Coforge Ltd. share price dropped over 4% and hit the lowest level in the last nine session tracking broad-based weakness in IT stocks while market participants weigh US Federal Reserve policy path.

The US Federal Open Market Committee will start its two-day policy meeting later today, where the rate-setting panel is likely to deliver a 25-basis-point rate cut. Some traders expect that the central bank may signal a slower pace of rate cuts as inflation remained high.

Tight monetary condition in the US impact Indian IT companies because most of the domestic companies do substantial business in the world's largest economies.

Other than IT stocks, overall weakness is visible in Indian markets as traders held their breath for cues on US Fed's policy outlook for 2026. Rupee's weakness, foreign fund outflows roiled the sentiment in the market.

Meanwhile, Morgan Stanley maintained an Overweight rating on Coforge Ltd. and hiked the target price to Rs 2,030 apiece. The current target price implies 4% upside from Monday's close price.

The brokerage expects that Coforge will likely to report steady margin and cash-flow profile going forward. There is also continued optimism on revenue growth trends.

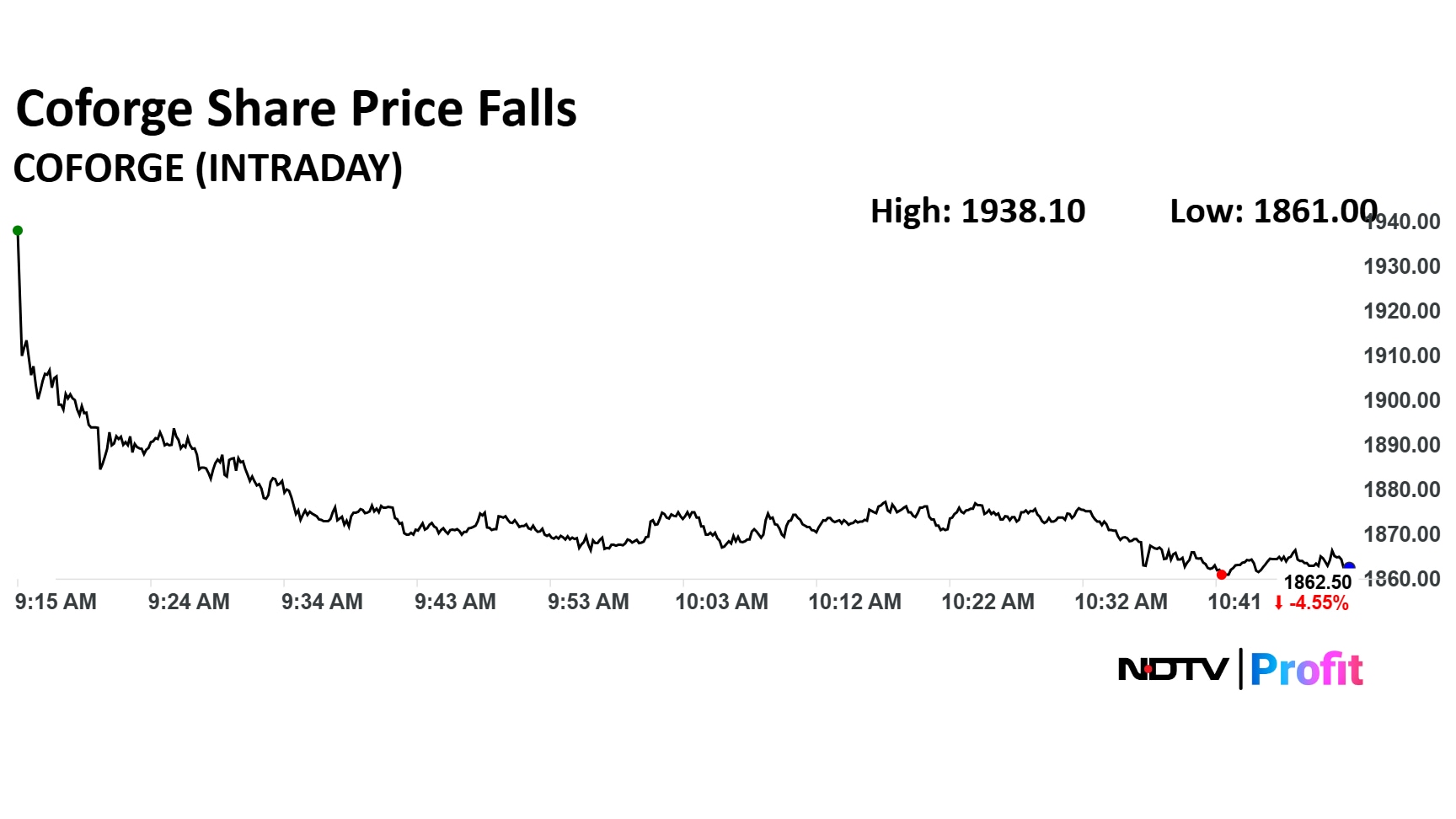

Coforge share price fell as much as 4.92% to Rs 1,855 apiece, the lowest level since Nov 26. It was trading 4.75% down at Rs 1,857 apiece as of 10:53 a.m., compared to 0.64% decline in the NSE Nifty 50 index.

The stock declined 3.86% on year to date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 50.21.

Out of 38 analysts tracking the company, 28 maintain a 'buy' rating, four recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.