The valuation premium Indian equities command over the emerging market benchmark is at its highest in two years, driven by a rebound in April even as an earnings recovery remains elusive.

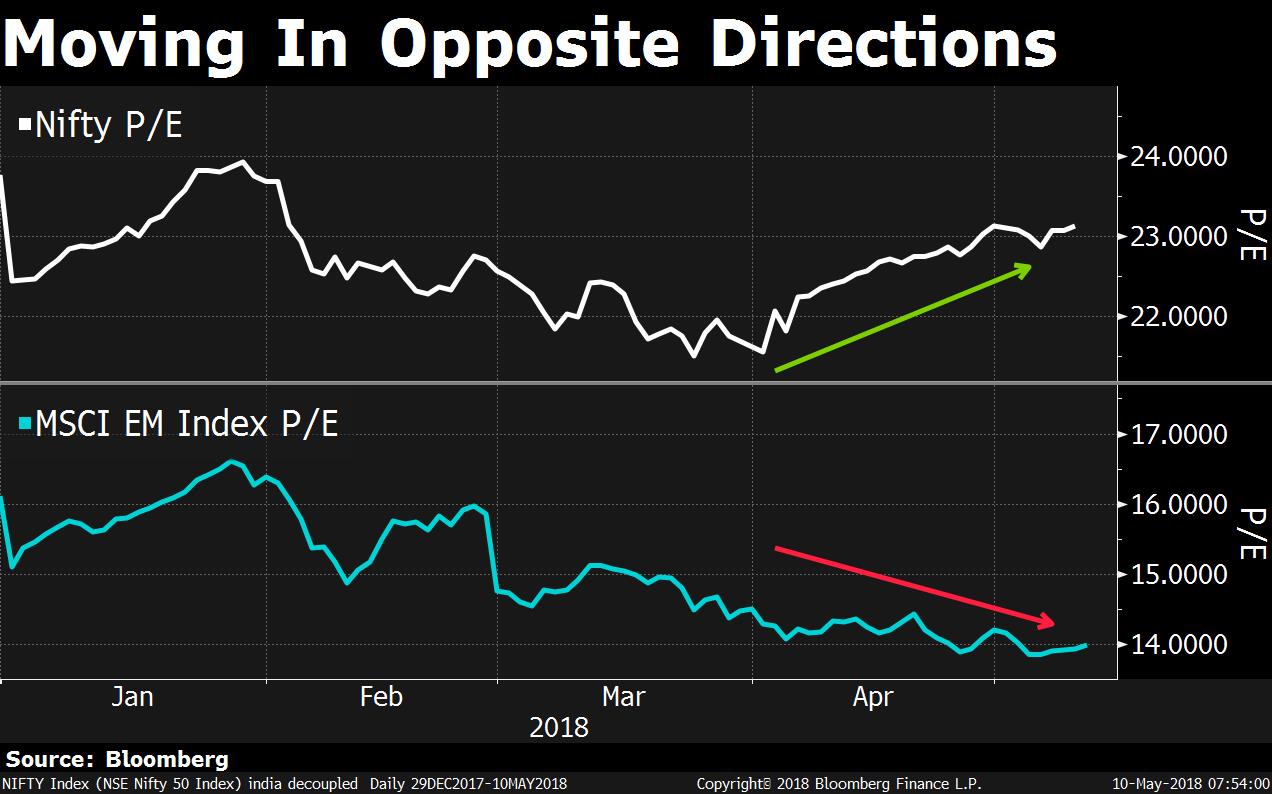

The ratio of the price-to-earnings multiple of the NSE Nifty Index and the MSCI Emerging Markets Index now stands at 1.65, gaining more than 10 percent from the March low. The Nifty rose over 7 percent during the period, while the MSCI Emerging Market Index fell more than 2 percent.

India's PE multiple is driven by price rise. Earnings have grown at an annualised rate of about 6 percent in the last four years. That compares with a 15 percent growth in the last decade and a half, according to Nirav Sheth, head of institutional equities at SBI Cap Securities.

