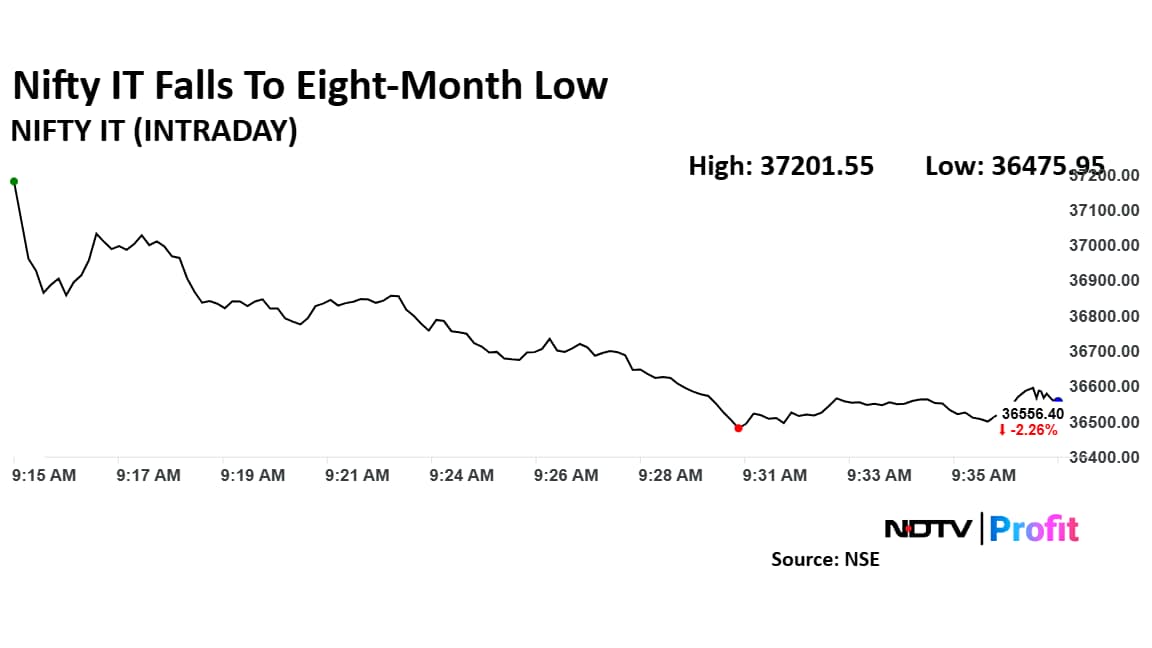

Shares of information technology companies were under pressure on Wednesday as the Nifty IT fell into bear market territory, with the index falling 21.67% from the record high it made in December.

The Nifty IT fell over 4% to hit a nine-month low, extending its decline for the fourth straight session.

