IDFC FIRST Bank's share price fell over 4% after the bank's board approved a plan to raise up to Rs 7,500 crore from two prominent investors, Warburg Pincus and Abu Dhabi Investment Authority. This capital will be raised through the issuance of compulsorily convertible preference shares.

The investors involved are Currant Sea Investments BV, an affiliate of Warburg Pincus, and Platinum Invictus, an affiliate of ADIA. The bank will issue 81.26 crore and 43.71 crore compulsorily convertible preference shares at Rs 60 each to Currant Sea and Platinum Invictus, respectively.

Currant Sea is set to invest Rs 4,876 crore, while Platinum Invictus will contribute Rs 2,624 crore. Following the transaction, Currant Sea will hold a 9.48% stake in the bank, and Platinum Invictus will own a 5.10% stake.

This preferential issue is contingent upon approvals from shareholders, the Reserve Bank of India, and the Competition Commission of India.

The bank's rationale for this fundraising is to scale up its profitability and grow its loan book by 20% annually over the next few years. In an investor presentation, the bank stated that the capital raise is essential for growth, enhancing capital adequacy, and reducing the need for frequent fundraising.

The increased capital adequacy will position IDFC FIRST Bank for robust and profitable growth. Post-fundraising, the bank's capital adequacy ratio is expected to improve to 18.9% from the current 16.1%.

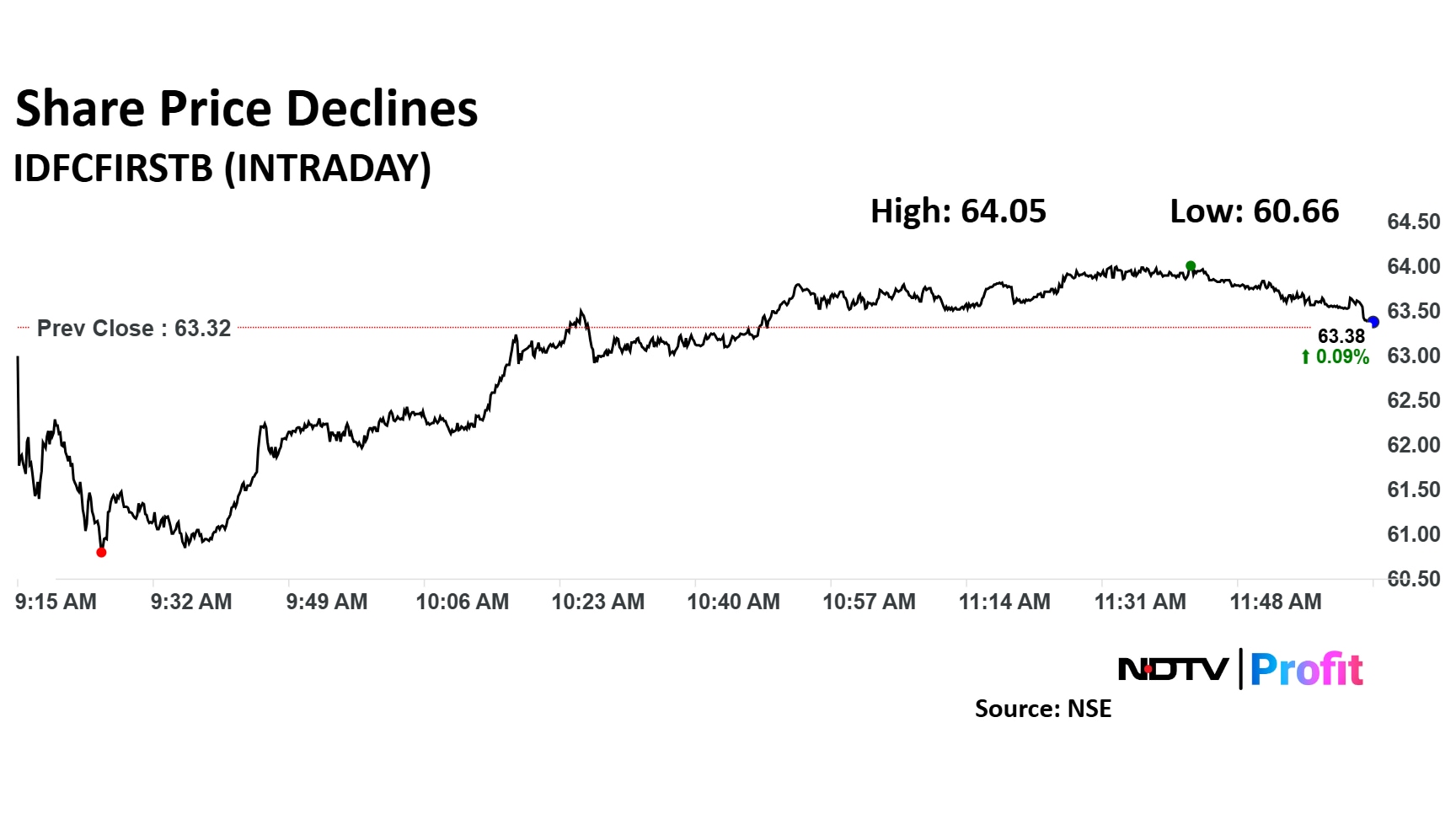

IDFC FIRST Bank Share Price Today

Shares of IDFC FIRST Bank fell as much as 4.20% to Rs 60 apiece. They pared losses to trade 0.02% higher at Rs 63.31 apiece, as of 12:09 p.m. This compares to a 0.79% advance in the NSE Nifty 50.

The stock has risen 21.60% in the last 12 months. The relative strength index was at 44.

Out of 37 analysts tracking the company, 22 maintain a 'buy' rating, 10 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.