India's derivatives market is set to cool further after the Securities and Exchanges Board of India announced a proposal to change the way open interest is calculated.

The move will be on the back of the capital markets regulator's slew of reforms first announced in October that led to a 35% tapering in the National Stock Exchange's turnover for index options and a 46% reduction in BSE Ltd.'s Sensex options trading volumes as of February.

The newly proposed changes, in addition to the monitoring of position limits beginning next month, are likely to reduce activity from proprietary trading groups, which make up a majority of an exchange's average daily turnover in the derivatives space.

"We lower our industry options premium to cash equity turnover estimate from 0.4x to 0.3x," Goldman Sachs said in a note on Monday.

"SEBI aims to align derivatives trading more closely with cash markets and curb speculative excesses," Mehul Kothari, deputy vice president of technical research at Anand Rathi Shares and Stock Brokers, told NDTV Profit. "Given the impact of past reforms, further cooling of the derivatives market appears inevitable."

Premium Turnover, Volumes Hit

SEBI's regulations have led to a reduction in volumes across cash market and derivatives segment, as previously acknowledged by both the NSE and BSE.

For the NSE, the premium turnover on index options — which is the total amount of premium paid on all index options traded on a given day — has fallen 35% from October highs when the regulatory changes were first announced.

The bourse's average daily premium turnover has cooled off to just over Rs 40,000 crore in February from around 62,000 crore five months prior.

The BSE, too, has seen a 46% volume drop in index options from October to February. However, the exchange has seen an 80% increase in the average daily premium turnover, which has grown from around Rs 6,300 crore in October to over Rs 11,000 crore in February, while it continues to gain market share.

"We await clarity on actual market impact as the norms are discussed and may also depend on the stance of new leadership at SEBI," analysts at Jefferies said on the recent development from the markets regulator.

Brokerages Ring Alarm Bells

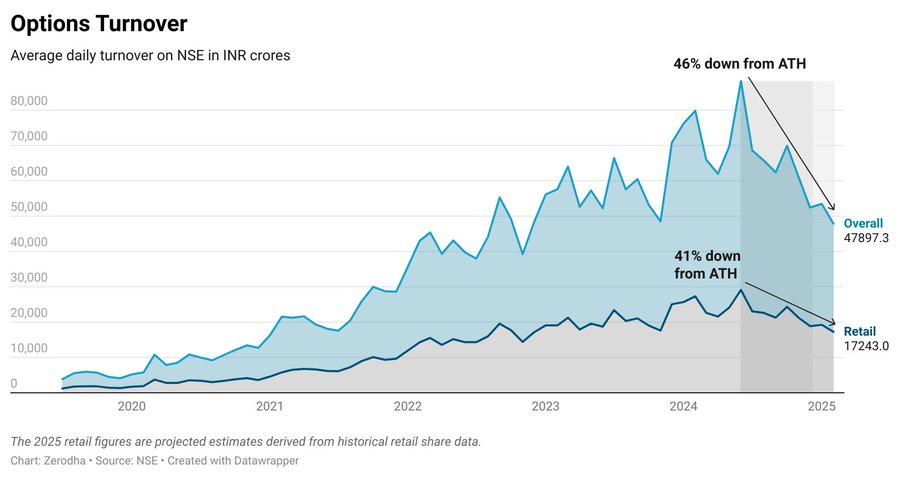

Brokerage platform Zerodha's chief executive, Nithin Kamath, took to X last Friday to highlight a downtrend in options turnover.

"Across brokers, there's a more than 30% drop in activity. Combined with the true-to-market circular, we are seeing degrowth in the business for the first time since we started 15 years ago," he posted along with a chart that showed declining daily turnover for option on the NSE.

Brokerage platform Zerodha's chief executive Nithin Kamath took to X on Friday to highlight a downtrend in options turnover (Source: Nithin Kamath/X)

In its quarterly post-earnings call with analysts in January, Angel One Ltd., too, had pointed out a short-term impact of 13–14% on net income till client behaviour adjusted to the regulatory changes.

In the call, the brokerage's chairperson, Dinesh Thakkar, had also said that he expected an additional 3–4% decline in the top line due to the regulation on grouping of monthly expiries for each of the exchanges.

"If this continues, the government will not make even Rs 40,000 crore from STT in FY 25/26, at least 50% below the Rs 80,000-crore estimate," Kamath had added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.