The share price for IndusInd Bank declined over 3% on Friday, after the private lender said it has identified two more accounting issues in internal audits.

An audit by the internal audit department found that Rs 674 crore was "incorrectly recorded as interest" over three quarters of fiscal 2025. This amount was fully reversed as on Jan. 10, 2025, IndusInd Bank informed the exchanges on Thursday.

The bank had first disclosed last month that an internal audit was being conducted into discrepancies in the microfinance business. A report was submitted on May 8, the bank said.

Additionally, a separate investigation was launched by the internal audit team after a whistleblower complaint was filed, alleging concerns in the "other assets" and "other liabilities" account.

This audit, too, revealed Rs 595-crore worth of unsubstantiated balances in the "other assets" accounts of the bank. These balances were set off against corresponding balances in the "other liabilities" accounts in January.

According to research firm Morgan Stanley's estimates, the full-year impact of the discrepancies will be Rs 900 crore on pre-tax basis. It will likely be accounted in fourth quarter earnings. After taking into account the derivative portfolio discrepancy, the cumulative impact will be Rs 3,000 crore on pre-tax basis, and Rs 2,300 crore on post-tax basis.

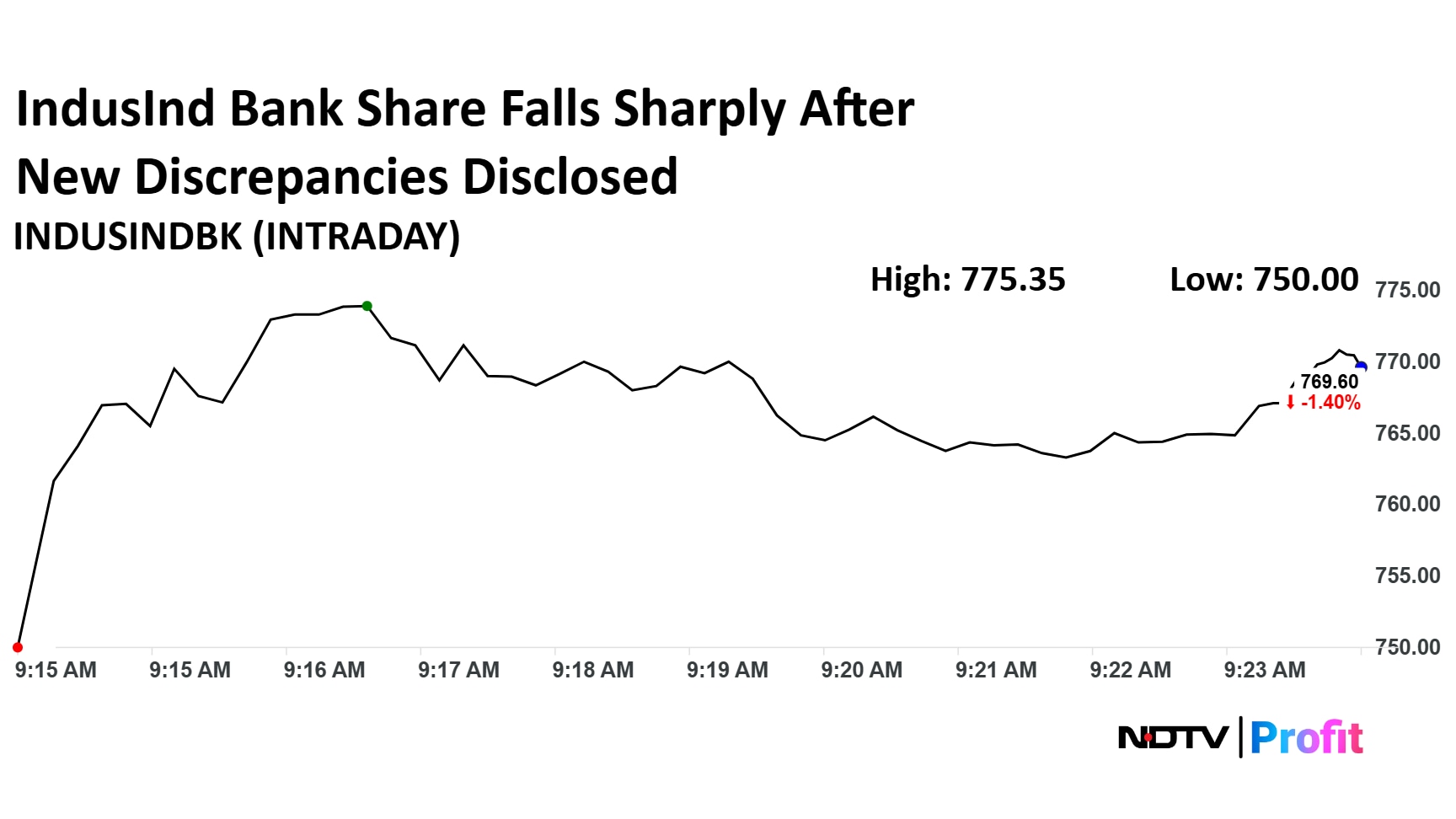

IndusInd Bank Share Price

The scrip fell as much as 3.91% to Rs 750 apiece, the lowest level since April 16, 2025. It pared losses to trade 2.05% lower at Rs 764.55 apiece, as of 9:30 a.m. This compares to a 0.19% decline in the NSE Nifty 50.

The stock has fallen 19.60% on a year-to-date basis, and is down 45.18% in the last 12 months. Total traded volume so far in the day stood at 0.45 times its 30-day average. The relative strength index was at 35.16.

Out of 44 analysts tracking the company, 17 maintain a 'buy' rating, 18 recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.