(Bloomberg) --

The NSE Nifty Next 50 Index is emerging as the hottest stock gauge in India, as investors look for pockets of outperformance in a market that's been hovering near record highs.

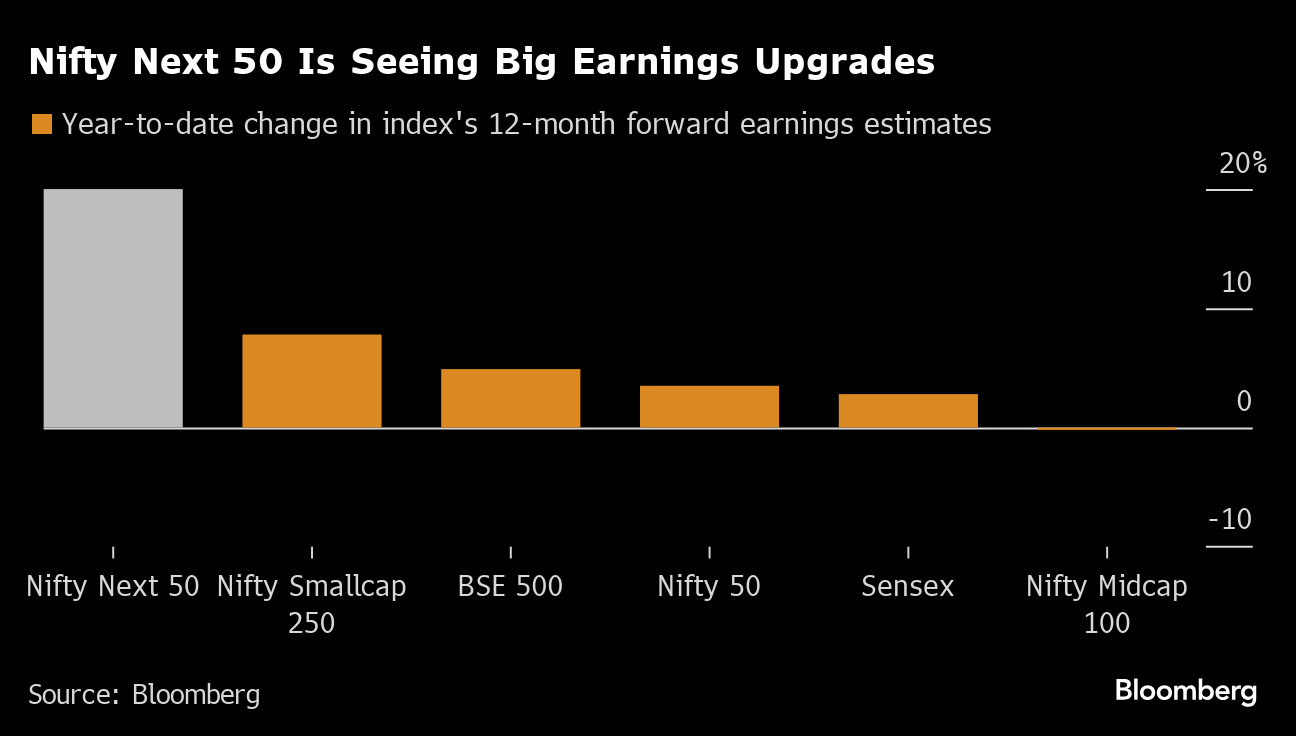

Earnings growth is proving to be a key metric. Made up of potential candidates for the benchmark Nifty 50, the gauge has seen its forward profit estimates climb 20% so far this year, far outpacing the 3.5% increase for the larger gauge. The Nifty Next's biggest components feature industrial and materials firms directly benefiting from an economy expected to grow more than 7% in 2024.

“The general trend in the market at the moment for foreign investors, and I would say the more savvy ones, is that they are going beyond the Nifty 50,” said Gary Dugan, chief investment officer at the Global CIO Office. “There's a lot of GDP in that second band of 50 companies beyond the Nifty,” he added.

An eight-year rally in Indian blue chips has driven up valuations and forced global funds to broaden their search for winners in the $4.6 trillion market. At the same time, the rising attraction of equities in China and elsewhere puts more pressure on local firms to deliver growth in earnings and return on investment.

The Next 50 measure is expected to deliver earnings growth of 39% over the coming year, according to estimates compiled by Bloomberg. That's likely to help extend its 65% rally seen over the past year despite the challenges facing the broader market. The gauge just notched its best quarter since 2009 versus the larger benchmark NSE Nifty 50 Index.

Global funds have increased allocations to some of the index's biggest stocks, including communication equipment maker Bharat Electronics Ltd., defense firm Hindustan Aeronautics Ltd. and Canara Bank Ltd., said Rupal Agarwal, Asia quantitative strategist at Sanford C. Bernstein.

While stocks in this second tier gauge are gaining on favorable comparisons with larger peers, they're also beating out smaller shares. A gauge of Indian small caps has undergone a correction that at one point wiped out more than $80 billion in market value amid concerns on high valuations and the impact of extreme volatility.

The Nifty Next “gives foreign investors a good way to participate in the India stories such as manufacturing, railway capex and public sector undertakings without worrying about liquidity,” Bernstein's Agarwal said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.