Indian Energy Exchange Ltd. shares fell over 2% on Thursday extending its decline for the second day as Dalmia Cement (Bharat) Ltd. offloaded shares in the company. This comes after the shares hit a one-month low on June 11.

Dalmia Cement (Bharat) offloaded 2.44% stake comprising 2.18 crore shares in IEX in open market, the company said in an exchange filing on Thursday. The deal value stood at Rs 2.17 lakh, the company added.

DPVL Ventures LLP and Dalmia Power Ltd. were the Persons Acting in Concert, as per the exchange filing. Dalmia Bharat offloaded that stake between June 3 and June 10.

After offloading, the company continues to hold 10.81% stake comprising 9.64 crore shares.

IEX has logged over 14% growth in electricity traded volume at 10,946 million units in May, as compared to the year-ago period. A total of 17.43 lakh Renewable Energy Certificates were traded during the month, marking a 65% year-on-year increase, an IEX statement said. The Real-Time Electricity Market reported its highest ever monthly traded volume in May when the volume increased to 4,770 MU from 3,352 MU a year ago, an increase of 42%.

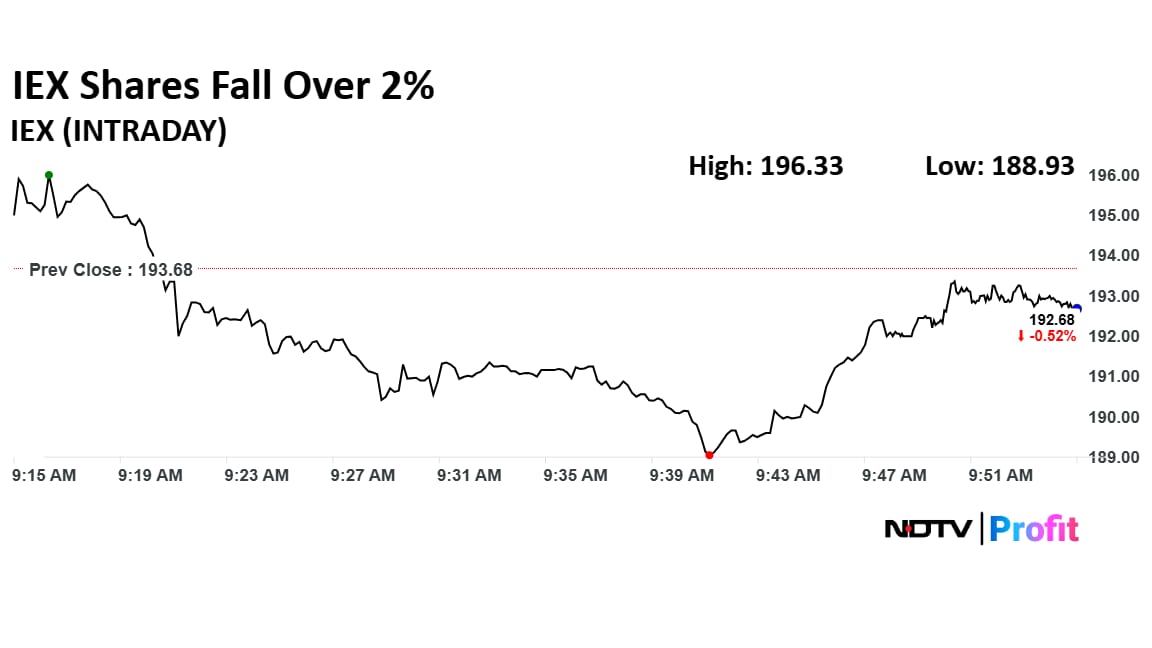

IEX Share Price Decline

The shares of IEX fell as much as 2.45% to Rs 188.93 apiece, a day after it hit a one-month low on June 11. They pared losses to trade 0.76% lower at Rs 192.45 apiece, as of 9:48 a.m. This compares to a 0.20% decline in the NSE Nifty 50.

The stock has risen 10.10% in the last 12 months and 5.64% year-to-date. Total traded volume so far in the day stood at 1.25 times its 30-day average. The relative strength index was at 27.45.

Out of 13 analysts tracking the company, eight maintain a 'buy' rating, two recommend a 'hold', and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 11% from the previous close.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.