Shares of Ideaforge Technology Ltd. rose nearly 8% on Monday hitting three-month high and extended gains for the third consecutive session. This comes as defence stocks extend their gains for the second day. In addition, the shares were trading at a high volume.

The shares of the unmanned aerial vehicle manufacturers have risen over 35% in the last three sessions. The rise was driven by expectations of increased focus and spending in light of geopolitical tensions between India and Pakistan.

"India can be a big exporter of defence equipment going forward," said Porinju Veliyath, the founder and chief executive officer of Equity Intelligence India Ltd. "Homegrown indigenous capabilities of Indian defence companies have shown tremendous success," he told NDTV Profit.

Pakistan's armed forces launched multiple attacks using drones and other munitions along the entire western border on the intervening night of May 8-9, which were 'effectively repulsed', said the Indian Army.

However, the two nations reached a mutual agreement on Saturday to halt hostilities across land, air and sea, which provided a shot of confidence to financial markets that had been treading cautiously in recent sessions and the defence stocks.

The NSE Nifty opened 1.72% up at 24,420.10 and climbed 3.04% intraday to touch 24,737.80, while the BSE Sensex jumped by 2.99%, or nearly 2,300 points, closing at 81,830.65 after opening 1.70% higher at 80,803.80.

The Nifty Defence index had seen a significant jump of 2.99%, reaching 7,301.25 on Monday, as of 9:58 a.m. It opened at 7,299.55.

Shares of defence companies, including Mishra Dhatu Nigam Ltd., Cochin Shipyard Ltd., Bharat Forge Ltd. and Mazagon Dock Shipbuilders Ltd., also rose in trade on Monday.

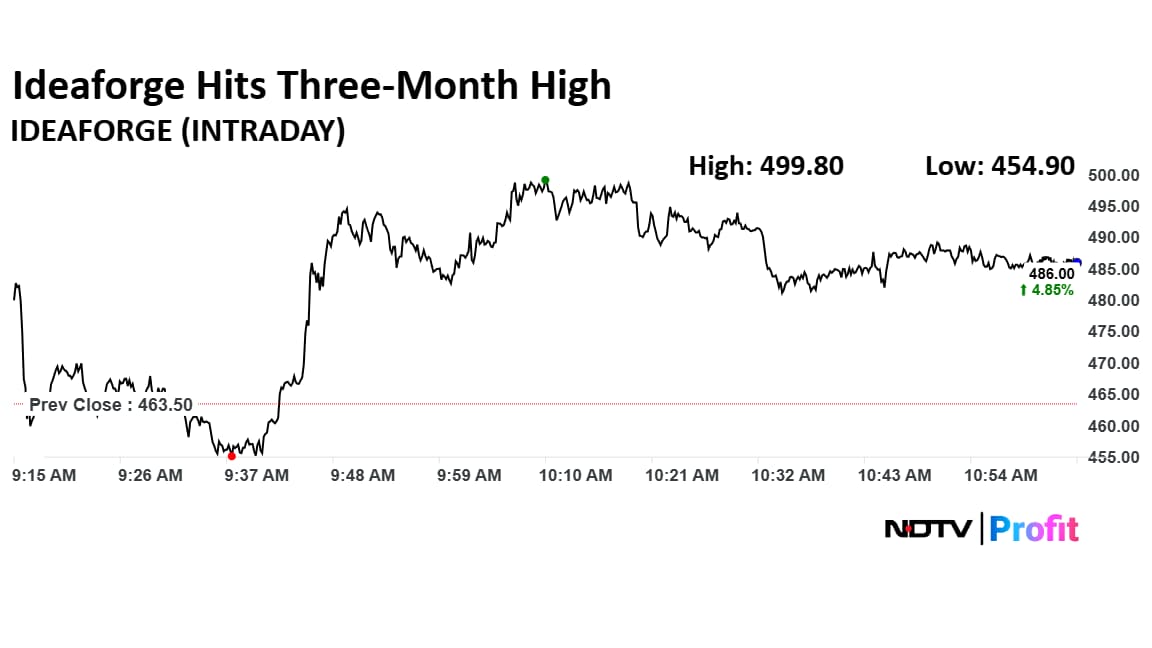

Ideaforge Shares Advance

Shares of Ideaforge rose as much as 7.83% to Rs 499.80 apiece, the highest level since Feb. 1. They pared gains to trade 4.41% higher at Rs 483.95 apiece, as of 11:01 a.m. This compares to a 2.81% advance in the NSE Nifty 50.

The stock has fallen 27.86% in the last 12 months and 17.75% year-to-date. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 53.40.

Out of two analysts tracking the company, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 20.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.