.jpeg?downsize=773:435)

- HDFC Bank will consider its first-ever bonus share issue on July 19

- The bank will also discuss a special interim dividend in the same meeting

- Q1 results for the financial year ending March 2026 will be announced then

HDFC Bank Ltd. said on Wednesday that it plans to consider its first-ever bonus share issue and a special interim dividend during its board meeting on July 19.

India's largest private lender will also announce the results for the first quarter of the financial year ending March 2026 on that date.

The bank paid a final dividend of Rs 22 for fiscal 2025 last month. The last time it paid a special dividend was in 2019, rewarding shareholders Rs 5 per share.

HDFC Bank has a dividend yield of 1.1% and trades at 21.7 times price-to-earnings.

Foreign institutions own a 48.84% stake in the private lender, and over 36 lakh retail investors holding nominal share capital up to Rs 2 lakh have a combined equity stake of 10.3% as of June, according to BSE shareholding data.

HDFC Bank recently sold stake worth Rs 10,000 crore in its NBFC unit HDB Financial Services Ltd. as part of the Offer For Sale (OFS) component during its IPO.

A bonus issue is the distribution of free shares to eligible shareholders. The share price falls in the ratio of the bonus allotment at the ex-date. However, this does not affect the overall value of holdings.

After the HDFC Bank board makes the announcement, it will issue the record date to determine eligible shareholders. The ex-date and the bonus share allotment date will also be declared through a stock exchange filing.

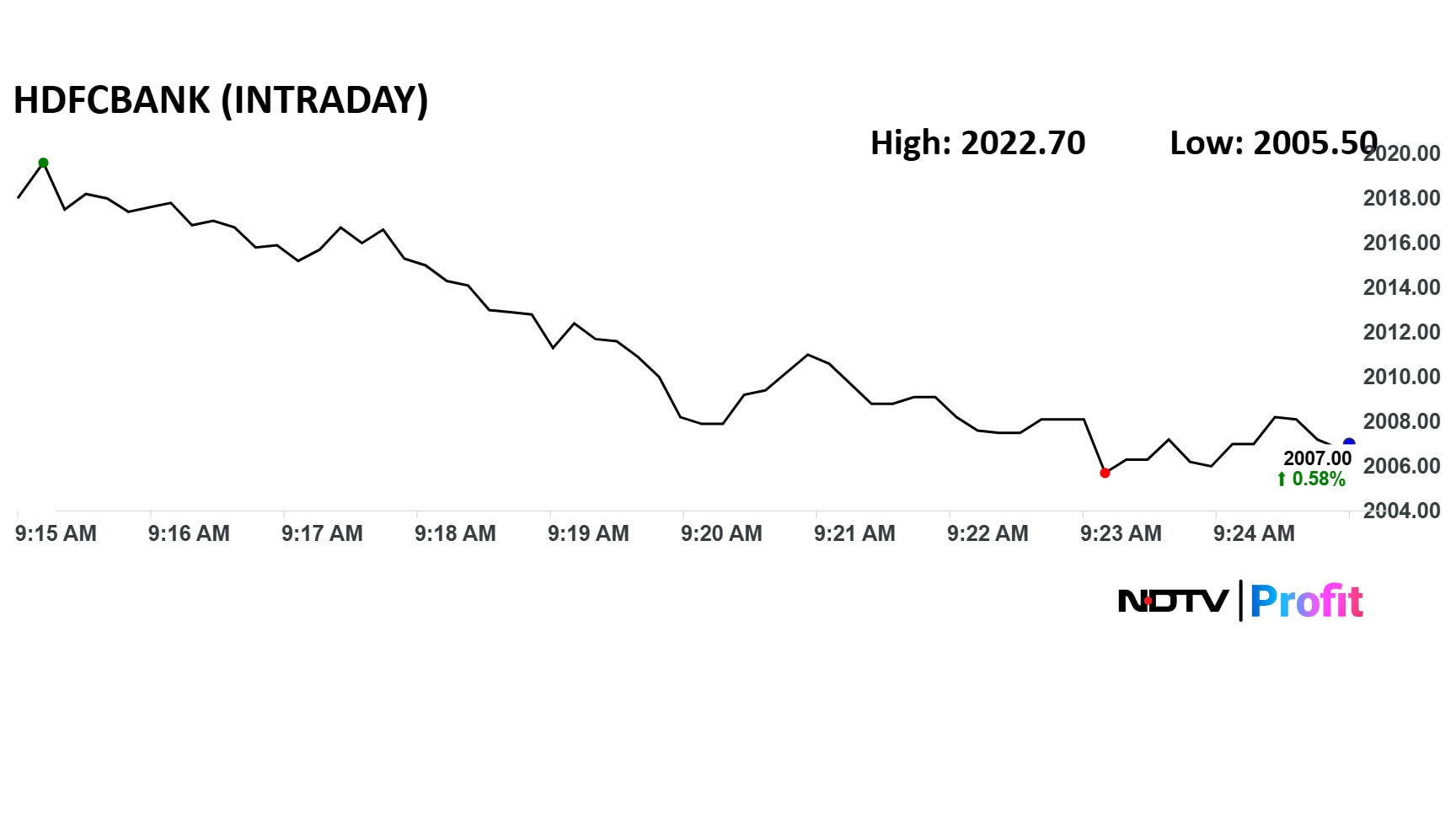

HDFC Bank share price gained as much as 1.4% to Rs 2,022.7 before cooling off. The scrip was up 0.6% as of 9.25 a.m., compared to a 0.22% decline in the benchmark Nifty 50.

It was the top contributor in the index in terms of points.

The stock has risen 24% in the last 12 months and 12.5% year-to-date.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.