The board of Jaiprakash Associates (JPA), the flagship company ofthe Jaypee Group, will meet on Monday to review the progress of its asset divestment plans. The company called for a board meeting after its lenders invoked the strategic debt restructuring option, with June 28 as the reference date.

Back in January, the joint lenders forum approved a corrective action plan which required the JP management to divest assets in order to deleverage the balance sheet.

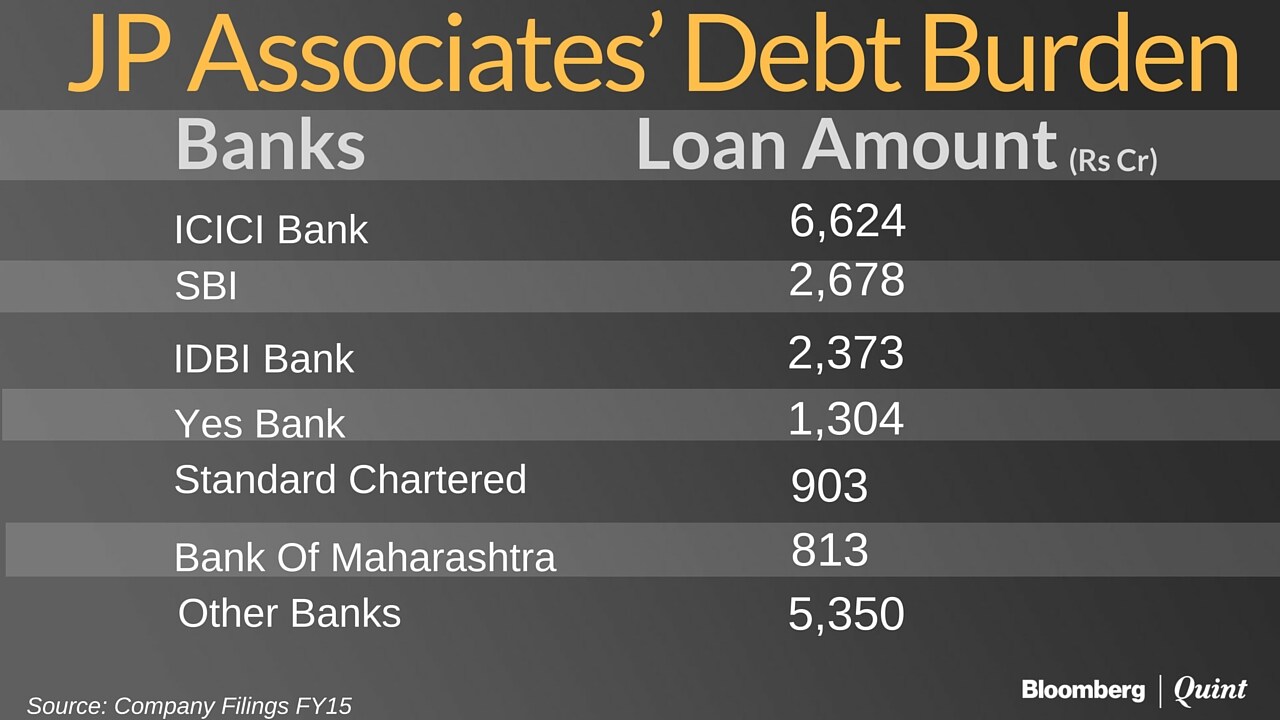

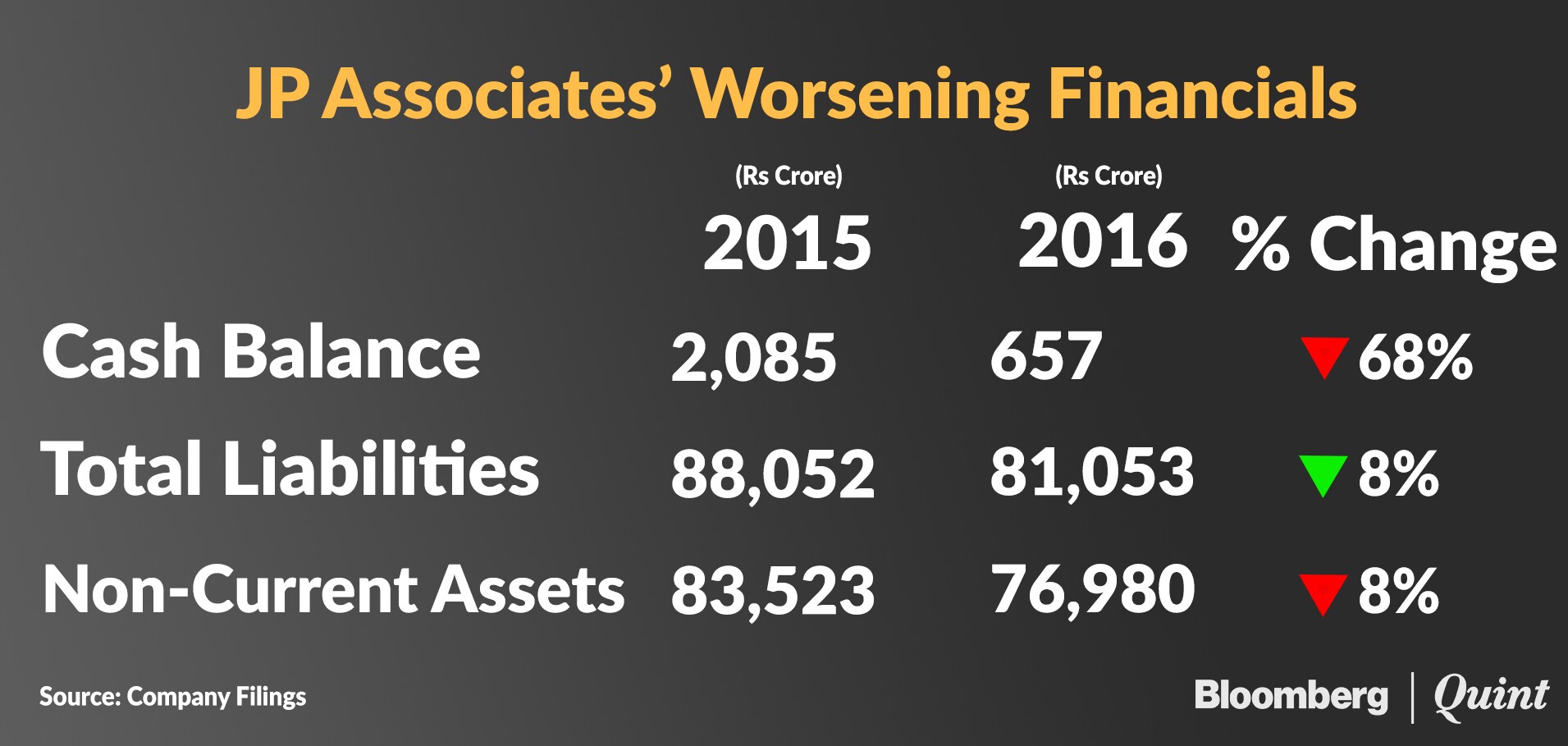

JP Associates had Rs 81,053 crore of consolidated debt on its balance sheet at the end of financial year 2015-16. The consolidated debt is six times itsnet-worth.

