JK Cement Ltd. saw its share price surge 2.81% on Tuesday following the announcement that its board of directors will consider raising up to Rs 500 crore through non-convertible debentures (NCDs).

The board meeting, scheduled for May 24 at the company's corporate office in Gurgaon, will discuss the private placement of NCDs as part of the company's strategic financial planning.

According to the exchange filing, the board will also review and approve the company's financial results and consider dividend declarations during the same meeting. The grey and white cement manufacturer plans to conduct the fundraise in one or more tranches within a year from the date of its 31st annual general meeting.

The board will also consider declaring a dividend for the financial year 2024-25 on the company's equity shares, subject to shareholder approval.

Additionally, the trading window for dealing in the company's securities is closed for designated employees, directors, promoters, and other connected persons from April 1, 2025, until 48 hours after the announcement of the financial results, the filing stated.

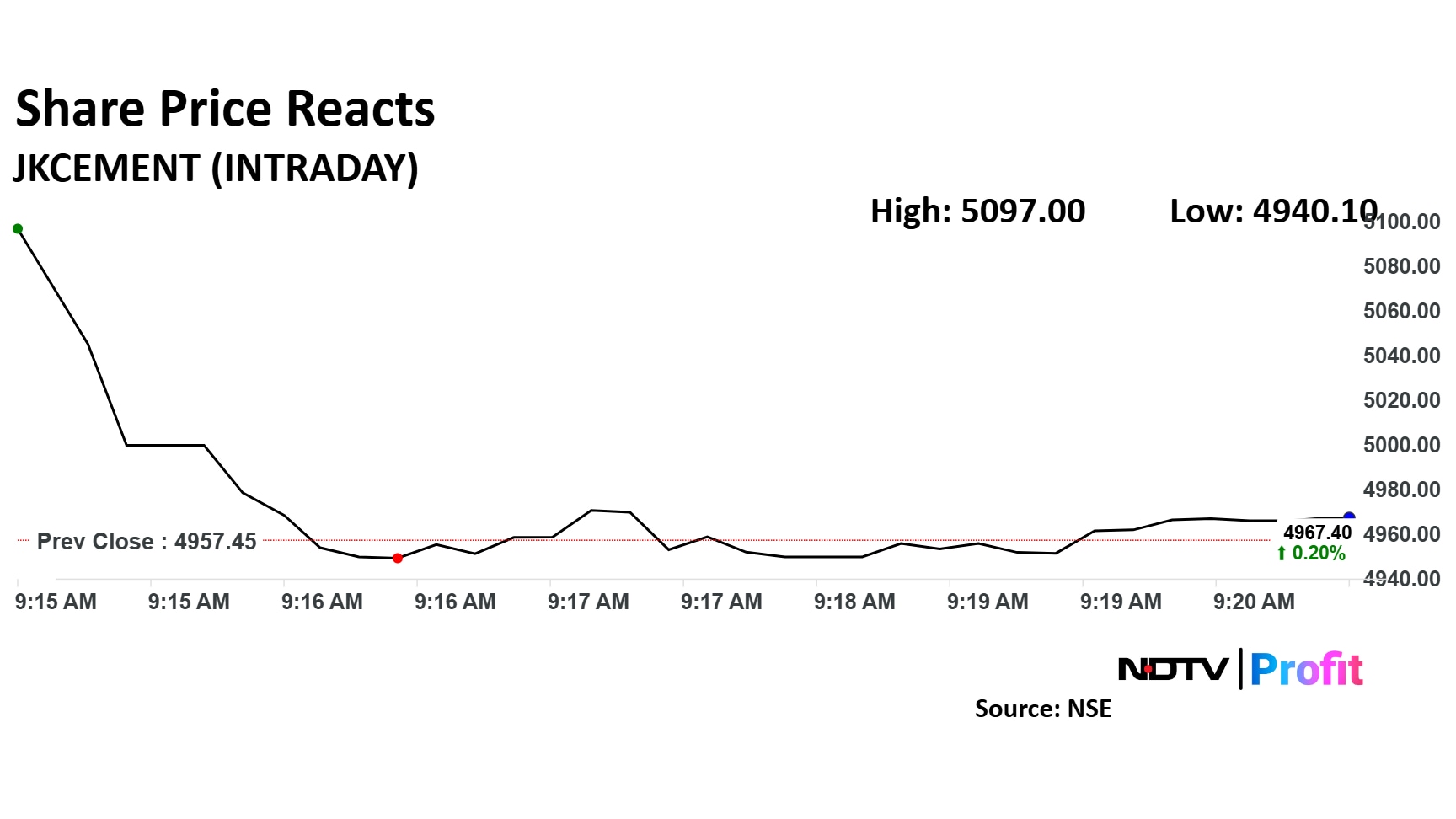

The scrip rose as much as 2.81% to Rs 5,097 apiece. It pared gains to trade 0.46% higher at Rs 4,980 apiece, as of 09:22 a.m. This compares to a 2.06% advance in the NSE Nifty 50 Index.

It has risen 17.65% in the last 12 months. The relative strength index was at 59.16.

Out of 28 analysts tracking the company, 20 maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.