- Infosys share price fell 1.30% ahead of Sept 11 board meeting on buyback programme

- This will be Infosys’s first share buyback in three years, after four since 2017

- Company typically buys back shares at 25% premium, using about 30% of cash reserves

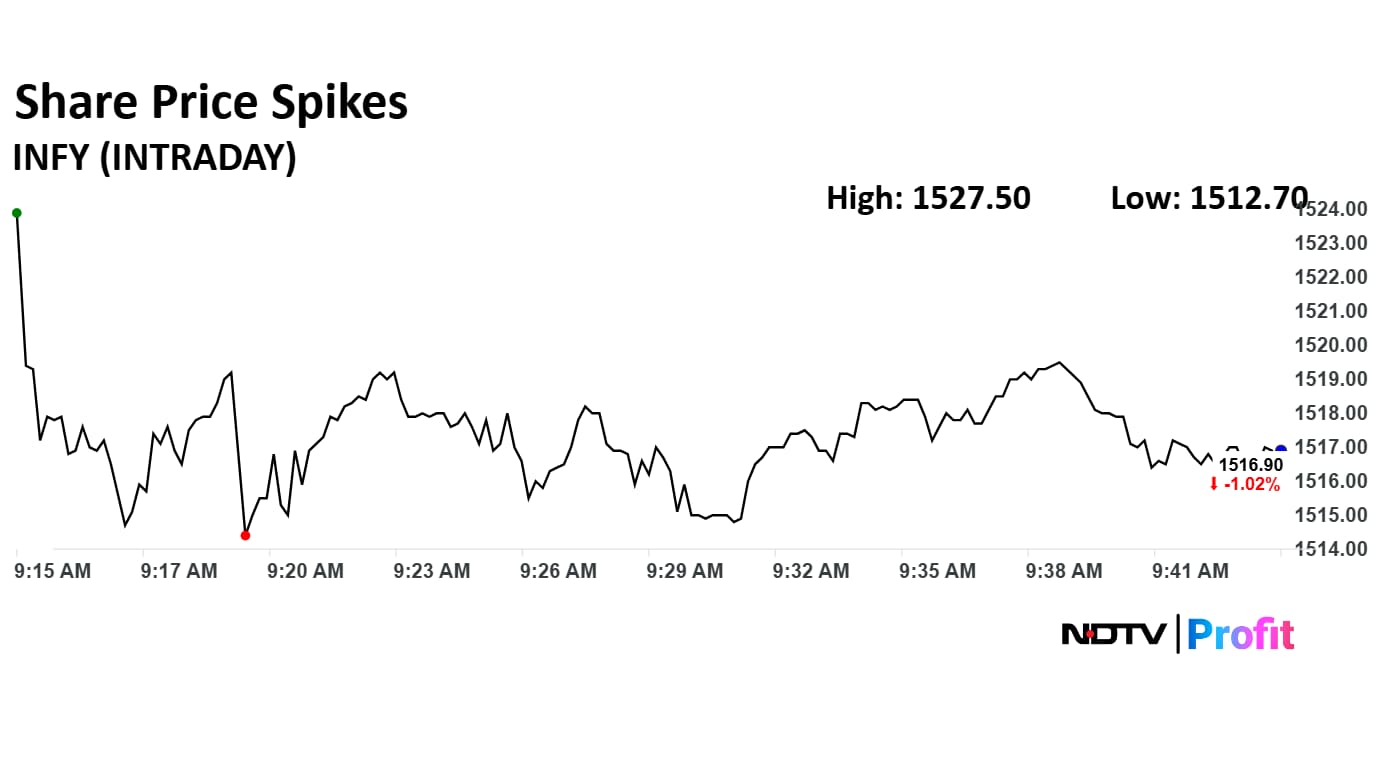

Infosys Ltd.'s share price declined on Thursday, falling 1.30% as the technology giant's board is set to meet on Sept. 11 to consider its fifth buyback program. Notably, this is going to be company's first buyback in three years. Infosys had conducted four buybacks from 2017 to 2023.

Past trends suggests that the company's buybacks have been done at an average premium of 25% to the current market price of the stock, and on average, Infosys spends 30% of its cash on buybacks. The company is likely to utilise cash of Rs 13,560 crore in the process.

The buyback comes at time of heightened pressure on IT stocks due to the worsening global macroeconomic situation led by tariff tensions between US and India. Based on analyst views and valuations, the stock has a consensus target price of Rs 1,743, which suggests a potential 13.7% upside.

However, the range of analyst price targets is quite wide, with the highest forecast at Rs 2,085 seeing a 36% upside and the lowest at Rs 1,440, with a 6% downside. The stock's current valuation, with a 12-month forward price-to-earnings ratio of 21.5 times, is trading at a discount compared to its 5-year average price-to-earnings ratio of 25 times, suggesting it may be undervalued relative to its historical performance.

The scrip fell as much as 1.30% to Rs 1,512.70 apiece. It pared losses to trade 1.07% lower at Rs 1,516.20 apiece, as of 09:46 a.m. This compares to a flat NSE Nifty 50 Index. It has fallen 20.62% in the last 12 months. The relative strength index was at 54.

Out of 50 analysts tracking the company, 35 maintain a 'buy' rating, 13 recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.