Goldman Sachs added Maruti Suzuki India Ltd. to its Asia-Pacific conviction list as the automobile manufacturer is well-positioned to benefit from an ongoing revival in domestic consumption. Maruti Suzuki India will also see the positive impact of the pay commission.

Goldman Sachs Equity Research Vice President Chandramouli Muthiah also believes that a pickup in demand for compact SUVs will be good for Maruti Suzuki India. He has projected a 6% and 11% earnings-per share estimates, respectively, for financial year 2027 and 2028.

In the upcoming auto demand cycle, Maruti Suzuki India will likely see growth in business. The automobile manufacturer is reviving its model launches after a gap of 2.5 years. It will launch Victoris SUV and eVitara.

Maruti Suzuki Emerges As Top Contributor To Nifty 50

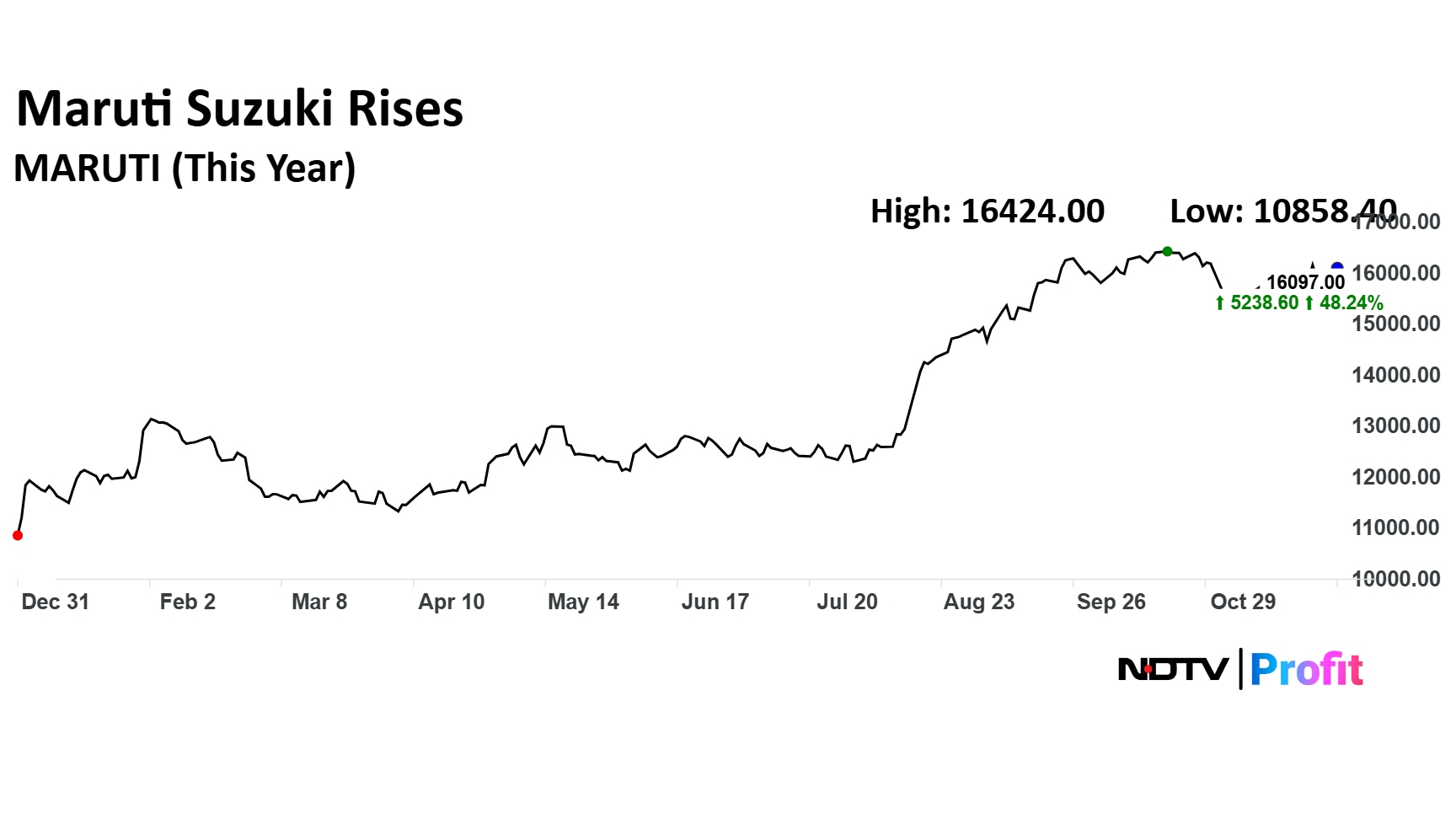

Maruti Suzuki India has emerged as one of the biggest contributors to the NSE Nifty 50 index. The stock has surged 48.24% on a year-to-date basis. The expectation is that GST 2.0 will likely revive the small-car sales in the domestic markets, which supported gains in the stock price.

Track live updates on major share price movements, latest stock market news, and analysts' views here with NDTV Profit

The automobile manufacturer saw a strong response to new launches in Dzire and Victoris range.

Maruti Suzuki India has planned to launch E-Vitara in India in the calendar year 2026. The automobile manufacturer has a target to launch eight new models by financial year 2030.

Key things to watch are whether the weight criteria in Café Norms gets approved, which will be a positive for Maruti Suzuki India, and the momentum of small cars sustains or not.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.