IHH Healthcare Bhd revised its offer for Fortis Healthcare Ltd. after the board of India's second-largest hospital chain decided it would only consider binding bids.

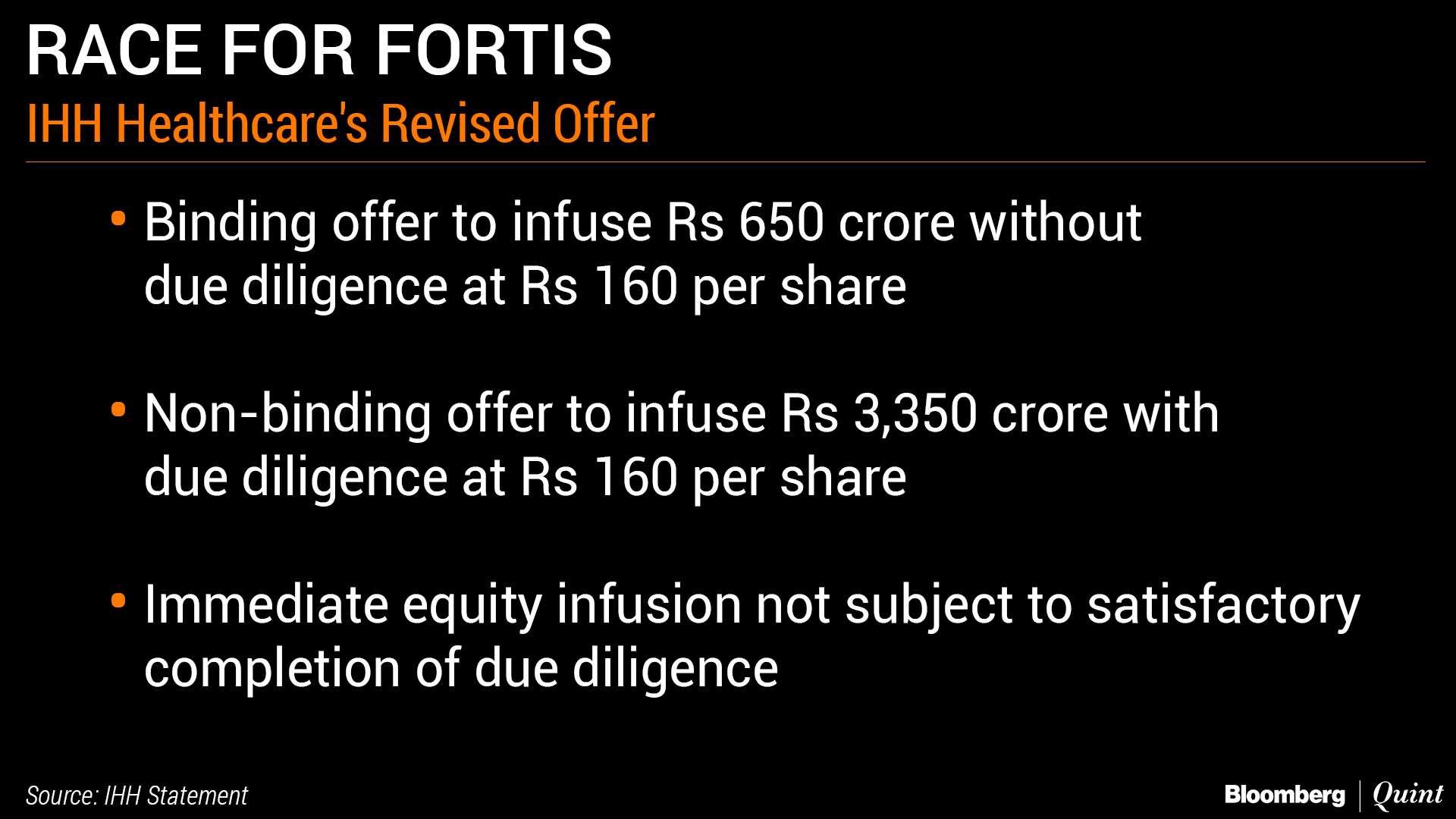

Asia's largest healthcare group made a binding offer to infuse Rs 650 crore through a preferential issue at Rs 160 per share, IHH Healthcare said in a statement. That's subject to confirmation that Fortis will give IHH immediate access to carry out a legal and financial due diligence. These funds, according to the revised offer, can only be used to pay off immediate dues to employees, creditors and debt servicing.

The new offer is similar to its original offer of $1.3 billion (or Rs 4,000 crore) but bifurcates it into two steps to meet the Fortis board's eligibility criteria. Besides the Rs 650 crore binding offer, IHH has made a non-binding offer of Rs 3,350 crore subject to completion of due diligence. IHH has given Fortis up to May 4 to respond, after which the offer will stand withdrawn.

Last week, the Fortis board had set up an advisory panel to evaluate only binding offers for its healthcare and diagnostics business. At least five investor groups are eyeing to takeover Fortis after its founder Malvinder Singh and Shivinder Singh stepped down from the board amid allegations of siphoning funds. The troubled healthcare company has also received binding offers from Manipal Health Enterprise Pvt Ltd., and Burman and Munjal families. Chinese conglomerate Fosun International and KKR-backed Radiant Life Care Pvt. Ltd. are also in the fray but with non-binding proposals.

IHH said the proposal for “immediate equity infusion is not contingent on satisfactory completion of due diligence”.

If Fortis agrees to the first part of the offer, IHH will pump up to Rs 3,350 crore through a subsequent preferential issue of shares at Rs 160 per share but only after it satisfactorily completes the due diligence. This, the Malaysian company said, would be completed within three weeks after Fortis grants it access.

The second part of the fund infusion can be used “for executing the long term strategic objectives of the company and optmising its strucuture through the acquisition of RHT (RHT Health Trust) assets,” IHH said in a letter to Fortis sent along with the media statement.

Also Read: Is The Fortis Board Focused On Value Maximisation?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.