(Bloomberg) -- Gold rose to the highest in more than three weeks after latest data showed ebbing inflation and weak retail sales, reinforcing expectations that the Federal Reserve will start cutting interest rates this year.

A measure of underlying US inflation cooled in April for the first time in six months, with the so-called core consumer price index — which excludes food and energy costs — increasing 0.3% from March, according to government data released Wednesday. Separate data out Wednesday showed retail sales stagnated in April, indicating high borrowing costs and mounting debt are encouraging greater prudence among consumers.

@akritiisharma explains https://t.co/3WTV30vOtS pic.twitter.com/1iVjlOWQr3

While the data provided some relief for policymakers looking to start cutting interest rates this year, they also pointed to potential economic weakness and sticky inflation, which would benefit gold as it's a hedge against financial stress and price pressures.

Still, for bullion to reach a fresh record, “we need more clarity on the number of rate cuts given its potential positive impact on ETF demand, a source of demand that has been absent since 2022,” said Ole Hansen, head of commodity strategy at Saxo Bank AS.

Investors remain net sellers of gold exchange-traded funds so far this year, with total holdings down 5.9%, according to data compiled by Bloomberg.

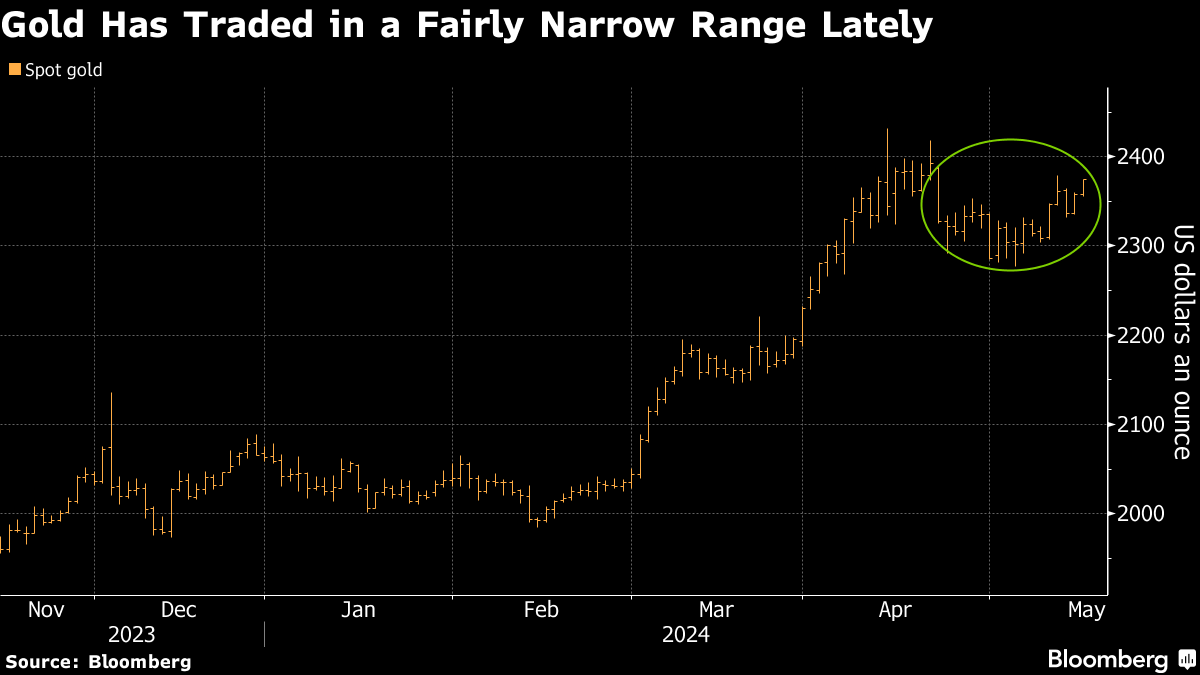

The precious metal has traded in a fairly narrow range over the last few weeks, following a blistering rally that saw it reach a record high in mid-April. Prices are up about 14% this year, with gains underpinned by central bank buying, heightened geopolitical risks and consumer demand in China. Bullion has gained despite the anticipated timing of the Fed's pivot being pushed back.

Spot gold rose 1.1% to $2,385.04 an ounce as of 11:25 a.m. in New York after earlier increasing as much as 1.2%. The Bloomberg Dollar Spot Index edged lower for a second day, which can also make bullion more attractive. Platinum climbed as much as 2.4% to the highest in almost a year.

Copper prices on the London Metal Exchange were 1.2% higher at $10,234 a ton after the data. Comex front-month copper futures were 0.2% lower, after earlier rallying to a record high as a short squeeze gripped the market.

Read More: Copper Short Squeeze in NY Prompts Rush to Send Metal to US

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.