Indus Towers Ltd. share price rose over 5% on Friday as data on the NSE showed promoter Bharti Airtel Ltd. acquired equity between Aug. 25 and Sept. 1 from the open market.

Bharti Airtel acquired over 68.7 lakh shares in the company in five tranches, as per insider trading data on the NSE. This represents 0.26% equity in Indus Towers.

The acquisition price has not been disclosed. The current market value of the shares is Rs 234 crore.

The Sunil Bharti Mittal-led telecom giant owned a 50% stake as of June in Indus Towers, India's largest mobile tower installation company.

In a recent note, analysts at Citi said Indus Towers' valuation is attractive in a regional and local context and believe "growth concerns appear overdone."

They expect strong FCF (Free Cash Flow) generation to support future payouts, despite a temporary delay. Any government relief for Vodafone Idea Ltd. in AGR dues could trigger a positive chain of events, enabling Indus Towers to reinstate dividends, the note said.

Indus Towers has not given any dividends to shareholders since 2022. The company became a subsidiary of Bharti Airtel following a buyback of shares in August 2024.

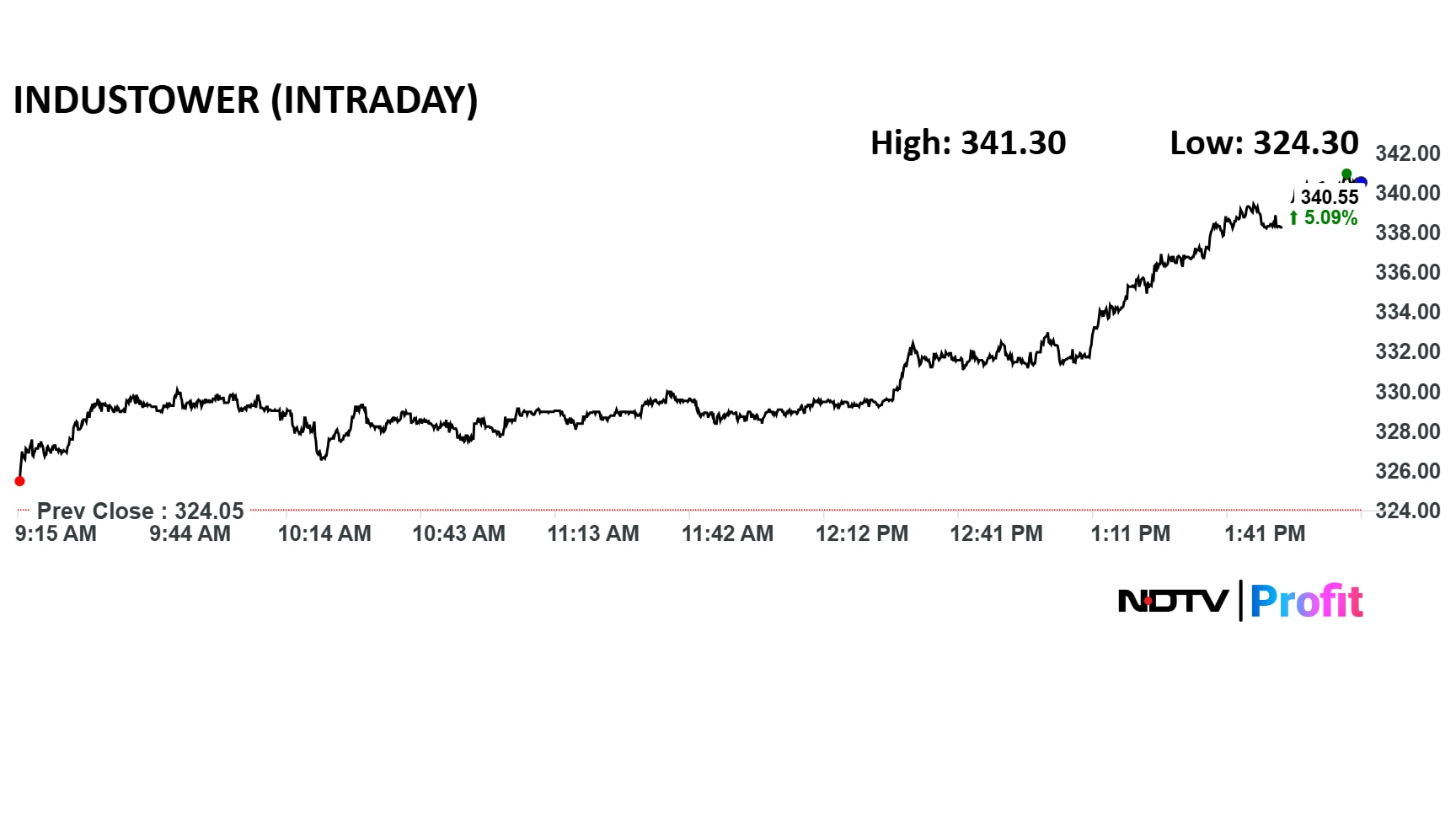

On Friday, the share price rose as much as 5.3% intraday to Rs 341.3 apiece. The stock has fallen 23% so far this year.

Nine out of the 23 analysts tracking Indus Towers have a 'buy' rating on the stock, seven each recommend a 'hold' and a 'sell', according to Bloomberg data. The average of the 12-month analyst price target of Rs xx implies a potential upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.