Gold steadied as investors braced for a Federal Reserve policy decision, a raft of vital economic data, and outcomes from US trade negotiations.

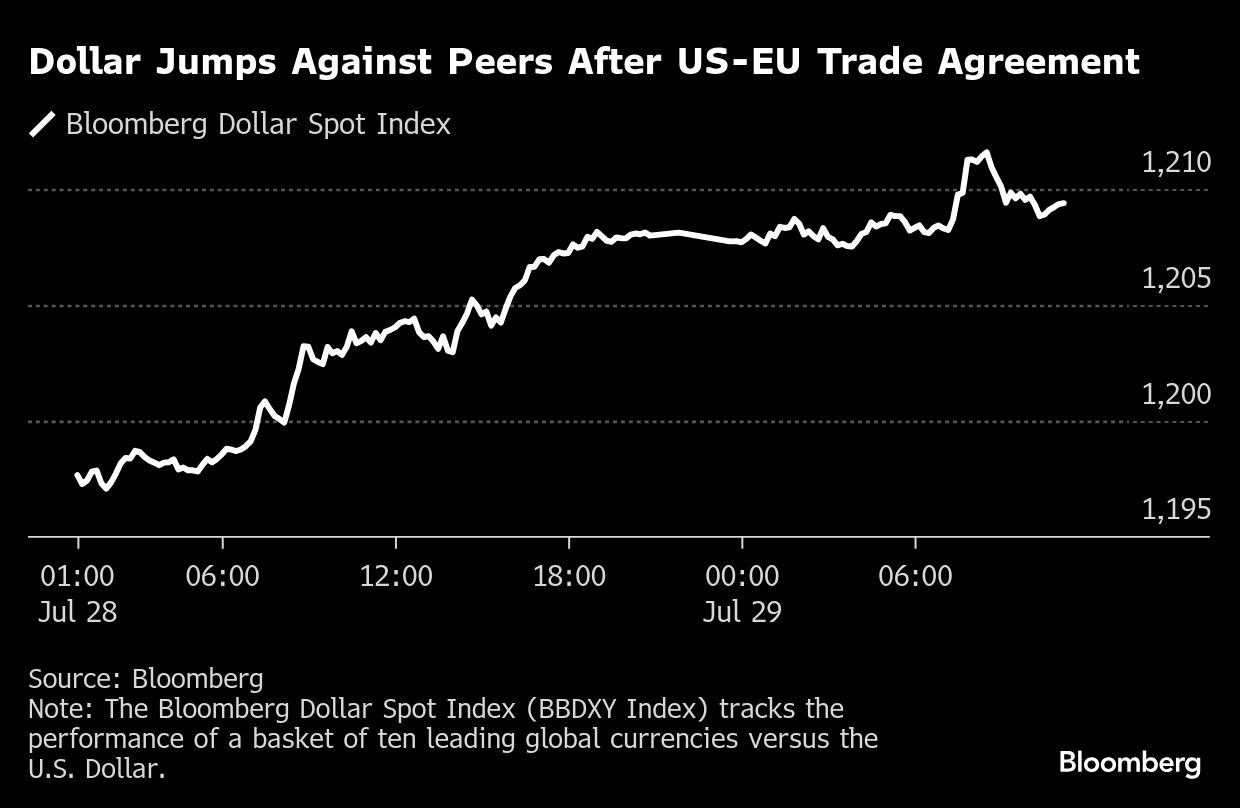

Bullion traded in a narrow range Tuesday after losing ground in the previous session amid a rally in the dollar. While the deal announced Monday between the US and the European Union initially quelled worries of a trade war, the asymmetric nature of the agreements have dented expectations for economic growth outside the US.

With President Donald Trump's Aug. 1 US tariff deadline fast approaching, several other trading partners — including South Korea and Brazil — are still racing to secure agreements. Meanwhile, Commerce Secretary Howard Lutnick on Monday said a 90-day extension of a trade truce between the US and China was a “likely outcome.”

Investors are also shifting attention to this week's slate of key indicators — from jobs and inflation to economic activity as well as the Fed's policy decision Wednesday. US central bank officials are expected to hold rates steady, although some committee members may register dissents against the pause. Lower borrowing costs tend to benefit bullion, as it doesn't pay interest.

“Three major events — the tariff talks, Fed rate decisions, and non-farm payroll reports — are lined up, likely to amplify gold-price volatility,” Pepperstone Group Ltd. research strategist Dilin Wu said in a note. “Gold currently sits at a crossroads between technical and fundamental forces.”

Gold is up by more than a quarter this year, with uncertainty around Trump's aggressive attempts to reshape global trade, along with conflicts in Ukraine and the Middle East, spurring a flight to safety. Still, the precious metal has been trading within a tight range over the past few months after spiking to an all-time high above $3,500 an ounce in April.

Spot gold was up 0.1% to $3,317.50 an ounce as of 12:47 a.m. in London. The Bloomberg Dollar Spot Index was up 0.2%. Silver and platinum fell, while palladium rose.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.