(Bloomberg) -- Global investors lapped up Indian government debt ahead of the country's entry into a major global bond index, shrugging off concerns about policy continuity after Prime Minister Narendra Modi's slim election win.

Foreign purchases of the nation's index-eligible sovereign securities have reached roughly 50 billion rupees ($599 million) so far this week, according to the local clearing agency's latest figures. They included 19 billion rupees on Tuesday, when Indian bonds tumbled on results showing tighter-than-expected victory for Modi's party.

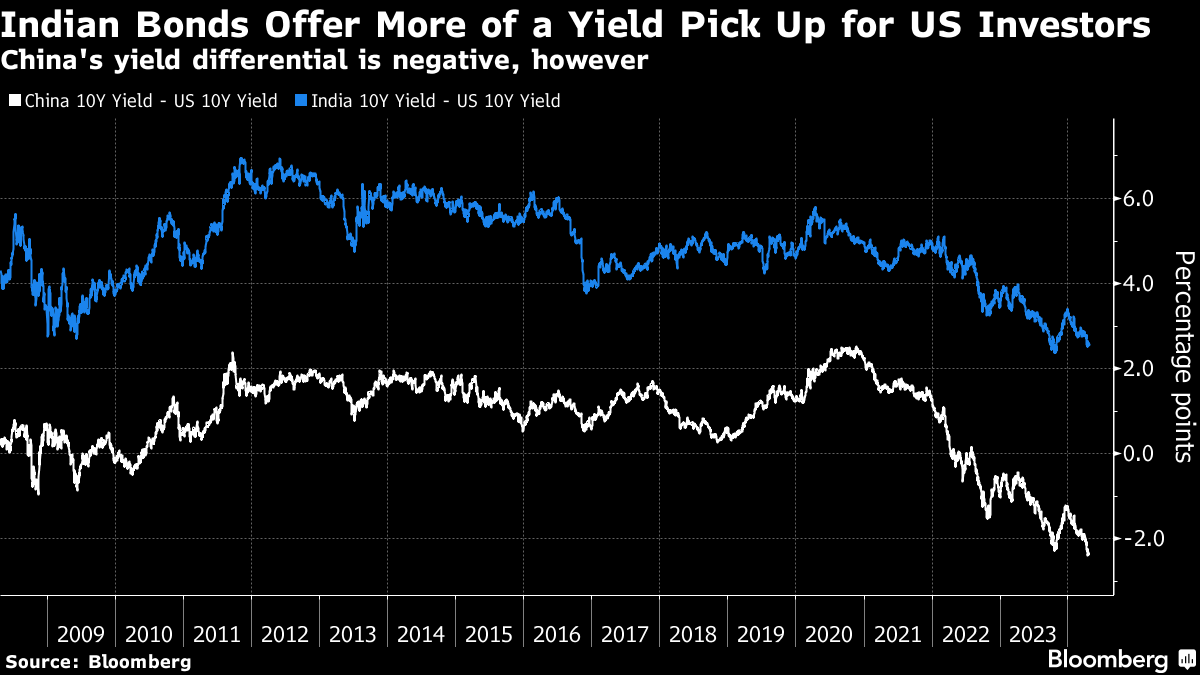

The foreign inflows underscore the importance of India's inclusion later this month into JPMorgan Chase & Co.'s key emerging-market debt index, a move expected to draw tens of billions of dollars from investors tracking the gauge. Foreign investors' more upbeat mood also highlights the lure of Indian debt's higher returns, with some downplaying worries over the impact of Modi's election setback on the country's fiscal discipline and currency stability.

“It remains a ‘buy on dips' market, likely offering opportunities for double-digit returns over the next few years,” Mayank Khemka, chief investment officer India at Deutsche Bank AG, wrote in a note. “The themes of digitalization, urbanization, and financialization will continue.”

The yield on India's benchmark 10-year sovereign bonds will drop to roughly 6.5% in the coming year, from just over 7% currently, in part due to inflows linked to the index inclusion, according to forecasts by UBS Group AG.

READ: BlackRock Stays Bullish on Indian Bonds After Narrow Modi Win

“While Modi's grand coalition had won by a much smaller margin relative to market expectations, we don't foresee significant change to India's growth prospects or fiscal consolidation path,” said Edward Ng, senior portfolio manager at Nikko Asset Management Asia Ltd.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.