Gold held a loss after President Donald Trump said imports of bullion won't be subject to US tariffs, although traders were still waiting for formal clarification over the policy following a federal ruling last week that sowed chaos and confusion across the market.

Spot gold held near $3,345 an ounce on Tuesday, following a 1.6% drop on in the previous session after Trump posted “Gold will not be Tariffed!” on social media. Futures of the precious metal in New York edged lower, after a 2.5% plunge on Monday.

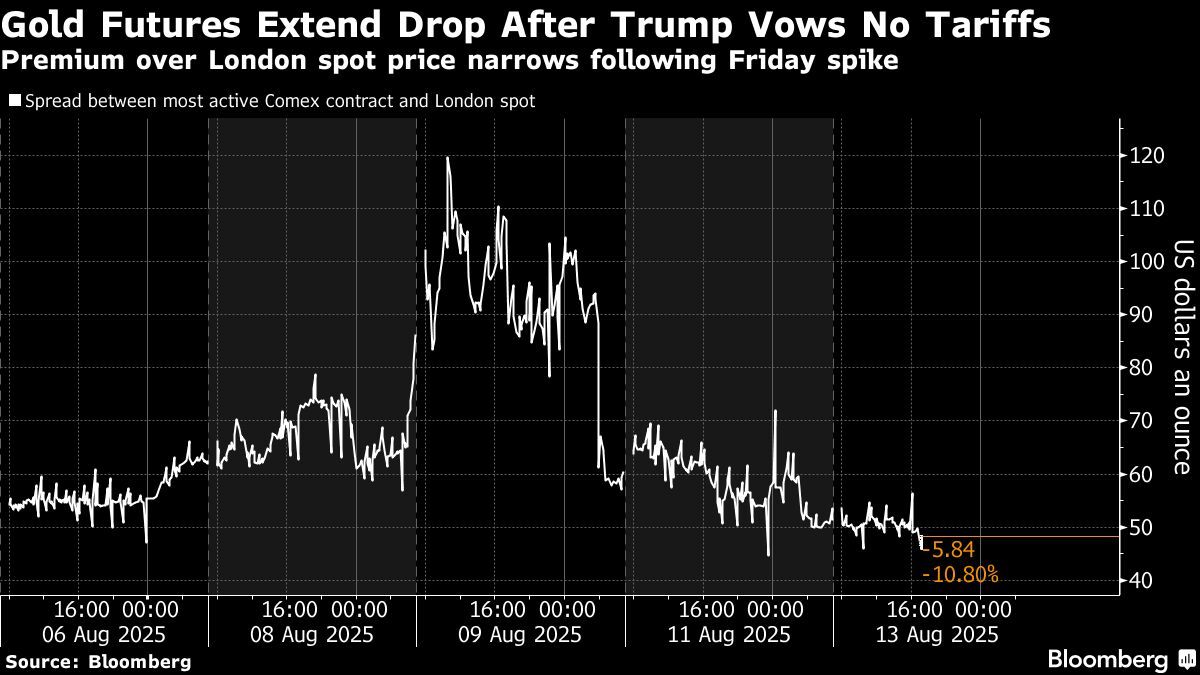

US Customs and Border Protection stunned traders last week by ruling the imports would be subject to duties. The shock led futures on New York's Comex to surge more than $100 an ounce above benchmark spot prices in London on Friday. The spread has since narrowed to about $50.

Washington's decision regarding gold tariffs has sweeping implications for the flow of bullion around the world, and potentially for the smooth functioning of the US futures contract. The administration had exempted the precious metal from duties in April, and until there is long-term clarity, traders say, precious metals markets will remain on edge.

Gold has climbed more than a quarter this year, with the bulk of those gains occurring in the first four months. It's been supported by geopolitical and trade tensions that have spurred haven demand, along with strong central bank purchases.

Elsewhere, the dollar held a gain ahead of a US inflation report due later Tuesday that may offer clues on the Federal Reserve's monetary policy path. Higher rates are negative for non-interest bearing gold, while a stronger greenback tends to make the dollar-denominated commodity more expensive for most buyers.

Investors were also weighing Trump's move on Monday to extend a tariff truce on Chinese goods for another 90 days into early November. The move should ease worries of a renewed trade war between the two biggest economies, reducing haven demand.

Spot gold rose 0.1% to $3,345.12 an ounce as of 8:15 a.m. in London. The Bloomberg Dollar Spot Index dipped 0.1%, after posting a 0.3% gain on Monday. Silver advanced, palladium was flat, while platinum fell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.