Gensol Engineering Ltd.'s share price hit a fresh life-low after it was locked in lower circuit for the fifth consecutive session in a row on Monday. The stock has been consistently slipping since Feb. 24, hitting multi-month lows as ratings agencies marked concerns over the company's delays in servicing the term-loan obligations. The firm also came under scanner for alleged falsification of data.

This comes after the company's board approved stock split in the ratio of 1:10 and fundraise of Rs 600 crore through the issuance of warrants and foreign currency convertible bonds. The stressed engineering, procurement and construction player intends to raise Rs 400 crore, through the issuance of foreign currency convertible bonds and Rs 199.99 crore through issuance of 3.57 crore warrants to promoter Jasminder Kaur on a private placement basis.

The warrants will be issued at Rs 56 apiece, after adjustment of sub-division of equity shares. This could mark an ex-split premium of 113% going by the stock's current market price.

This comes three days after the company said in a press release that its promoters were infusing Rs 28 crore in the firm through the conversion of warrants into equity. These warrants would be converted into 4.43 equity shares at a price of Rs 871 per share, it said last week.

Credit rating agencies ICRA and Care Ratings downgraded Rs 2,050 crore of Gensol's debt — over Rs 1,640 crore in long term and over Rs 400 crore in short term debt facilities — to default status earlier this month.

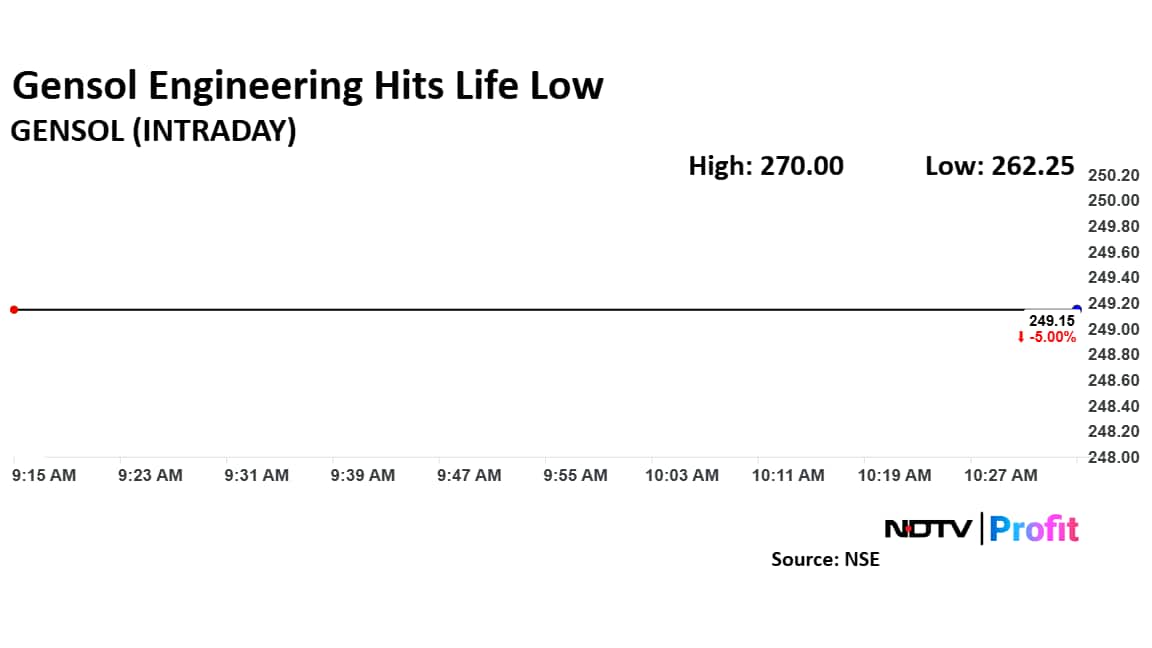

Gensol Engineering Share Price

The company's stock has faced significant pressure recently. Shares of Gensol Engineering have hit lower circuit for the fifth consecutive day and has hit the lower circuit nine times in this month alone.

The stock on Monday was locked in the lower circuit of 5% at Rs 249.15 per share. This compares to a 0.38% advance in the NSE Nifty 50. The stock's lower circuit was revised to 5% earlier this month.

It has fallen 68.83% in the last 12 months and 67.73% year-to-date. While the stock has fallen 53.49% this month, it is down 44.94% since listing. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 14, indicating it was oversold.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.