Gensol Engineering Ltd. saw its share price plummet by 20% on Tuesday, hitting the lower circuit, after the stock received a rating downgrade from CARE Ratings on Tuesday. The downgrade comes in response to delays in servicing term loan obligations.

CARE Ratings has revised the ratings for GEL's bank facilities, downgrading the long-term bank facilities to CARE D from CARE BB+; Stable, and the long-term/short-term bank facilities to CARE D from CARE BB+; Stable/CARE A4+. The rating action aligns with CARE's policy on default recognition, following feedback from GEL's lenders regarding delays in debt servicing.

GEL, the flagship company of the Gensol Group, has a decade-long track record in the renewable power segment. The company provides engineering, procurement, and construction and operations and maintenance services for solar power projects and also generates revenue from its EV leasing business.

Gensol Engineering's quarterly earnings report revealed a decline in both its bottom line and operational performance. The company reported a 6.1% drop in net profit for Q3, with earnings of Rs 16.9 crore, down from Rs 18 crore in the same period last year.

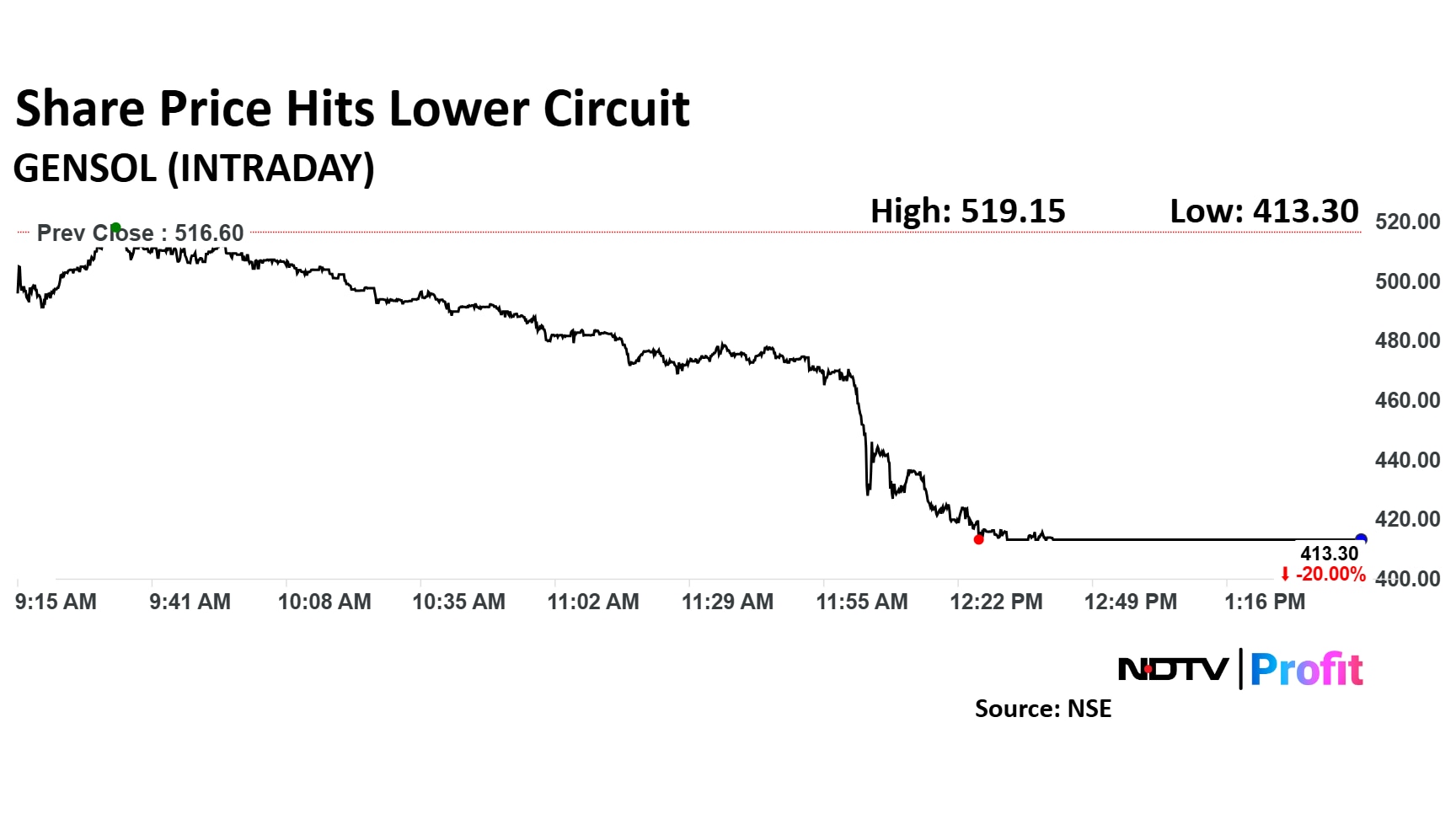

Gensol Engineering Share Price Today

The scrip fell as much as 20% to Rs 413 apiece. It pared losses to trade at the same level as of 01:48 p.m. This compares to a 0.28% decline in the NSE Nifty 50.

The stock has fallen 58.35% in the last 12 months. The relative strength index was at 20.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.