Shares of Indian Bank will be in the limelight on Monday as the day marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

The record date determines the eligible shareholders who will receive the dividend payment. The ex-dividend date, which mostly coincides with the record date, marks when the share price adjusts to reflect the upcoming payout.

Indian Bank's board of directors announced a final dividend of Rs 16.25 per share for the financial year 2025. The record date to determine the shareholders eligible for the dividend payout has been fixed as June 10.

Under the T+1 settlement mechanism, investors must ensure their purchase is completed a day before the record date. This means shares bought on Monday will be settled in time for shareholders' names to appear on the company's records on Tuesdat, securing their entitlement to the dividend.

Indian Bank's net profit was up by 32% annually at Rs 2,956 crore in March 2025 from Rs 2,247 crore in March 2024.

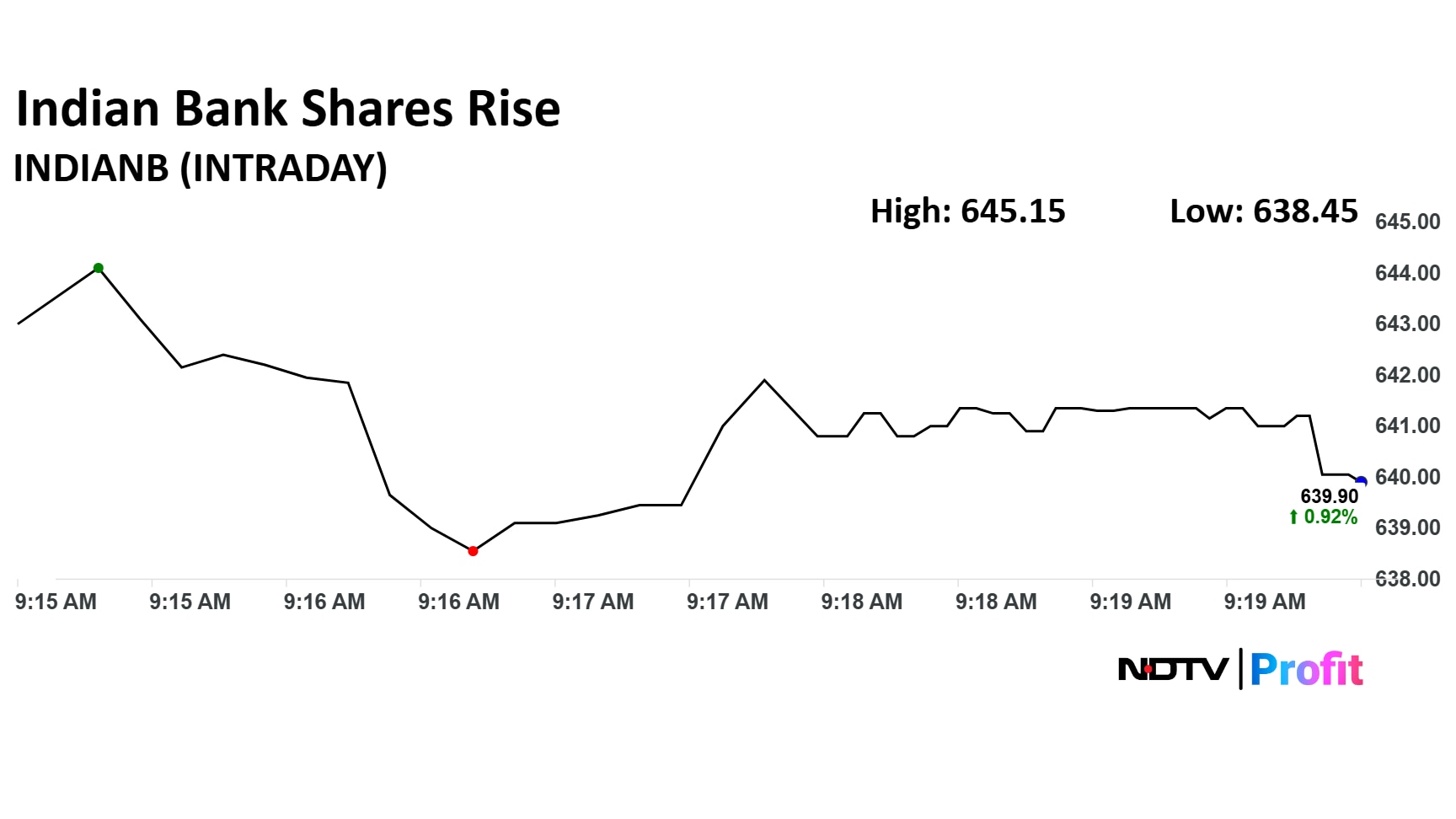

Indian Bank Share Price Today:

The share price for Indian Bank rose as much as 1.75% to Rs 645.15 apiece, the highest level since June 3. It pared gains to trade 0.88% higher at Rs 638.70 apiece, as of 9:17 a.m. This compares to a 0.53% advance in the NSE Nifty 50 Index.

The share price has risen 21.02% on a year-to-date basis, and is up 19.93% in the last 12 months. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 53.15.

Out of 12 analysts tracking the company, 11 maintain a 'buy' rating, and one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.