Indian stocks continued to decline as foreign portfolio investors sold equities for the third straight day on Wednesday, the longest stretch of selloff since October.

FPI net sold equities worth Rs 1,688.2 crore, according to provisional data released on the exchanges, taking the three-day total to Rs 3,089.21 crore. FPIs sold equities worth Rs 765.3 crore and Rs 635.69 crore on Monday and Friday.

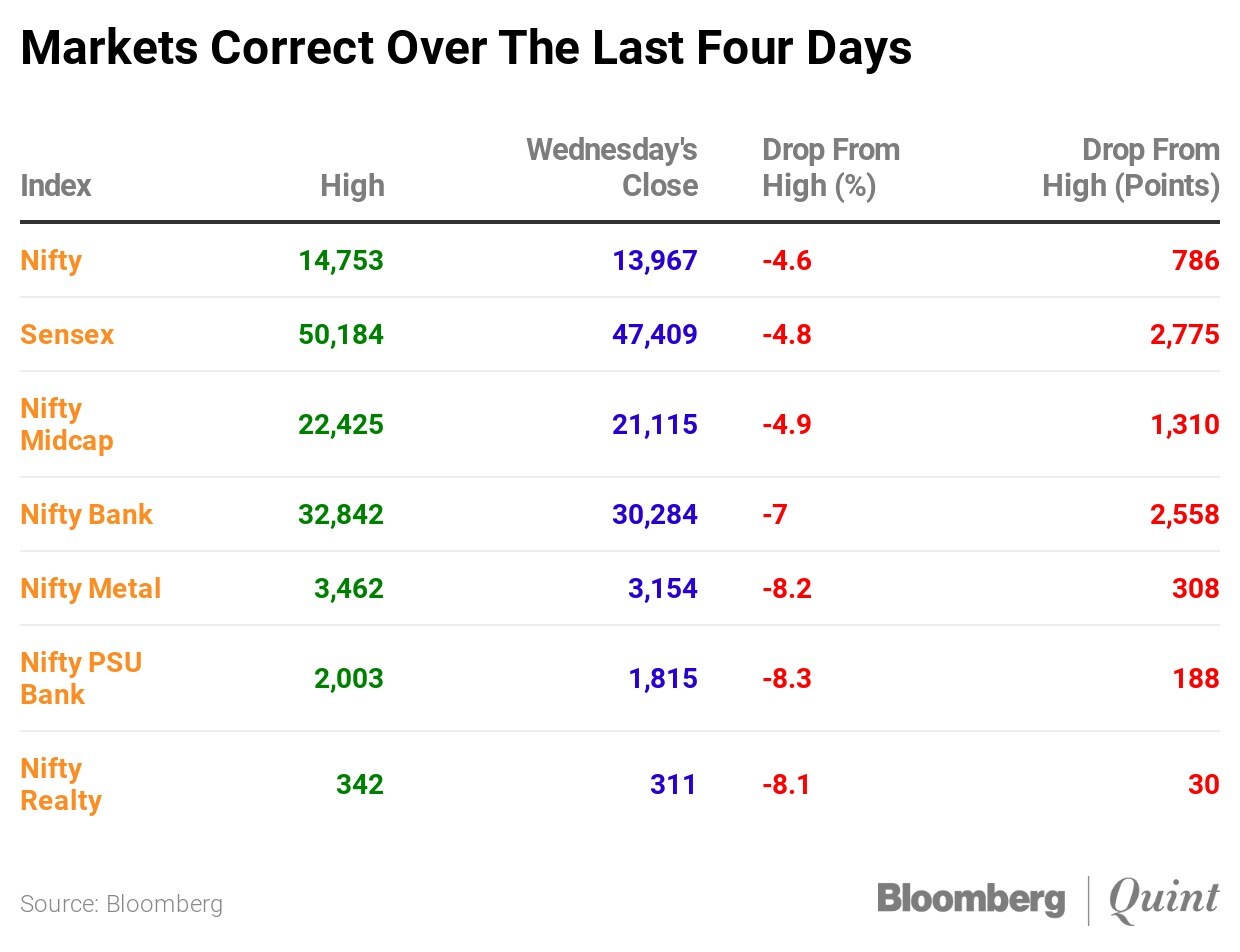

The S&P BSE Sensex scaled 50,000 on January 21. Foreign inflows for the month until then stood at Rs 21,713 crore. Over the last four trading sessions starting Thursday, the Sensex tumbled 2,775 points or 4.8% from its record intraday high of 50,182 in the worst losing streak since September. The NSE Nifty 50 index, which scaled its record 14,753 on Thursday, has fallen 800 points in the last four sessions.

Siddhartha Khemka of Motilal Oswal attributed the selling to FPIs booking profits at higher levels. "If you see globally, most of the key triggers are done with the U.S. President Biden taking over, stimulus plans being laid out and the vaccine rollout," he told BloombergQuint over phone. "In the domestic context, the risk-reward at such valuations were not favourable. Plus, there is the uncertainty of the budget. So they are choosing to take some chips off the table," he said.

The last time FIIs net sold equities for three straight days was between Oct. 28 and 30. They sold equities worth Rs 870.9 crore on Oct. 30, Rs 421 crore on Oct. 29 and Rs 1,130 crore on Oct. 28.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.