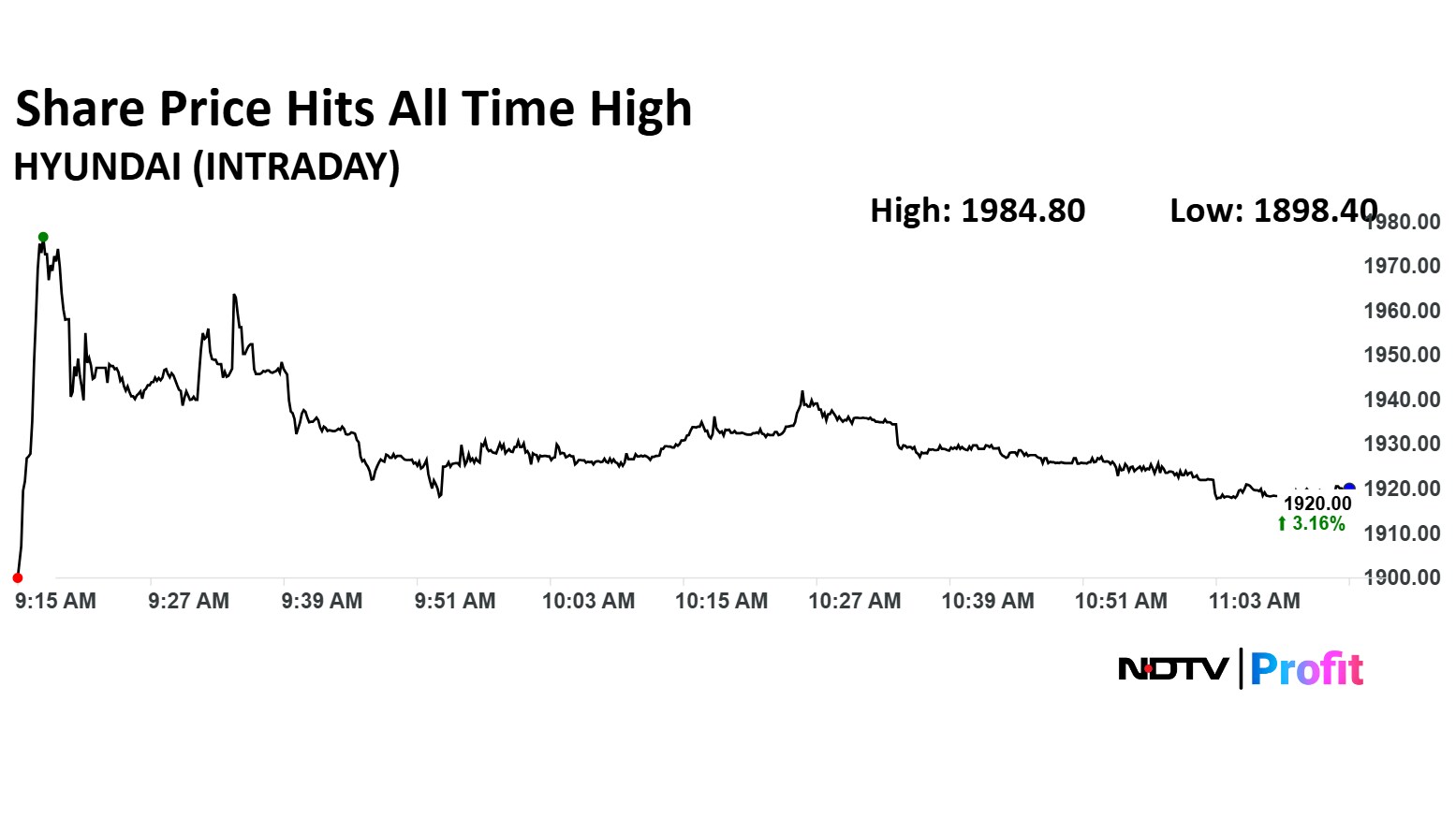

Hyundai Motor India Ltd.'s share price surged by 6.65% on Monday, reaching an all-time high. This marks the fourth consecutive session of gains for the company's shares, which have risen nearly 9% since June 2.

The Nifty Auto index rose nearly 1% as it continued Friday's rally when it recorded an intraday rise of 1.20%, driven by the Reserve Bank of India's Monetary Policy Committee's decision to cut the key lending rate by 50 basis points to 5.5%. This reduction is expected to boost economic activity by making borrowing cheaper for both businesses and consumers.

The rate cut is anticipated to lower EMI costs for customers, providing a positive outlook for auto stocks, including Hyundai Motor India.

In other news, Hyundai Motor India recently released Rs 16 crore as the first tranche towards the subscription of 23.6 lakh shares of FPEL TN Wind Farm.

The scrip rose as much as 6.65% to Rs 1,984.8 apiece. It pared gains to trade 3.11% higher at Rs 1,919 apiece, as of 11:14 a.m. This compares to a 0.49% advance in the NSE Nifty 50 Index.

It has risen 5.46% in the last 12 months. Total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 66.

Out of 22 analysts tracking the company, 18 maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7% from the current market price.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.