India currency, money, rupee.jpeg?downsize=773:435)

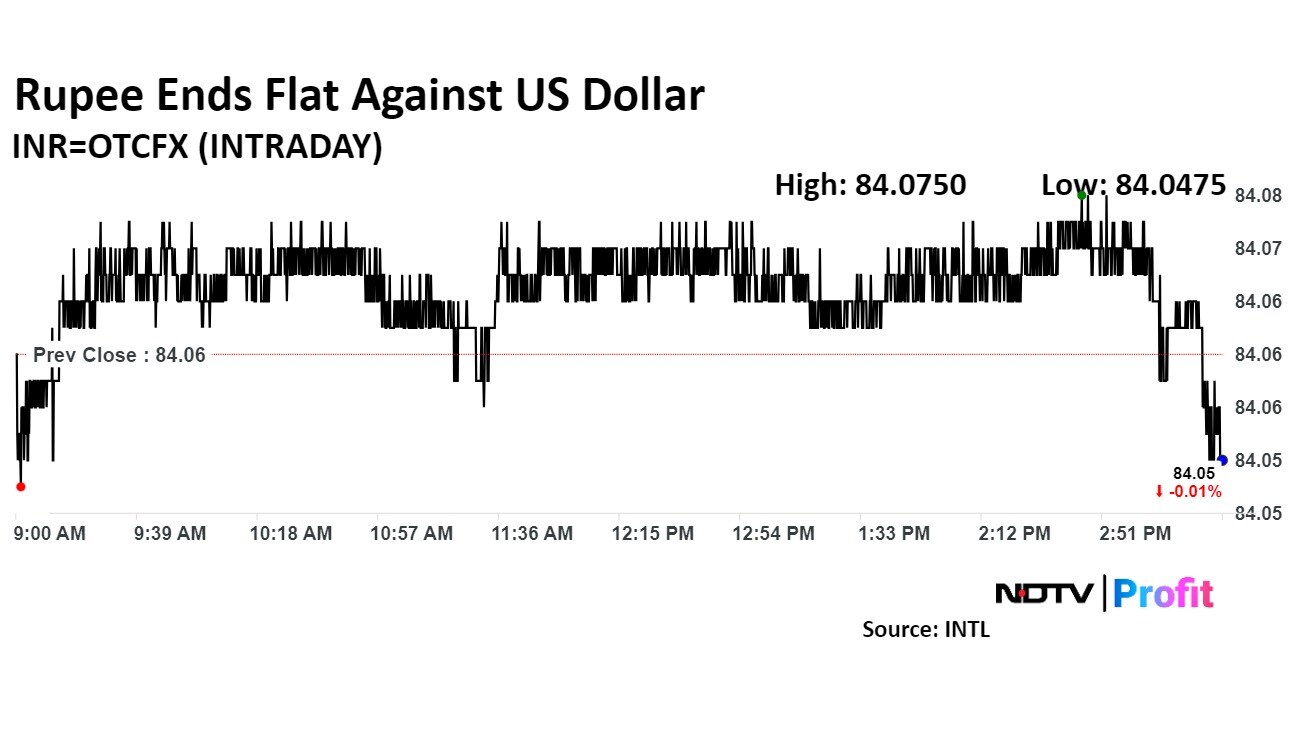

The Indian rupee ended the day little changed on Monday amid likely dollar selling by the Reserve Bank of India that countered the impact of demand for the greenback from foreign portfolio investments.

The unit appreciated 1 paisa to Rs 84.06 against the US dollar after closing at Rs 84.07 on Friday. This comes after the currency touched an all-time low of Rs 84.09 in the previous session, according to Bloomberg data.

"The FPIs have sold almost Rs 60,000 crore of stocks since the last 10 days, and they have also started selling in Indian debt on Friday. The rupee did not cross Rs 84.08 today, but the dollar was well bid against it, as RBI sold dollars to protect it at Rs 84.08," said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

The upcoming Hyundai IPO is unlikely to attract significant foreign investment, according to him. "With a US holiday today (Columbus Day), cash demand for the dollar-rupee pair may be subdued," Bhansali said.

Indian equities saw significant outflows in October, with foreign institutional investors offloading nearly $6.4 billion as market sentiment shifted to a risk-off mode, according to Amit Pabari, managing director of CR Forex Advisors.

Both experts agree that the rupee could see some support from the RBI's interventions. "The Reserve Bank of India's intervention and strong resistance at the Rs 84.10 level could trigger a pullback below Rs 84," Pabari said, adding that easing FII outflows might offer some relief.

Rupee may trade between Rs 83.96 to Rs 84.15 for today, according to Bhansali.

Crude oil prices were 2.44% down at $77.11 driven by Hurricane Milton's impact on US oil production and rising geopolitical tensions between Israel and Iran in the Middle East. The dollar index was trading positively at 0.16% up or $103.056.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.