A six-day winning streak that propelled the S&P 500 to the brink of a bull market is set to pause as investors bet that US stocks will lag the rest of the world.

S&P 500 contracts retreated 0.3%. By contrast, equity gauges in Europe and Asia advanced. The dollar's weakness continued, dropping 0.2%. Gold and Bitcoin fell. Treasuries gained across the curve after whipsawing on Monday, with the 10-year yield declining 1 basis point to 4.44%.

Japanese notes tumbled after a government bond auction received the lowest demand since 2012, pointing to increasing concerns about investor support as the Bank of Japan dials back its huge debt holdings.

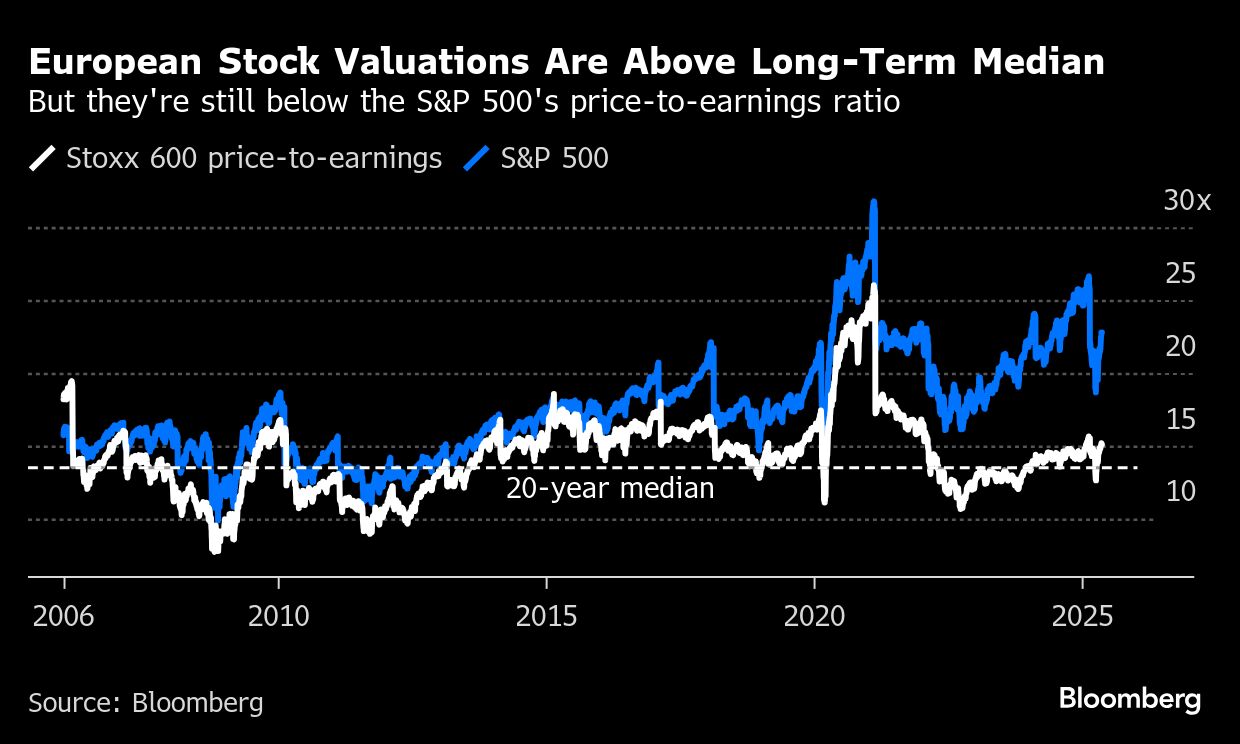

Some Wall Street strategists are betting European stocks will enjoy their best performance relative to the US in at least two decades as the region's economic outlook improves. While US stocks have rallied in recent weeks, two Federal Officials warned on Monday that they would adopt a wait-and-see approach before lowering interest rates.

While European stocks have seen improved inflows this year, the next leg of the region's outperformance will be driven by structural shifts, such as higher investments in defense and infrastructure, said Elise Badoy, Citigroup Inc.'s head of EMEA equity research.

“We continue to recommend diversification into the European market — we're neutral on the US — but I think that comes with the perspective that it will be a bumpy ride,” Badoy told Bloomberg TV on Tuesday.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 9:33 a.m. London time

S&P 500 futures fell 0.3%

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.3%

The MSCI Emerging Markets Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.1266

The Japanese yen rose 0.4% to 144.22 per dollar

The offshore yuan was little changed at 7.2192 per dollar

The British pound rose 0.2% to $1.3387

Cryptocurrencies

Bitcoin fell 0.4% to $105,048.34

Ether rose 0.3% to $2,527.44

Bonds

The yield on 10-year Treasuries declined one basis point to 4.44%

Germany's 10-year yield declined three basis points to 2.56%

Britain's 10-year yield declined five basis points to 4.62%

Commodities

Brent crude fell 0.3% to $65.37 a barrel

Spot gold fell 0.1% to $3,225.22 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.