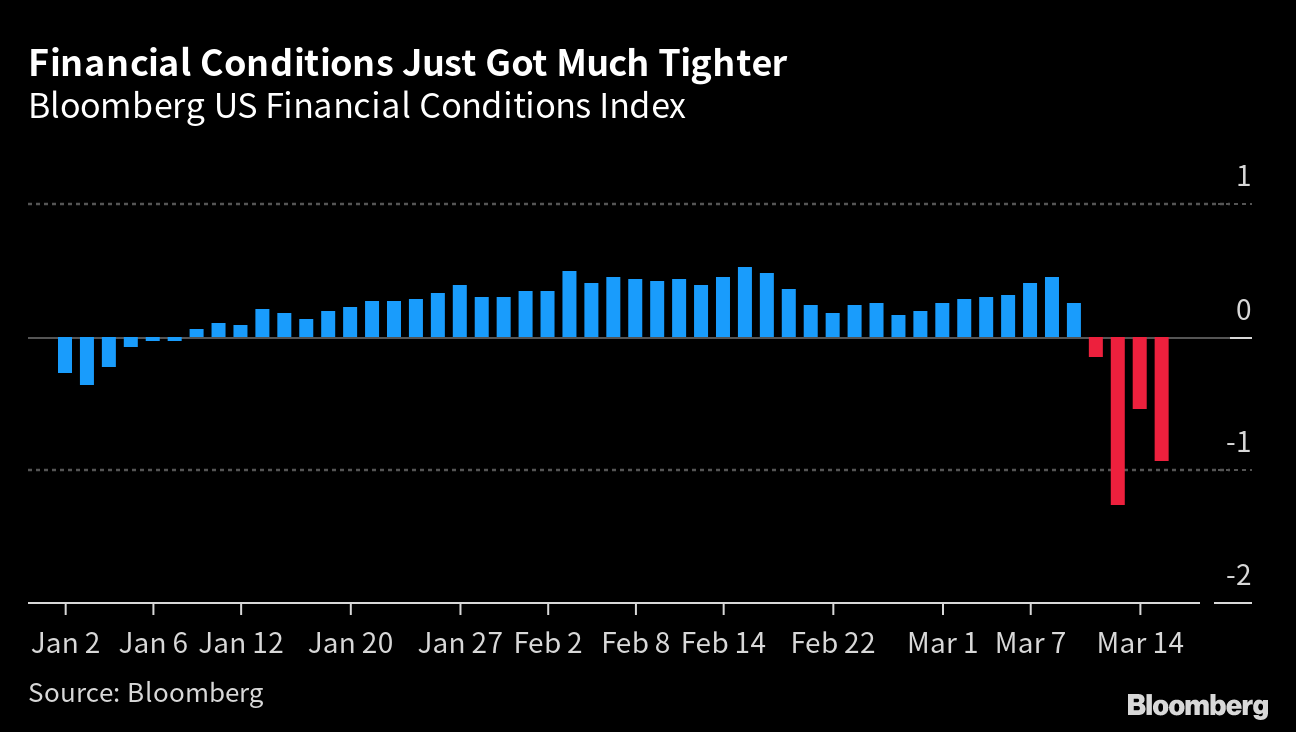

(Bloomberg) -- Goldman Sachs Group Inc. boosted its estimate of the odds of a US recession to 35% over the next 12 months in response to increased uncertainty over the economic impact of bank stress.

Economists led by Jan Hatzius raised Goldman's assessment of the prospects of a slump from a previous one-in-four chance after the collapse of Silicon Valley Bank. The new estimate is still below the 60% median of economists surveyed by Bloomberg.

Goldman's proprietary indicators of activity growth still remain positive, with its business survey trackers averaging a slightly-expansionary 52 in February, with the dividing line at 50, Hatzius said in a research note.

Goldman's real-time estimate on jobs data suggests the layoff rate ticked up slightly though remains low at 1.2%, while the jobs-workers gap declined to remain above the 2 million level its economists estimate is necessary to “rebalance the labor market.”

Global investors have become extremely sensitive to the potential for systemic financial stresses, fears that were further escalated by the crisis of confidence in Credit Suisse Group AG. In response, swaps traders have brought forward expectations for interest rate cuts by the Federal Reserve.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.