The stock price of GTPL Hathway Ltd., a player in the digital cable TV and broadband service sector, rose nearly 17% as the company is expected to report its third quarter earnings on Thursday, after its Q2 performance showed mixed results.

In the second quarter of the current financial year, GTPL Hathway reported a sharp decline in net profit, which fell by 61.8% year-on-year. The company posted a profit of Rs 13.7 crore for the quarter ending September, down from Rs 35.9 crore in the same period last year.

Despite the profit decline, the company's revenue grew by 9.8% year-on-year, reaching Rs 856 crore for Q2, compared to Rs 779 crore in the same period for fiscal 2024.

The company continued to grow its subscriber base, ending the quarter with 9.50 million active subscribers and 8.80 million paying subscribers.

GTPL Hathway is an India-based company specialising in the distribution of television channels through its digital cable network and the provision of broadband services.

The company offers a variety of cable TV services, including standard definition (SD), high definition (HD), and hybrid services that combine cable TV and over-the-top (OTT) offerings.

GTPL Hathway is present in key Indian markets, including Gujarat, Maharashtra, West Bengal, Tamil Nadu, and Uttar Pradesh. The company also offers broadband services via its wholly owned subsidiary, GTPL Broadband, which provides high-speed, unlimited data broadband using Fiber to the Home (FTTH) technology.

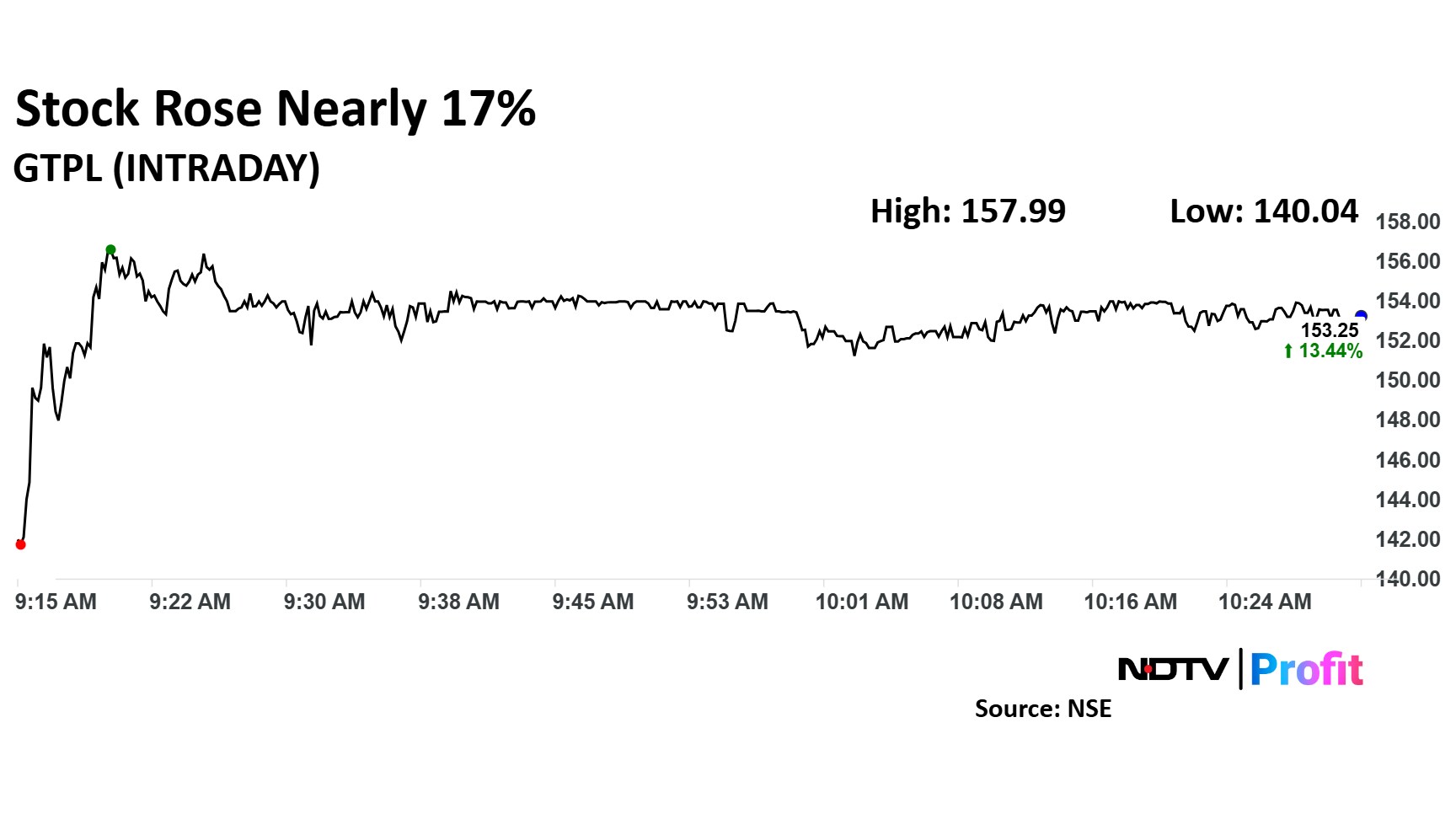

GTPL Hathway Share Price Today

The scrip rose as much as 16.95% to Rs 157.99 apiece. It pared gains to trade 14% higher at Rs 154 apiece, as of 10:21 a.m. This compares to a 0.20% advance in the NSE Nifty 50.

It has fallen 23.75% in the last 12 months. Total traded volume so far in the day stood at 117 times its 30-day average. The relative strength index was at 66.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.