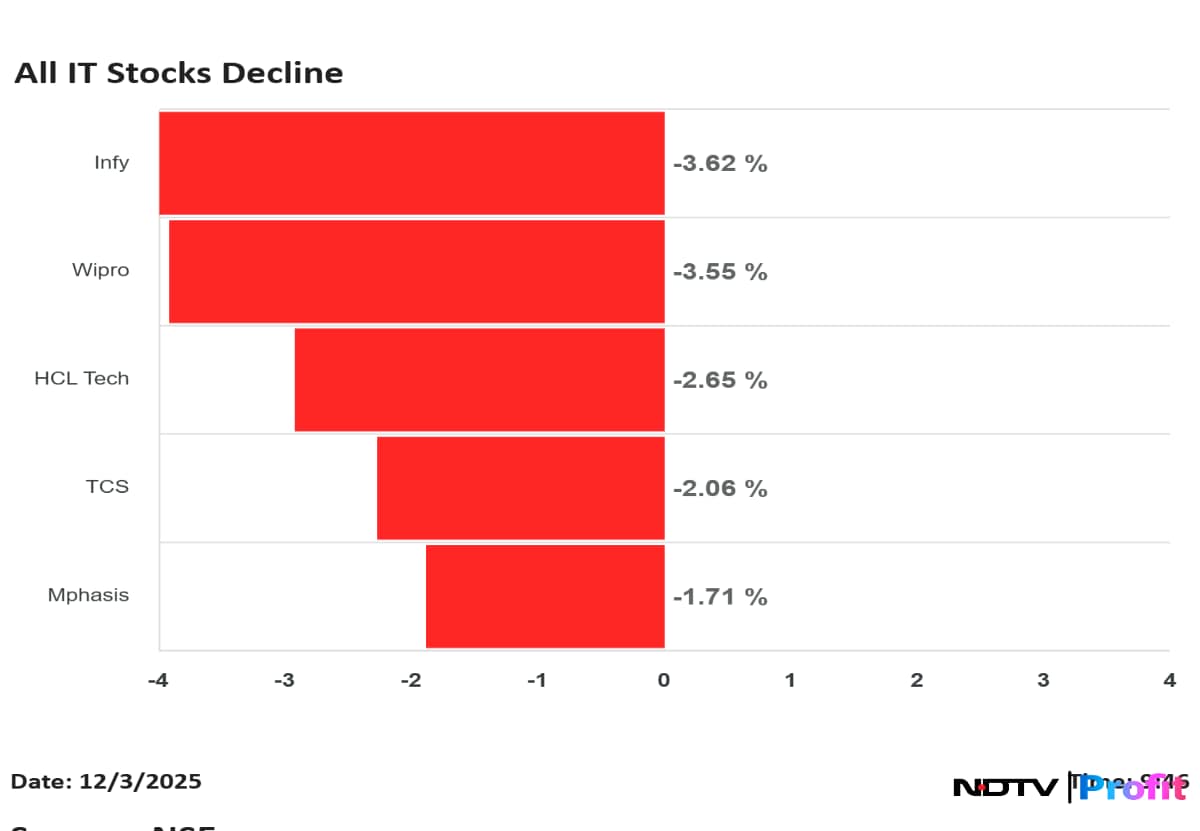

The index was dragged down by heavyweights Infosys Ltd. and Wipro Ltd. that have also seen an over 20% decline. LTIMindtree Ltd. and Mphasis Ltd. have also corrected over 30% from Dec. 13 last year.

On Tuesday, the index fell over 2% following a sharp decline in tech-heavy Nasdaq Composite that declined by 4%, marking its worst session since September 2022.

The index has fallen nearly 4% this week and over 16% this year, making it one of the worst performing sectors. The recent decline in the sector can be credited to concerns that the US economy may fall into a recession by the year-end due to President Donald Trump's tariff implementation. With investors exiting tech stocks and fear of tariffs mounting, the stocks could take a further hit.

"Few economists are now predicting that the probability of a U.S. recession taking place this year stands at 40%," Sumit Pokharna, vice president of fundamental research at Kotak Securities, said.

Fear of tariffs, concerns about a US slowdown, expectations of rising inflation, uncertainty around Fed rate cuts, delays in IT spending decisions by US customers, a stalled IT order pipeline, and increased competition for large deals are all challenging factors for the Indian IT sector. As a result, IT sector stocks are facing significant losses, Pokharna said.

The decline on Wednesday follows a report by Morgan Stanley, which says there will be a downside for both the revenue growth of Indian IT services and its valuation.

Indian IT stocks have corrected 6-18%, against a 6% correction in the Sensex. Despite this drop, relative valuations when compared to the Sensex are still at a five-year average, the brokerage said.

The brokerage's top picks from the sector are LTIMindtree and Coforge Ltd. It prefers Tata Consultancy Services Ltd. over Infosys and Tech Mahindra Ltd. over HCL Technologies Ltd.

In the mid-cap space, the brokerage picked Coforge over Mphasis and L&T Technology Services Ltd. over Tata Elxsi Ltd. and Cyient.

Morgan Stanley downgraded Infosys to 'equal weight', picking micro stories over macro plays. This pulled the stocks down to its eight-month low on Wednesday. Infosys fell over 4.39%, but pared losses to trade 4.83% lower. The stock has fallen nearly 7% this week and nearly 16% so far this year.

Wipro has fallen the most in the IT index with a decline of nearly 5%, followed by Infosys. HCLTech fell over 3% to Rs 1,514.05 apiece, while Persistent Systems Ltd. saw a 2.67% decline. Mphasis, TCS, Coforge and LTIMindtree also fell over 2% on Wednesday. Tech Mahindra, one of the brokerage's top picks, fell 1.82% to Rs 1,452.30 apiece.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.