Billionaire Radhakishan Damani-owned Avenue Supermarts Ltd., which runs retail chain D-Mart, went public on Tuesday, notching up a valuation of nearly Rs 40,000 crore on debut. Here are five things you need to know…

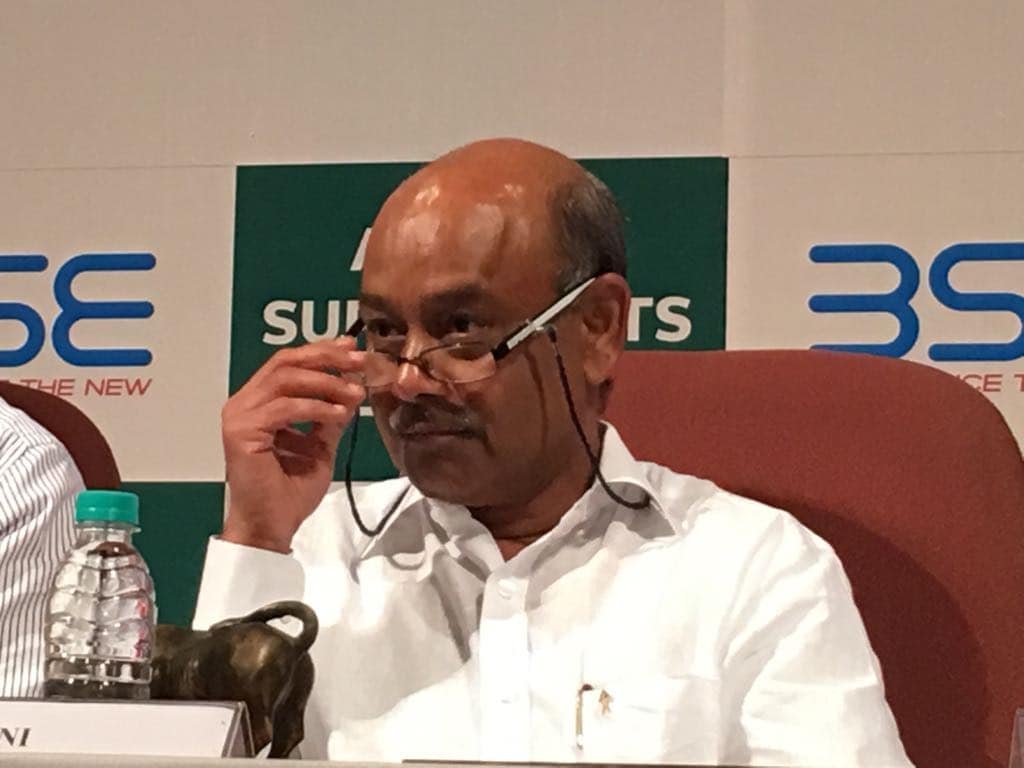

Who is Radhakishan Damani?

The 61-year-old stock-broker-turned-entrepreneur is the owner of the D-Mart supermarket chain.

How much stake does the Damani family hold in D-Mart?

Damani holds 39.4 percent in Avenue Supermarts while his family owns another 42.8 percent.

What's the value of the Damani family's stake?

It's more than the market capitalisation of two Nifty 50 companies — Tata Power Ltd. and ACC Ltd.

(Valuation at close of trading on Tuesday )

Also Read: D-Mart's Parent Avenue Supermarts Doubles On Listing

How much is D-Mart valued at?

That's higher than the combined market capitalisation of its two biggest rivals — Future Retail Ltd. and Aditya Birla Fashion Ltd.

(Valuation at close of trading on Tuesday)

What are Damani's other investments?

He owns more than 1 percent stake in nine companies, including cigarette maker VST Industries Ltd. and logistics services provider Blue Dart Express Ltd.

Data compiled by BloombergQuint

Also Read: Bargain Hunting By Wives Turns D-Mart Owner Radhakishan Damani A Billionaire

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.