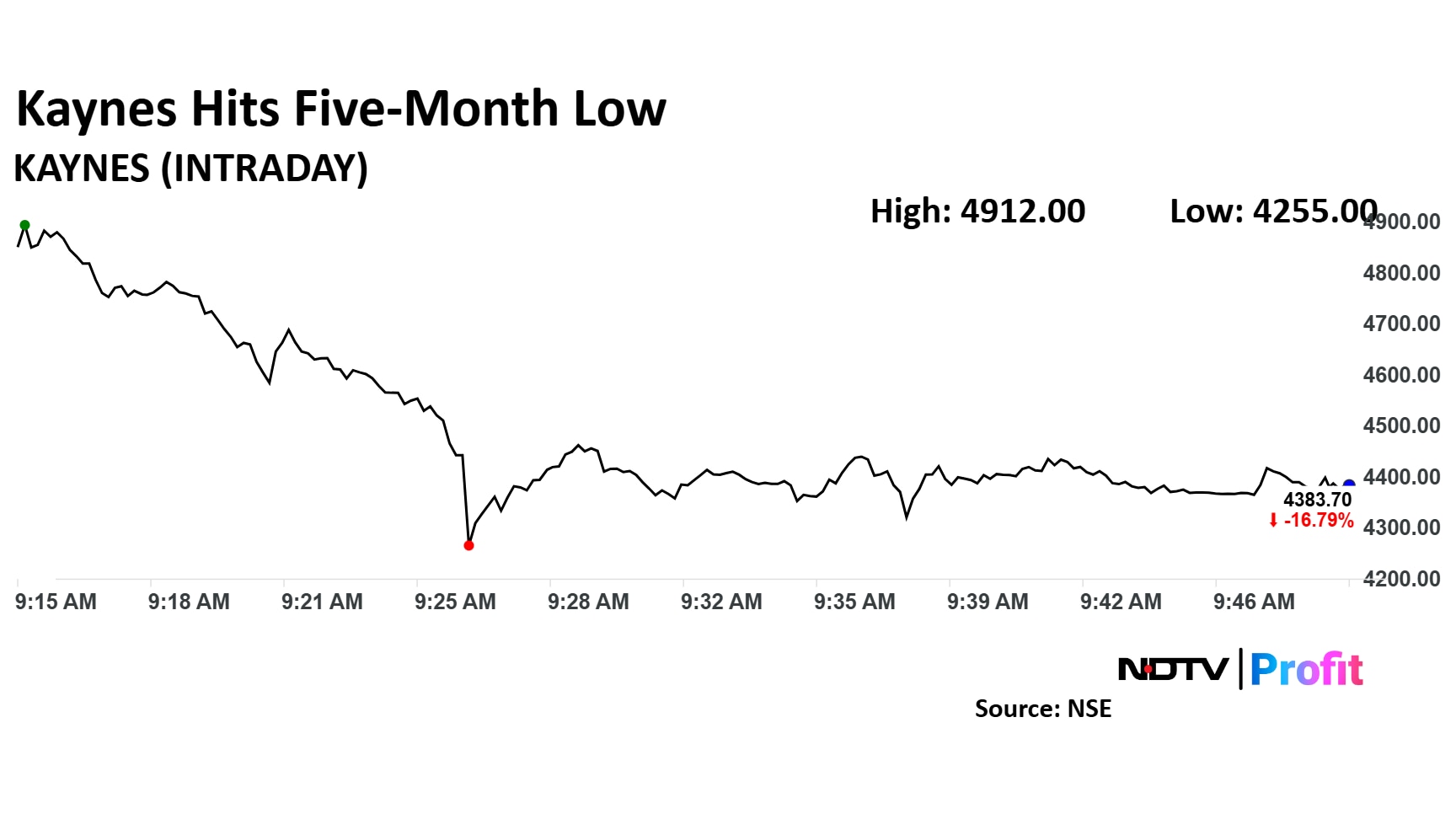

Kaynes Technology Share Price

The scrip fell as much as 19.2% to Rs 4,255 apiece, the lowest level since Aug. 12. It pared losses to trade 18% lower at Rs 4,320 apiece, as of 9:55 a.m. This compares to a 0.9% decline in the NSE Nifty 50.

It has risen 52% in the last 12 months. Total traded volume so far in the day stood at 1.92 times its 30-day average. The relative strength index was at 22.4, indicating that the stock may be oversold.

Out of 23 analysts tracking the company, 14 maintain a 'buy' rating, six recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 35.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.