Asset Sales

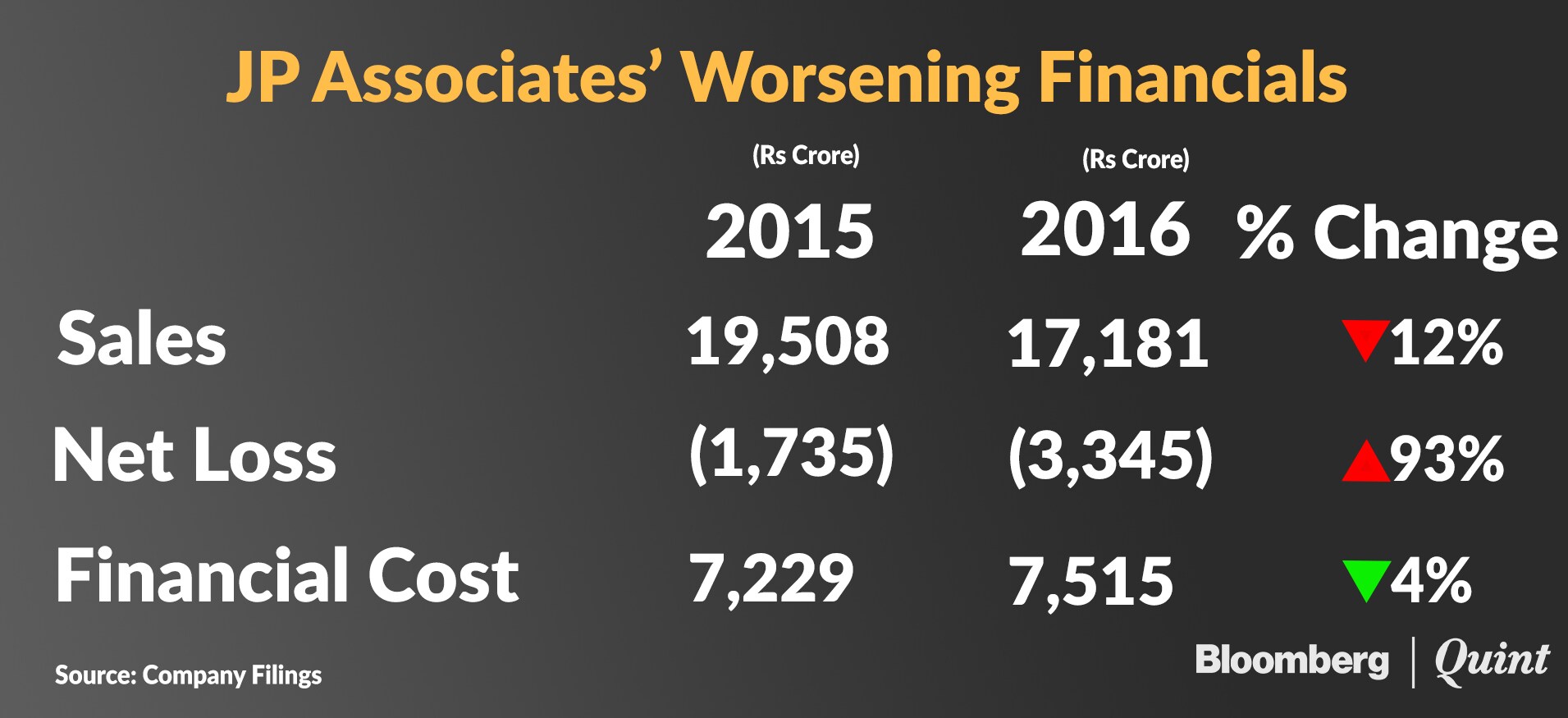

In financial year 2015-16, JP Associates' financials deteriorated further, and the company was forced to sell its cement, hydro-power and wind power assets.

The asset sales helped the company reduce its liabilities by 8 percent. But the company has been struggling to generate enough cash to service its interest payments. The interest coverage ratio has worsened to 0.87 from 0.64 over the last 2 years.

Cement Business Sale

In March 2016, JPA entered into a definitive agreement with UltraTech Cement to sell its 17.2 million tonne cement capacity for an enterprise value of Rs 15,900 crore. The transaction was expected to be completed in 9-12 months.

Post the completion of the deal, JPA will retain 10.6 million tonne cement capacity, and will have presence in Uttar Pradesh, Madhya Pradesh, Karnataka and Andhra Pradesh.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.