JM Financial Services has initiated coverage on FirstCry parent Brainbees Solutions Ltd., India's largest specialised childcare platform, with a 'buy' rating and a target price of Rs 692, implying a 14% upside. The brokerage's optimism is supported by FirstCry's dominant position in the 0-4 age group market, significant gross margin expansion potential, and its ability to replicate success internationally and in the D2C segment.

JM Financial highlights FirstCry's presence in the organised childcare market, where it holds over 20% market share, with its online segment boasting an even higher 24% share. The company's omnichannel strategy—integrating a network of 1,124 physical stores and a robust online platform—has been pivotal to its growth, said the brokerage.

The firm notes that FirstCry's proprietary brands, such as BabyHug, have driven substantial growth. With a gross merchandise value of Rs 2,500 crore, BabyHug is a key contributor to the company's profitability. JM Financial anticipates expansion of gross margin by fiscal 2029.

FirstCry's international operations, launched in the UAE and Saudi Arabia, have been lauded for their rapid success. The UAE business has already achieved operating profitability, while the Saudi operations are expected to follow by fiscal 2027. JM Financial sees international markets as a key growth driver, with a $10 billion market opportunity projected across the two countries by fiscal 2029.

JM Financial expects FirstCry's revenue to grow at a compound annual growth rate of 20% over fiscals 2024 to 2029, with adjusted Ebitda margins expanding to 12% by financial year 2029.

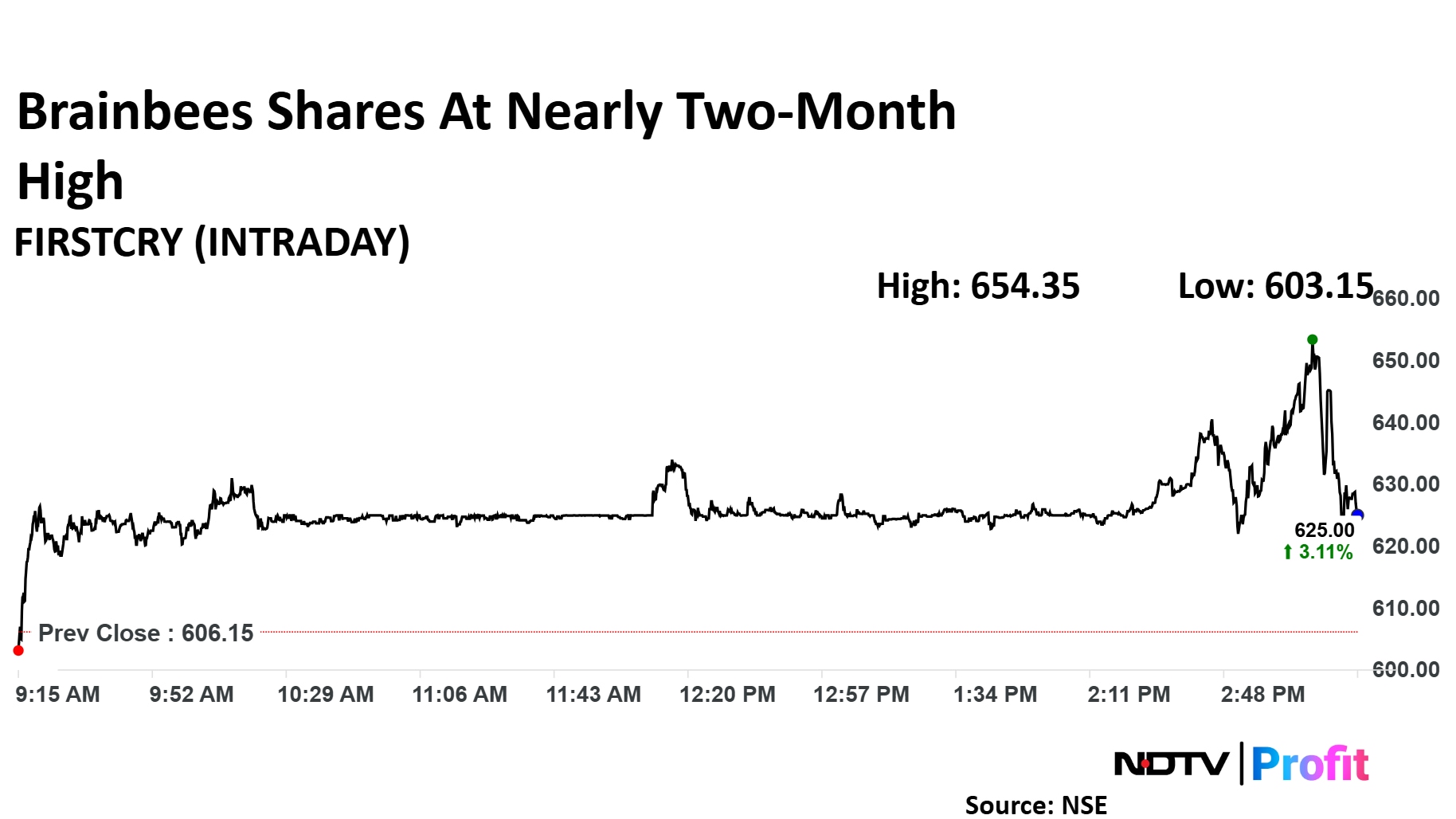

Brainbees Solutions Share Price Today

The scrip rose as much as 7.95% to Rs 654.35 apiece, the highest level since Oct. 31, 2024. It pared gains to trade 2.78% higher at Rs 623 apiece, as of 03:22 p.m. This compares to a 1.54% decline in the NSE Nifty 50 index.

It has fallen 7.27% since listing. Total traded volume in the day stood at 1.8 times its 30-day average. The relative strength index was at 57.44.

Five analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.