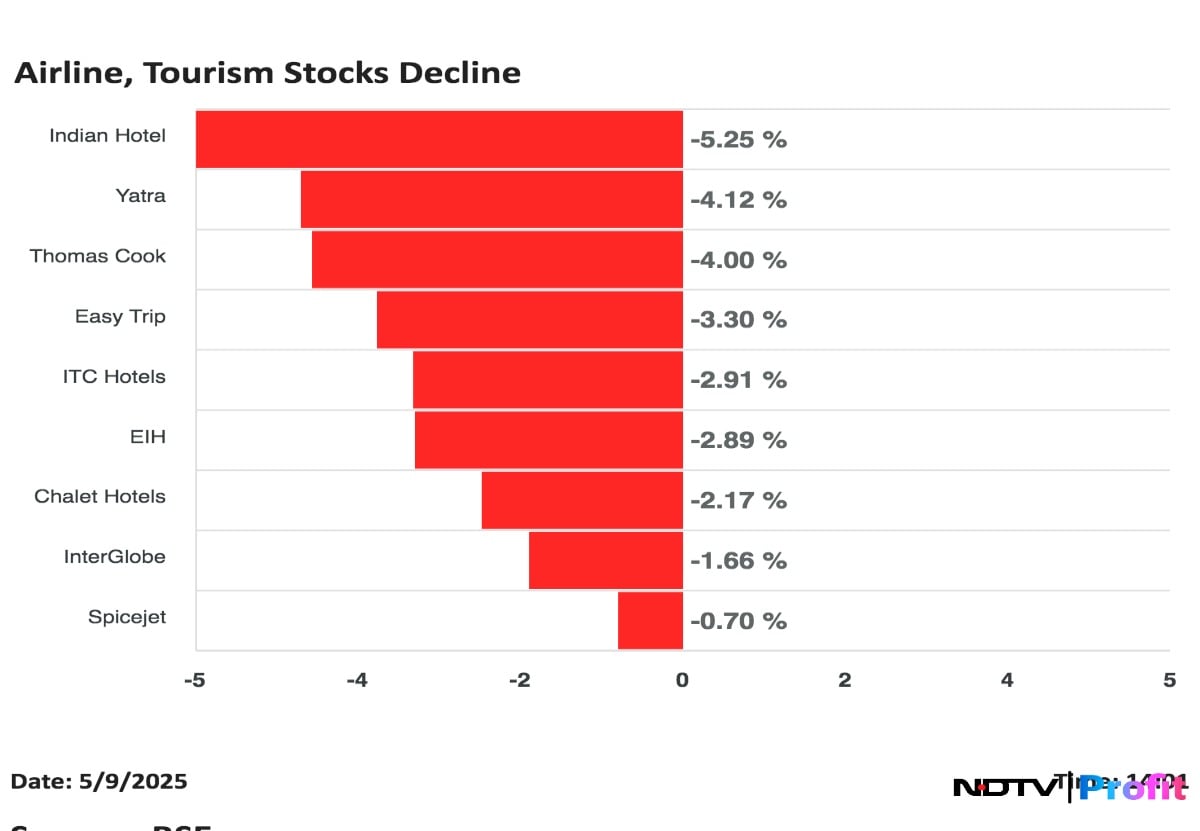

Shares of travel, tourism, and hospitality companies declined on Friday, as escalating tensions between India and Pakistan triggered broad fears of disrupted travel plans, lower tourism demand, and dampened discretionary spending.

The selloff was fuelled by geopolitical uncertainty, after Pakistan launched heavy artillery shelling, drone, and loitering munition attacks overnight across key border areas, including Jammu and Kashmir, Punjab, and Rajasthan. Jammu Airport, which houses an Indian Air Force station, and the strategic Pathankot Airbase were among the targets reportedly hit. The attacks followed a recent terror strike in Kashmir, further intensifying cross-border tensions.

Indian Hotels Co. and EIH Ltd. led the sectoral decline, both plunging over 6% during intraday trade. Thomas Cook (India) Ltd. fell more than 5%, while InterGlobe Aviation Ltd.—the operator of IndiGo airlines—lost nearly 5%, as concerns mounted over travel disruptions and cancellations.

Online travel aggregators were also hit. EaseMyTrip Ltd. fell 4.70% to Rs 11.55 per share, while Yatra Online Ltd. traded more than 4% lower. Budget airline SpiceJet Ltd. declined 2.78%, and hotel operators Chalet Hotels Ltd. and ITC Hotels were down 3.96% and 3.98%, respectively.

With 24 airports across India temporarily shut under Operation Sindoor and heightened military activity, analysts expect short-term pain for the travel and tourism sector unless the situation de-escalates quickly.

According to an HSBC report, IndiGo, Air India, and SpiceJet are among the hardest hit, with estimated daily EBIT losses of Rs 7 crore, Rs 5 crore, and Rs 1.5 crore, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.