JSW Steel Ltd.'s shares erased losses to rise nearly 3% after Supreme Court ordered a stay on the liquidation of Bhushan Steel & Power Ltd. and allowed the Jindal firm to file a review petition in the matter.

Earlier this month, the apex court had called Jindal Steel's acquisition of Bhushan Steel illegal and ordered its liquidation.

In an order, the apex court ordered that the resolution plan submitted by JSW Steel in 2019 be rejected. JSW Steel had won the bid to acquire Bhushan Power & Steel under the insolvency and bankruptcy code for a little less than Rs 20,000 crore. It had beaten Tata Group and UK-based Liberty Group to win the asset. The acquisition was later concluded in 2021.

"To protect the fairness of the process and avoid premature liquidation, the Supreme Court directed that a 'status quo' be maintained," the court stated.

While no conclusive judgement has been passed, the apex court has acknowledged the complexity and financial entanglements involved and warned that no effective orders should be passed by NCLT until the Supreme Court disposes of the review.

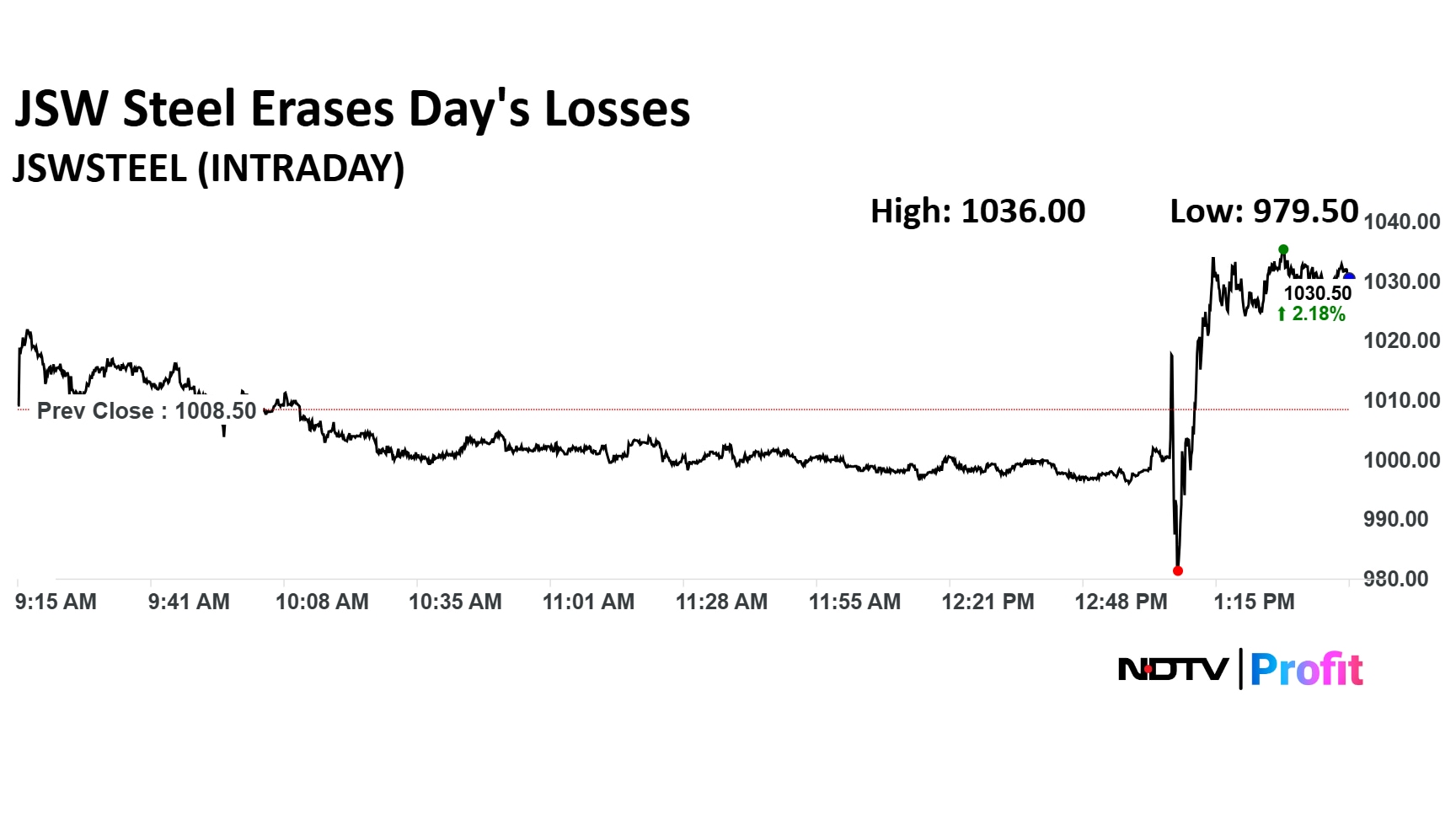

JSW Steel Share Price

Share price for JSW Steel fell as much as 2.88% to Rs 979.50 apiece, the lowest level since May 12, 2025. It erased losses to trade 1.66% higher at Rs 1,025.20 apiece, as of 1:40 p.m. This compares to a 0.47% advance in the NSE Nifty 50.

The stock has risen 14.52% on a year-to-date basis, and is up 13.56% in the last 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 70.40.

Out of 34 analysts tracking the company, 18 maintain a 'buy' rating, six recommend a 'hold' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.