IT stocks took centre stage on Monday after they plunged collectively in the backdrop of Accenture Plc's share price declining in the United States despite the company reporting healthy third quarter performance.

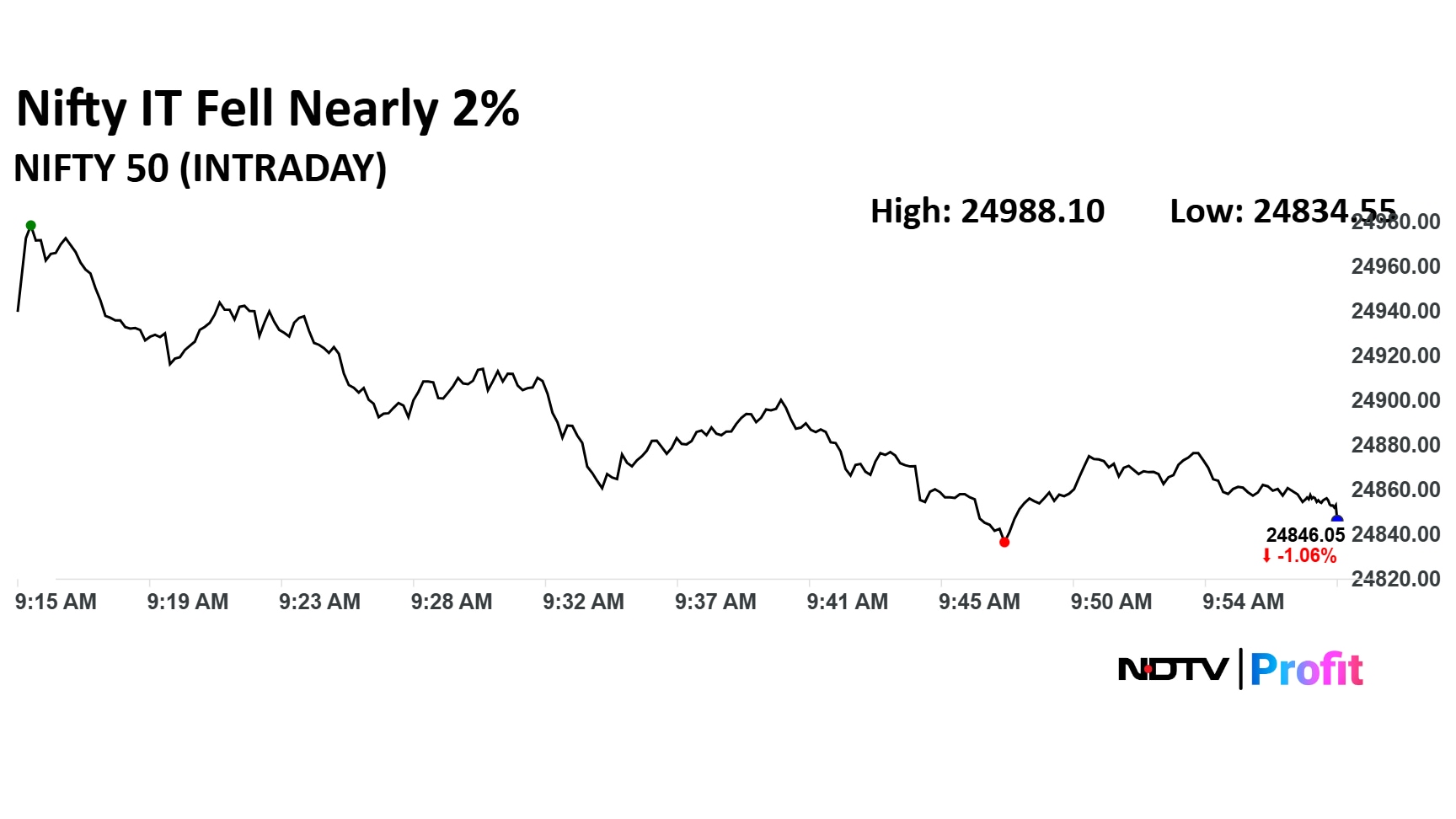

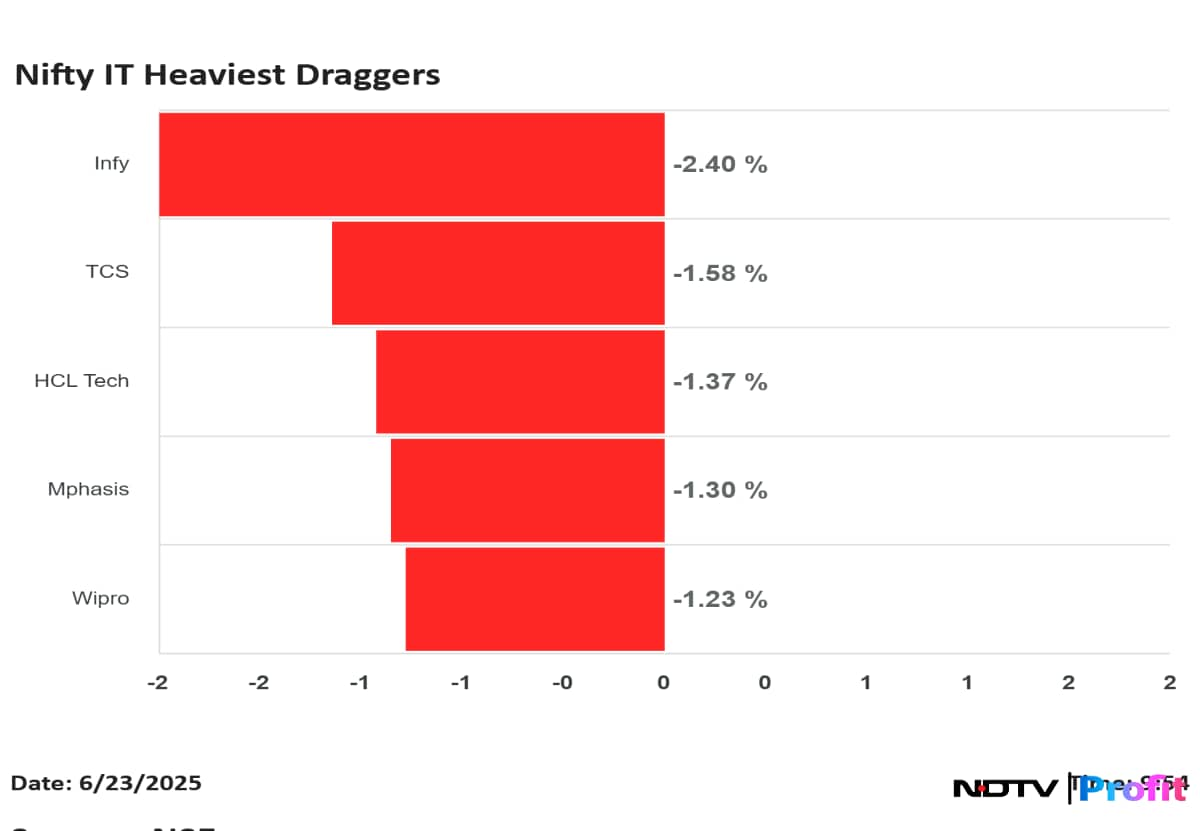

Nifty IT fell nearly 2% with Infosys Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., Mphasis Ltd., and Wipro Ltd. weighing heaviest on the sector.

Infosys led the decline after it fell as much as 2.40%, followed by TCS at 1.58%, and HCLTech at 1.37%. Mphasis and Wipro were also among the top five losers and fell 1.30% and 1.23%, respectively.

Accenture Plc. stock plunged nearly 11% in New York on Friday, after the IT services company reported its third-quarter results and issued its outlook. According to Bloomberg, analysts pointed to weaker-than-expected bookings as a key concern.

Accenture reported revenue rising 8% year-on-year to $17.7 billion for the third quarter of fiscal 2025, beating estimates of $17.3 billion. Earnings per share rose 15% to $3.49, while operating margin expanded to 16.8%.

The company raised its full-year revenue growth forecast to 6–7% in local currency, up from 5–7% earlier. Free-cash-flow guidance was bumped up to a range of $9 billion to $9.7 billion, and earnings per share are now expected in the range of $12.77 and $12.89.

New bookings during the quarter stood at $19.7 billion, down 6% in US dollar terms. Consulting accounted for $9.08 billion and managed services brought in $10.62 billion. Generative AI-related bookings contributed $1.5 billion. Despite a year-on-year decline in new bookings, the company reported 30 clients with over $100 million in quarterly bookings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.