He said the current premium is on account of depression in earnings for the year ended March. “But expect that to change. Earnings will likely grow 20 percent for the financial year 2019 and the recovery will largely be led by growth in private corporate facing banks,” Sheth told BloombergQuint.

Expect bank earnings to compound more than 50 percent over next couple of years.”Nirav Sheth, SBI Cap Securities

That's because India is a relative lightweight with 8.4 percent weightage in the MSCI EM Index, which is dominated by China at 27.3 percent. The benchmarks trades at lower valuation currently to India since China is now trading at 15.4 times its earnings— 7.5 percent lower than the March high.

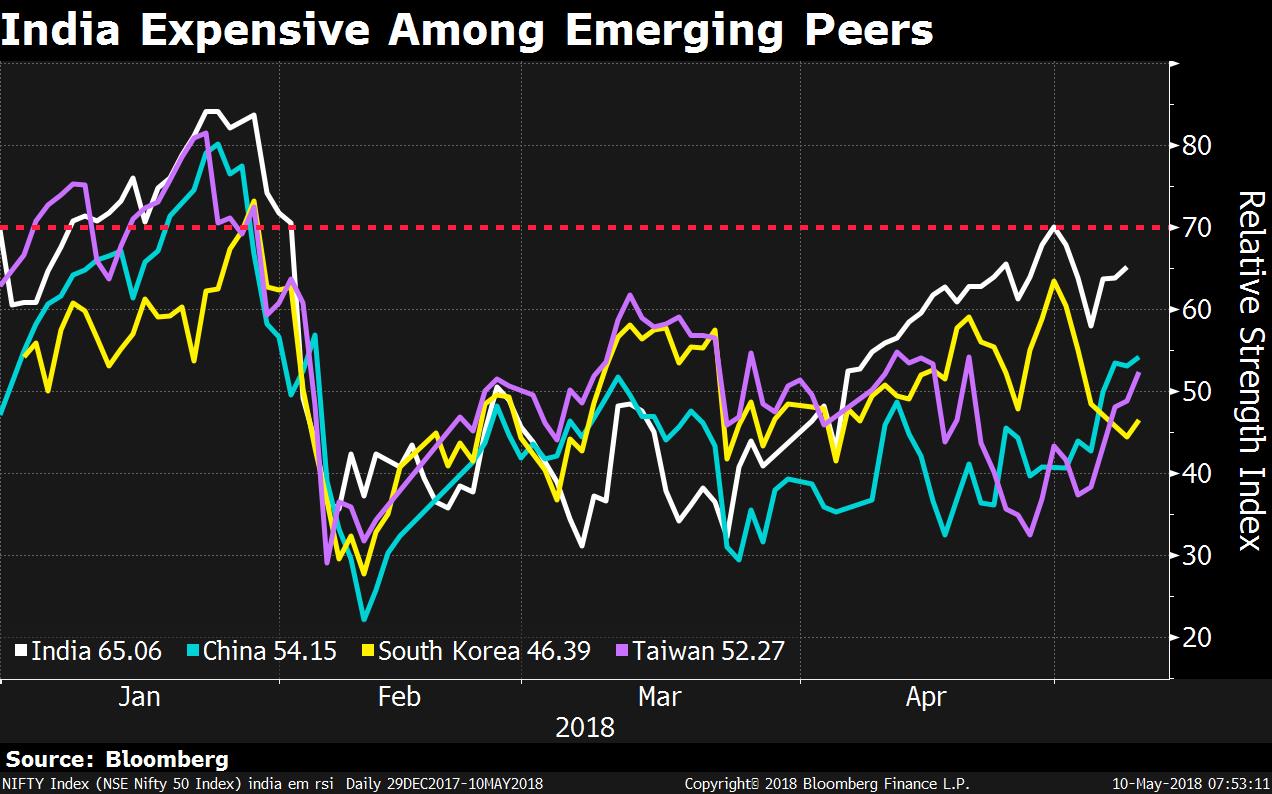

The Nifty is, however, nearing the overbought level on the Relative Strength Index, while China, South Korea and Taiwan are still considerably away. RSI in the overbought region indicates a possible correction.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.