Wall Street's cautious bounce faded quickly as some tech megacaps lost steam, overshadowing a rally in cryptocurrencies in the wake of a rough start to December. Bonds and the dollar stabilized.

The S&P 500 was little changed, with 300 shares falling. A sense of caution prevailed after a report that OpenAI's Sam Altman is redirecting internal resources to speed up improvements to ChatGPT, declaring a “code red” situation that will delay work on other initiatives. Tesla Inc. led losses in megacaps as Michael Burry called the shares “ridiculously overvalued.”

Following a plunge of as much as 8% on Monday, Bitcoin reclaimed its $90,000 mark. The largest token has fallen almost 30% since hitting a record in early October. The downturn accelerated when roughly $19 billion in leveraged bets were wiped out.

The S&P 500 hovered near 6,820. Tesla lost 1.8%. Boeing Co. rallied as the planemaker expects to generate cash again in 2026.

Short-dated Treasuries outperformed the rest of the curve, with two-year yields down two basis points to 3.51%. The dollar wavered.

Anyone looking to bet against US stocks this month would be wise to consider the strength of the American economy and ongoing enthusiasm around artificial intelligence.

That's the view at 22V Research, where strategists say an increase in consumer spending and investments in AI are likely to support productivity, allowing firms to deliver the profits needed to power stocks higher.

“Being short here requires high confidence in a much weaker economic backdrop or a significant change in the outlook for AI capex,” according to strategists led by Dennis Debusschere.

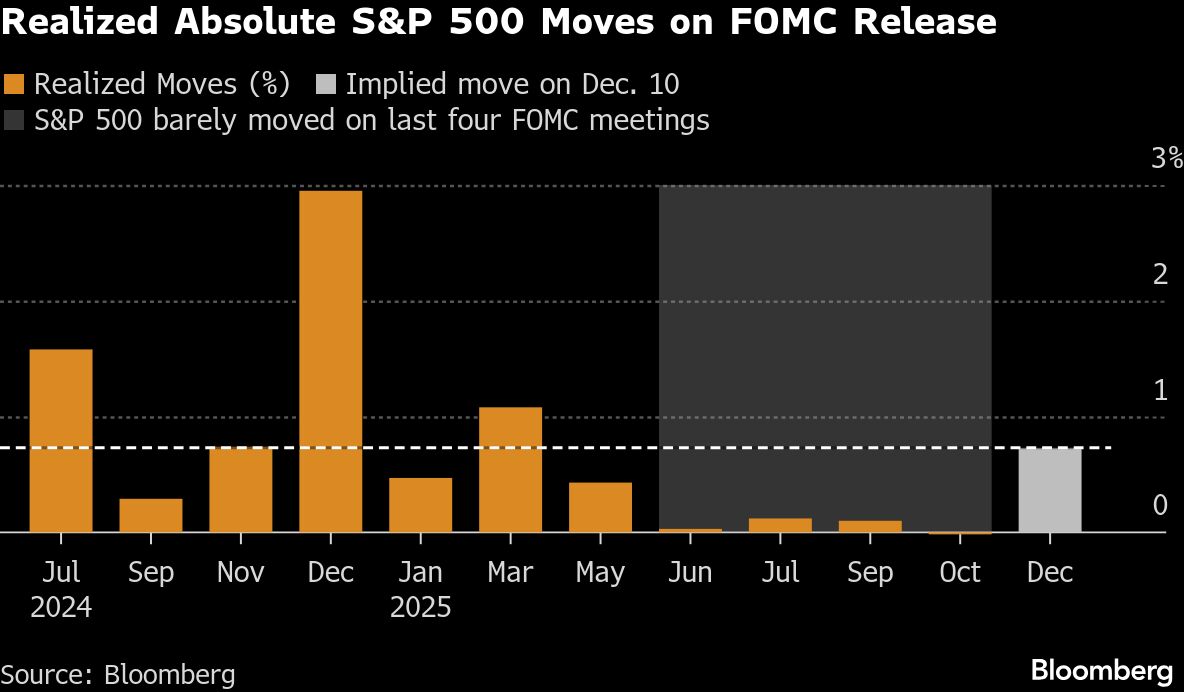

Meantime, Barclays Plc strategists noted that S&P 500 implied moves ahead of Federal Reserve meetings have declined since early 2023, with realized moves hovering near zero recently. It's a trend that underscores the fading influence of monetary policy, they said.

After cutting interest rates by more than a percentage point, Fed officials are now wondering where to stop – and finding there's more disagreement than ever.

In the past year or so, prescriptions for where rates should end up have diverged by the most since at least 2012, when US central bankers started publishing their estimates. That's feeding into an unusually public split over whether to deliver another cut next week, and what comes after that.

“Nothing is going to change our view that the Fed eases next week, but it is looking more like a hawkish cut,” said Andrew Brenner at NatAlliance Securities. “We can see at least three dissents next week.”

Some of the main moves in markets:

Stocks

The S&P 500 was little changed as of 11:34 a.m. New York time

The Nasdaq 100 rose 0.2%

The Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index was little changed

The Russell 2000 Index was little changed

Most Short Rolling fell 0.4%

GS Non Profitable Tech rose 0.9%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1608

The British pound fell 0.2% to $1.3192

The Japanese yen fell 0.2% to 155.81 per dollar

Cryptocurrencies

Bitcoin rose 4.7% to $90,472.56

Ether rose 7.2% to $2,994.8

Bonds

The yield on 10-year Treasuries was little changed at 4.09%

Germany's 10-year yield was little changed at 2.75%

Britain's 10-year yield was little changed at 4.48%

The yield on 2-year Treasuries declined two basis points to 3.51%

The yield on 30-year Treasuries advanced one basis point to 4.75%

Commodities

West Texas Intermediate crude fell 0.5% to $59.01 a barrel

Spot gold fell 1.2% to $4,182.39 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.