With five months of net outflows, 2021 is shaping up to be the second-worst in five years for foreign portfolio investments into Indian equity markets.

So far, as on Nov. 30, net FPI inflow amounts to Rs 44,778 crore or $6.28 billion, data on the National Securities Depository Ltd.'s website shows. In the last five years, that betters only 2018 which saw a net outflow.

2021 YTD: Rs 44,778 crore ($6.28 billion)

2020: Rs 1,70,262 crore ($23 billion)

2019: Rs 1,01,122 crore ($14.36 billion)

2018: (net outflow) Rs 33,014 ($4.39 billion)

2017: Rs 51,252 crore ($7.76 billion)

It's still possible that December squares the year with 2017 or even betters it, but prospects look dim as the new Covid-19 variant and inflation concerns have put global investors on the edge. Indian indices' outperformance and valuation may also serve as speed breakers.

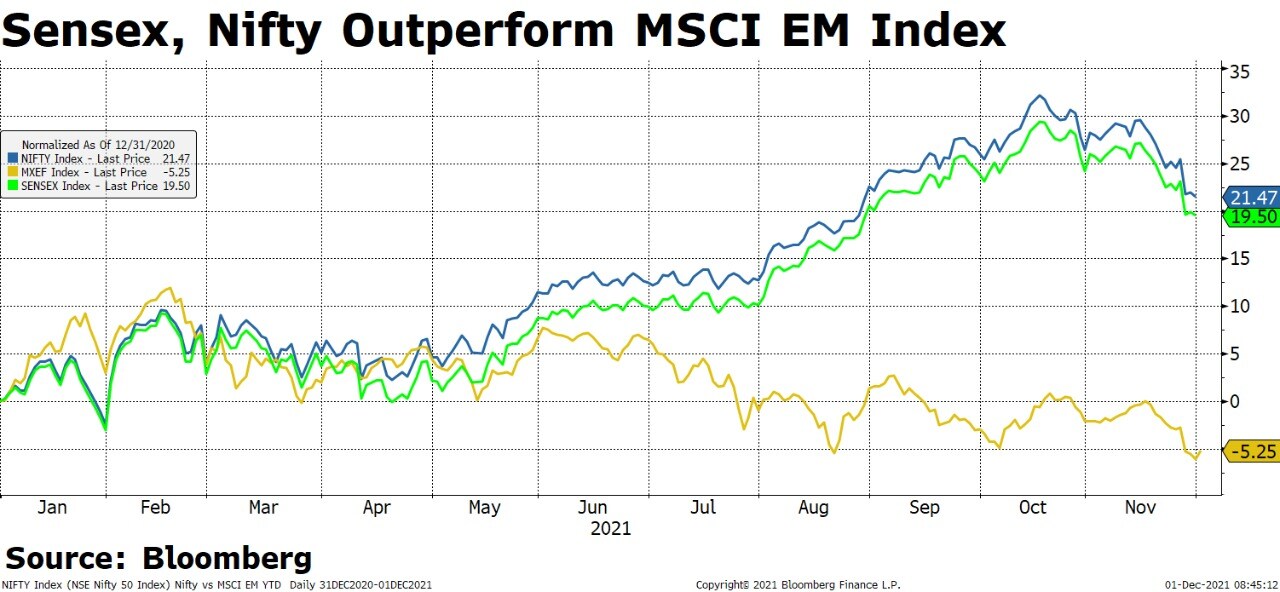

India's stock benchmarks outperformed their emerging market peers with both the S&P BSE Sensex and NSE Nifty 50 gaining around 20% compared with a 5.25% drop in the MSCI Emerging Markets index in 2021 so far.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.