(Bloomberg) --

Indian bonds are likely to attract about $100 billion of foreign inflows in the coming years, lured by the global bond index inclusion, according to HSBC Asset Management.

While inclusion into global indexes may trigger inflows of as much as $50 billion, a similar amount of flows is also expected from large institutional investors, sovereign wealth funds and pension funds, Shriram Ramanathan, chief investment officer of fixed income at HSBC Asset Management's India unit, said in an interview.

India has become a favorite market for Wall Street investors, attracted by one of the world's fastest rates of economic growth and as it positions itself as an alternative to China. Foreigners own just 2% of the government bonds, highlighting how global funds remain light on holdings.

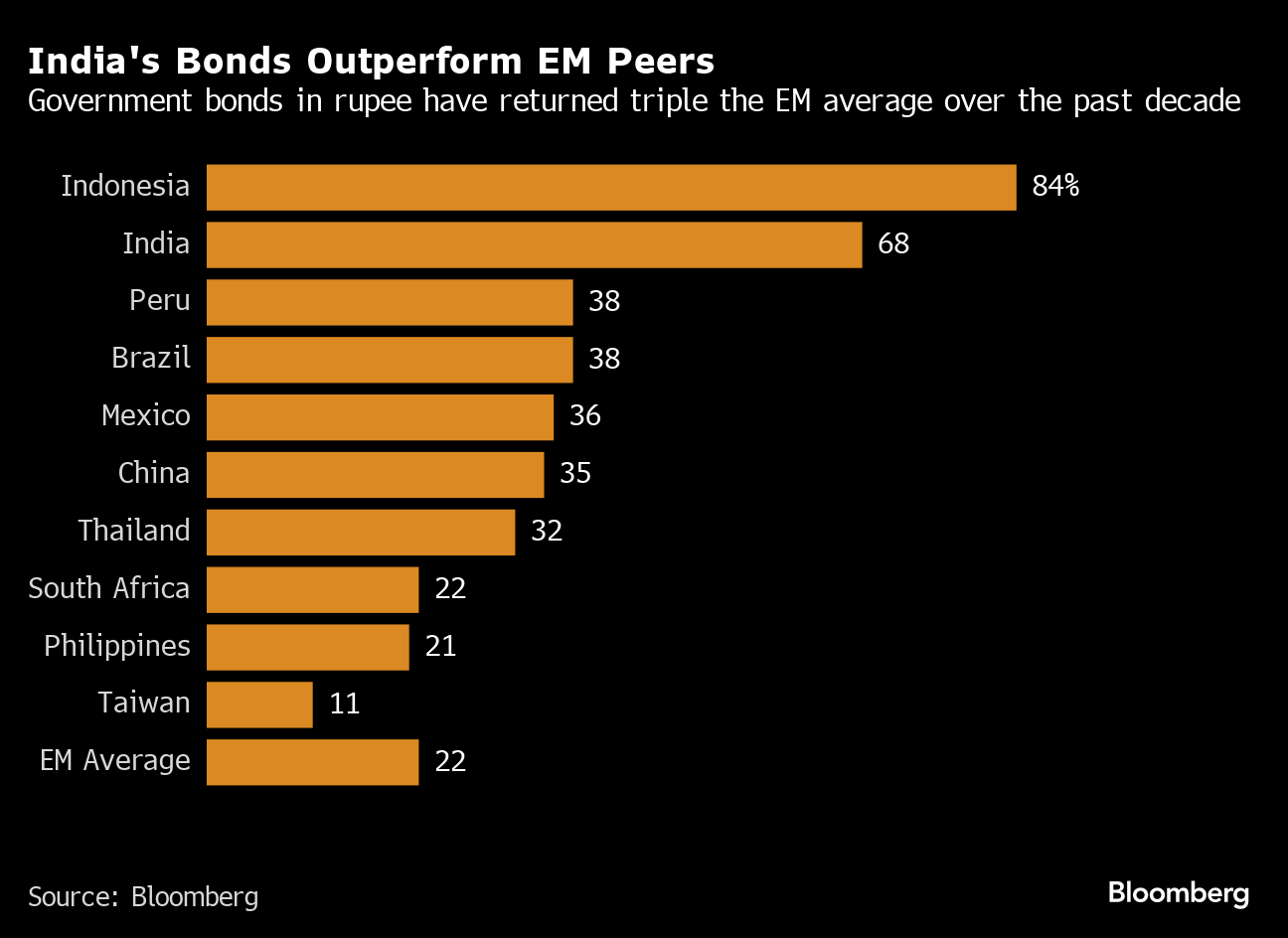

“India really stands out as a fairly attractive destination for a strategic allocation from various large institutional investors,” said Ramanathan. “People start appreciating some of the nuances and the risk returns that it has delivered over the last five and 10 years which make it an extremely attractive proposition.”

The monetary policy, inflation targeting and the fiscal policy have helped building credibility over the recent years, and set up the performance of India's economy in the coming years, he said. HSBC's estimates align with other global bank's view on potential flows into India's equity market.

India's trillion-dollar sovereign bond market is gearing up for a rush of foreign money in the run-up to inclusion in JPMorgan Chase & Co.'s emerging markets bond index in June.

Bloomberg Index Services Ltd., which competes with global index providers, has launched a consultation to solicit feedback on the proposed inclusion of India's Fully Accessible Route, or FAR bonds in its emerging market local currency index. FAR bonds are securities that have no investment curbs for foreigners.

India's economy made a strong start to the year, with services activity climbing to a six-month high and manufacturing picking up pace in January, a new flash survey by HSBC Holdings Plc showed. The purchasing managers index for services rose to 61.2 from 59 in December, while the manufacturing PMI increased to a four-month high of 56.9, HSBC said. The composite PMI jumped to 61.

Foreigners own just about 2% of government bonds, making their ownership one of the lowest among emerging markets. Due to India's low correlation with global markets and other developing nations, India should be a stand-alone investment destination and part of EM allocations, similar to China, he said.

India's 10-year bond yield at 7.17% are the highest in emerging Asia. The local yields are “fairly attractive” and higher carry provide favorable diversification opportunity, and that along with economic stability is “somewhat of a rarity in the world right now,” he said.

--With assistance from Subhadip Sircar.

(Updates with PMI data in the eighth paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.