Shares of IndusInd Bank Ltd. rose nearly 6% on Monday after the Reserve Bank of India, in a rare clarification, assured customers of the bank's financial stability.

IndusInd Bank remains well capitalised and its financial position remains satisfactory, RBI said in a statement on Saturday.

The central bank said, “…there is no need for depositors to react to the speculative reports at this juncture. The bank's financial health remains stable and is being monitored closely by Reserve Bank.”

The central bank said that as per auditor-reviewed financial results of the bank for the quarter ended December, the lender has maintained a comfortable Capital Adequacy Ratio of 16.46% and Provision Coverage Ratio of 70.20%. The Liquidity Coverage Ratio of the bank was at 113% as of March 9, 2025, as against regulatory requirement of 100%.

The clarification by the RBI came days after IndusInd Bank disclosed a discrepancy in accounting with an estimated impact of 2.35% of the bank's net worth. Soon after the disclosure, massive decline in the bank's scrip was witnessed.

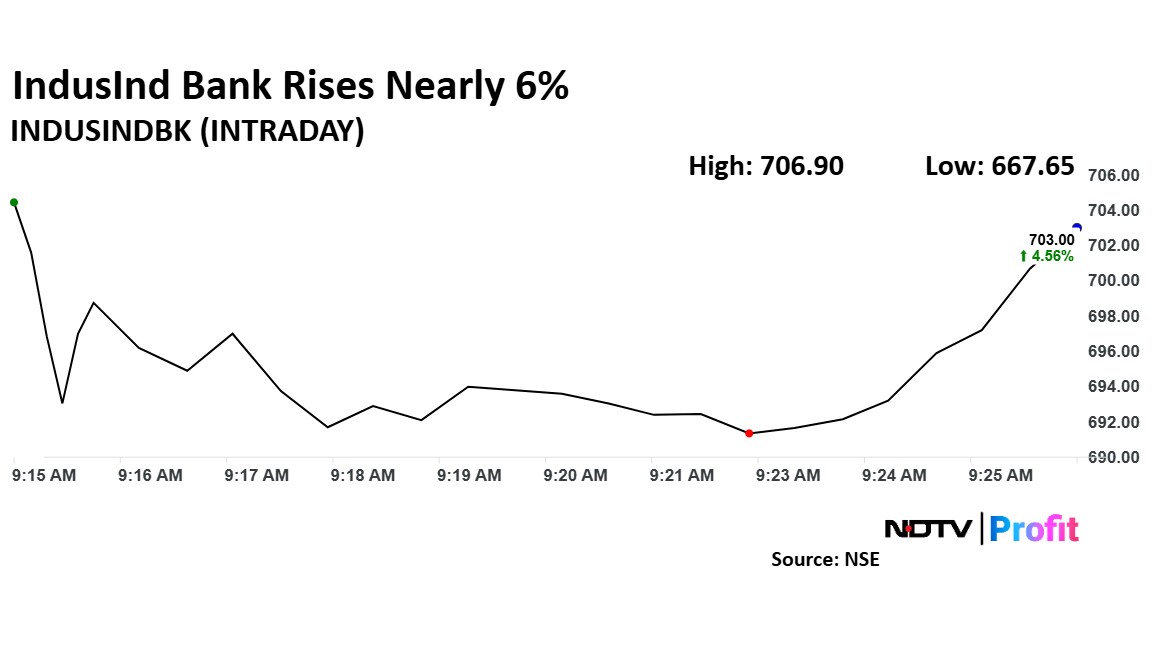

IndusInd Bank Share Price

IndusInd Bank share price rose nearly 6% in early trade on Monday. It pared gains to trade 2.84% higher at Rs 691.45 apiece, as of 9:28 a.m. This compares to a 0.67% advance in the NSE Nifty 50 Index.

It has fallen 53.30% in the last 12 months and 28.49% year-to-date. The relative strength index was at 24, indicating it was oversold.

Out of 48 analysts tracking the company, 21 maintain a 'buy' rating, 18 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 52.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.