Stocks fell as the Trump administration escalated its trade war, with investors bracing for a flurry of economic reports this week that is expected to offer an early read on the impact of tariffs.

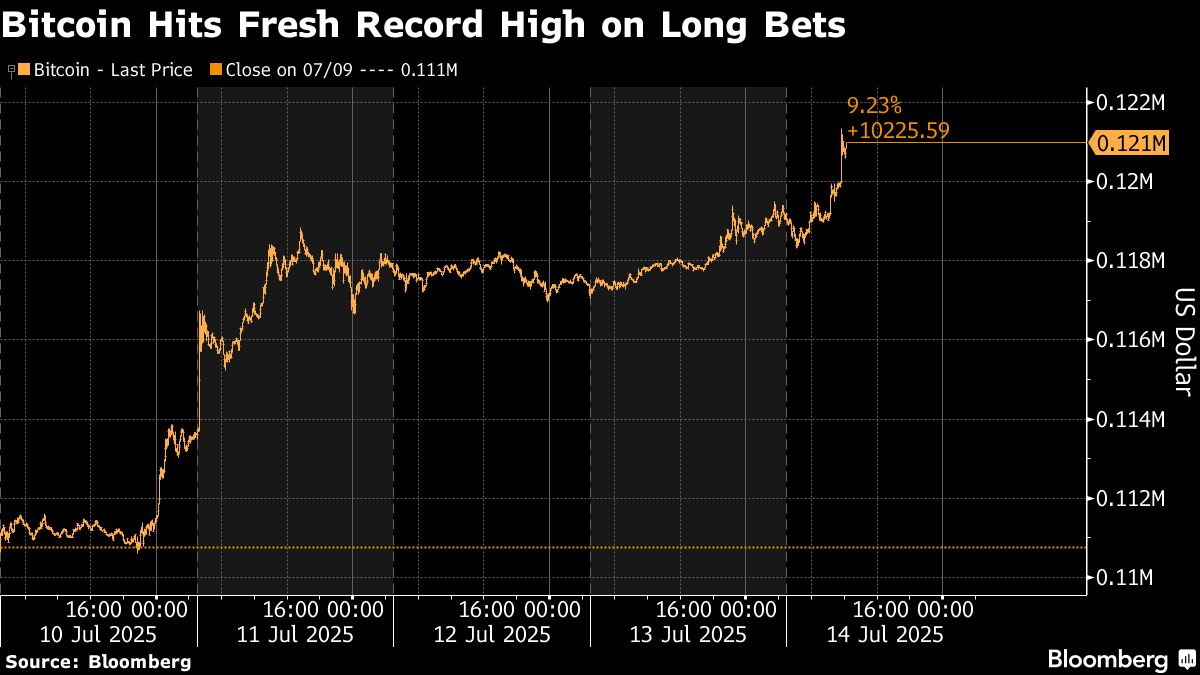

Europe's Stoxx 600 dropped 0.5%, with trade-sensitive automakers leading the losses. S&P 500 futures retreated 0.4%. Bitcoin soared past $120,000 for the first time. Japanese long-term bonds extended their declines on fiscal worries before local elections. The dollar and US Treasuries were little changed.

US President Donald Trump's weekend threat to impose 30% tariffs on the European Union and Mexico is testing market resilience, following a series of escalated trade measures against multiple partners. While traders largely view it as a negotiating tactic and expect any final tariffs to be softer, the moves have injected uncertainty just as the S&P 500 was trading near record highs.

Economic data due Tuesday is expected to show US inflation edged higher in June, as companies began passing on the rising cost of imported goods. The figures could shape the Federal Reserve's wait-and-see stance on rate cuts, with swaps still pricing in nearly two quarter-point reductions this year.

Separately, Trump and his allies stepped up their criticism of Federal Reserve Chair Jerome Powell's handling of the expensive renovation of the Fed's headquarters. Some administration officials are attempting to build a case to remove Powell from the Fed's Board of Governors.

Late on Sunday, Trump repeated his criticism of Powell and said if the Fed chair stepped down, that would be a “good thing.” Deutsche Bank AG strategist George Saravelos said the potential dismissal of Powell is a major and underpriced risk that could trigger a selloff in the US dollar and Treasuries.

Corporate Highlights:

Synopsys Inc has secured China's approval to buy out Ansys Inc. for $35 billion, a major win for a company regarded as key to helping sustain US dominance of certain aspects of semiconductor technology.

Tesla Inc. plans to poll shareholders on whether to invest in xAI, Elon Musk said after the Wall Street Journal reported SpaceX was prepared to funnel $2 billion into the Grok chatbot developer.

Jane Street Group LLC has deposited 48.4 billion rupees ($564 million) in an escrow account to comply with an order from India's securities regulator, part of an ongoing probe into allegations of market manipulation by the US trading giant.

UniCredit SpA said it will assess the next steps on its takeover plan for Banco BPM SpA amid doubts over whether the deal will go ahead, following a ruling by an Italian court over government requirements imposed on the transaction.

Partners Group is selling a large asset in its buyout portfolio to a consortium led by its own infrastructure division.

Astra Zeneca Plc's experimental hypertension drug Baxdrostat reduced the blood pressure of patients who have an uncontrolled or treatment-resistant form of the condition.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.5% as of 9:02 a.m. London time

S&P 500 futures fell 0.4%

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.4%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1688

The Japanese yen was little changed at 147.34 per dollar

The offshore yuan was little changed at 7.1692 per dollar

The British pound was little changed at $1.3487

Cryptocurrencies

Bitcoin rose 2.9% to $122,619.75

Ether rose 1.6% to $3,041.88

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.43%

Germany's 10-year yield was little changed at 2.73%

Britain's 10-year yield was little changed at 4.62%

Commodities

Brent crude rose 1.3% to $71.26 a barrel

Spot gold rose 0.4% to $3,369.83 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.